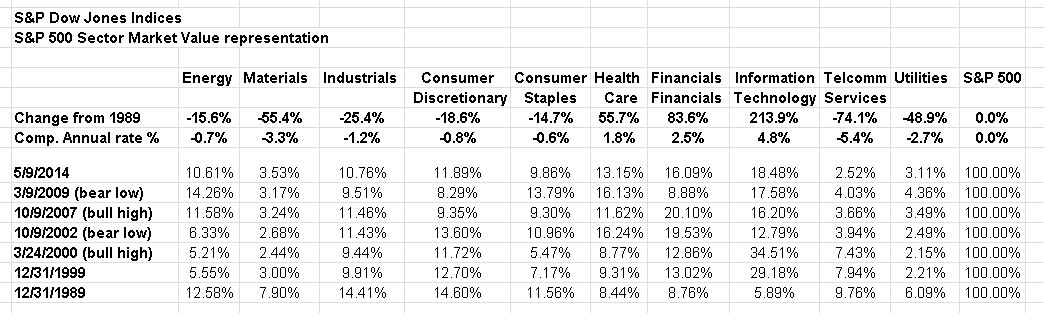

The makeup of the S&P 500 reflects the U.S. overall big-cap public market, and while it’s relevance to investing is well known, it is also a reflection on the changes in U.S. culture. Last December Facebook was added to the S&P 500, signaling the importance of social media. The prior month J.C. Penney was removed, signaling the end of traditional ‘mail order’ houses (Sears, Montgomery Ward, Woolworth), as the new ‘mail order’ houses, such as Amazon.com and to some degree negotiated mail order issue eBay took their business place. In 2012, Apple started to pay a dividend, propelling Information Technology to become the largest dividend payer (who would have tunk it), just as Apple’s price move had helped the sector maintained its position as the largest sector in the index. And in December 2010, The New York Times was removed from the S&P 500, in what many saw as signaling that print products no longer needed representation in the big caps – as the issue was added to the S&P MidCap 400; Eastman Kodak – one of the original S&P 500 and nifty-50 issues was also moved to the S&P MidCap. On a higher level, from the end of 1989, the shift has been to Health Care, as Americans live longer, and spend more to do so; the Finance sector saw financial institutions grow and try to become ‘one-shop’ centers, as retirement responsibility was shifted to individuals from institutions (as health care is now doing), and investing, insurance, and ‘planning’ has grown; and of course Information Technology, to which the capabilities of my smart phone overpowers rooms of computers from when I used key-punch cards in college (I still have some in the office, along with a few 5” floppies, and an epcdic 6250 tape). Down over the period, partially because of the faster pace of the growth of the former three, is materials, which is partially due to the shift in global operations (this is a U.S. index, even though foreign sales for the S&P 500 are approaching 50%). Consumer groups have declined, partially due lower market values, inspired by lower margins and profits (again, global shifts in production play a key issue). However, the largest decline is in the Industrial sector, where the share of ‘made in the U.S.A.’ and ‘look for the union label’ has declined – which is a commentary in and of itself. Not seen in the sectors is Transportation, which declined so much it was moved from a major group (there were four originally: industrials, transportation, financials, and utilities) to a sub-group within Industrials. And while I’m on sectors, let me note that most investors don’t realize how small energy is – at 10.6% of the index it ranks 6th in market value of the 10 sectors. That wasn’t always the situation. Energy, for a very brief period in July 2008 was the largest sector under GICS (then Information Technology and Financials). And if I go back to my Stock Guide days (where I started), and construct proforma groups, the 1980 representation for Energy is 28.7%, with financials and the equivalent of Information Technology being a lot smaller.

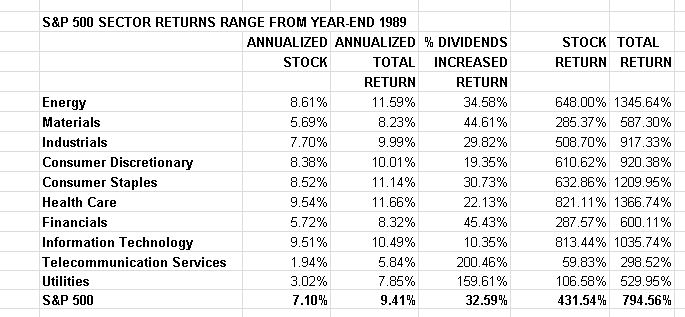

As for those die-hard capitalists who denounce sentimental retrospectives (although there is always money in sentimental retrospectives – just ask the movie industry), here are the hard, cold prices. News reports typically focus on short-term gains, sometimes the big winner for the day, then at month-end, quarter-end and year-end. The news follows the ‘glory’ of the win, quick money, and playing the long-shot. However, many investors are long-term and not home-run hitter, and they measure their numbers over years and decades. Long-term investing has different characteristics. For that time period dividends count significantly, since they pay every year – in good markets and bad (cash-flow is up there in importance), and when compounded can change the return (and therefore the rick-reward trade-off) significantly. To illustrate, utilities are generally considered slower, but steadier growth investments, paying dividends as they go; they typically (and there are lots of non-typicals out there) attracts income seekers and those wishing lower risk and lower volatility. Since 1989 utilities have returned 3.03% compounded annually, but with dividends added back in, they have returned 7.85% – lower than the S&P 500’s 7.10% stock return, but closer to the 9.41% with dividends (which is a risk-reward trade-off). Information Technology, a sector known for higher risk, has returned 9.51% in stock, and slightly higher with their lower dividends – 10.49%. The difference in breakdown is significant, but so is the risk, with each investor deciding their own trade-off. Sector investor is also popular for long-term trends, where investors believe certain groups will need to survive and prosper over time. Health Care, which is up 11.66% with dividends (the best of any sector) and energy, which is up 11.59% are examples.

The posts on this blog are opinions, not advice. Please read our Disclaimers.