The New York-listed iShares Europe 350 ETF has more than doubled in size in the past six months; the front page of last Friday’s Financial Times reported that U.S. purchases of European equities have surged, while the Wall Street Journal noted yesterday that “Europe is back.”

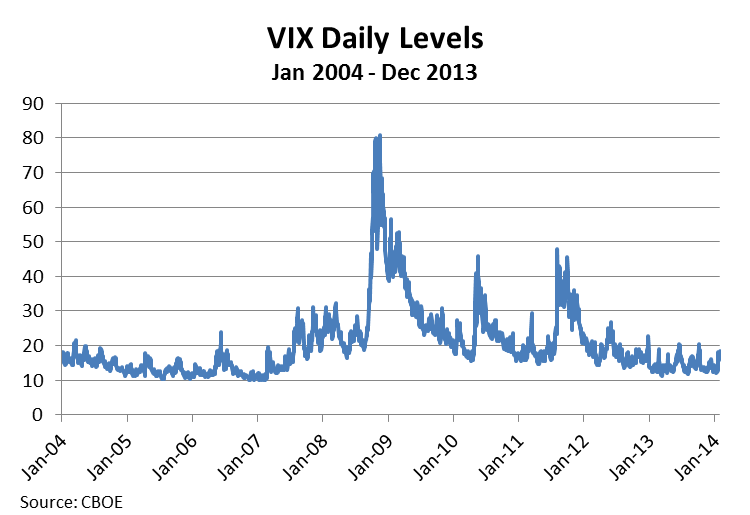

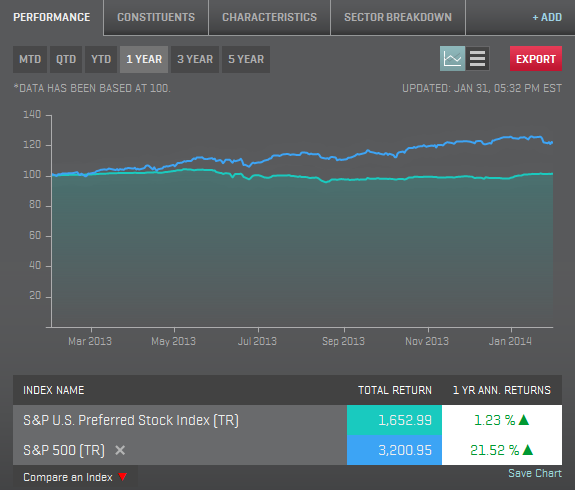

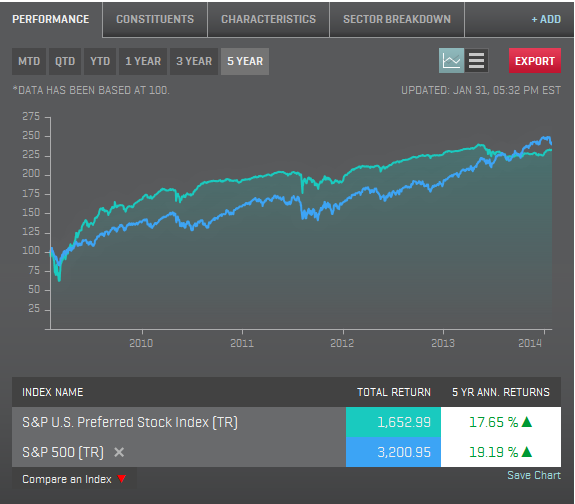

European equities have underperformed U.S. equities by around 45% since the financial crisis. Despite having a good year in 2013, the S&P Europe 350 remains well below its pre-crisis levels; the S&P 500 spent much of late 2013 recording new highs. So why would U.S. investors take an interest in European stocks?

One explanation is that while the Euro crisis of 2012 discouraged transatlantic investment, with better economic news it is natural to expect some returning investment from U.S. asset allocators. But valuations may also be playing an important role.

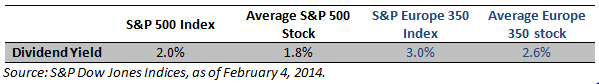

The comparatively small rise in European stock prices since 2009 has resulted in much more attractive valuation levels than in the U.S., both at the security and Index level. Dividend yield provides one example:

European equities look attractive on a risk-free rate comparison, too. While the dividend yield for the S&P Europe 350 is well above the German 10 year rate of 1.6%, the dividend yield for the S&P 500 is below the current 10 year UST yield of 2.6%.

Such metrics are attracting attention, and not just from U.S. investors. In the U.K., The Telegraph’s list of countries with the most attractive CAPE valuations is heavily biased towards European entries. Other examples abound.

Note in both cases that the yield of the index (which is tilted in favour of larger companies) is higher than the average stock yield, suggesting that smaller-cap companies have not been the drivers of income. That means that the risk profile can look attractive too: a dividend yield of 2.8% is available even when restricting attention only to those members of the Europe 350 that have increased dividends every year for the past 10 years*.

All other things equal, the Europe 350 would have to gain 50% in price to match U.S. dividend yields. The stock markets are famed for their regular mockery of predictions, but to the degree that valuations are driving U.S. flows into Europe, such dynamics are likely to remain in place for some time.

*For example, via the S&P Europe 350 Dividend Aristocrats Index.