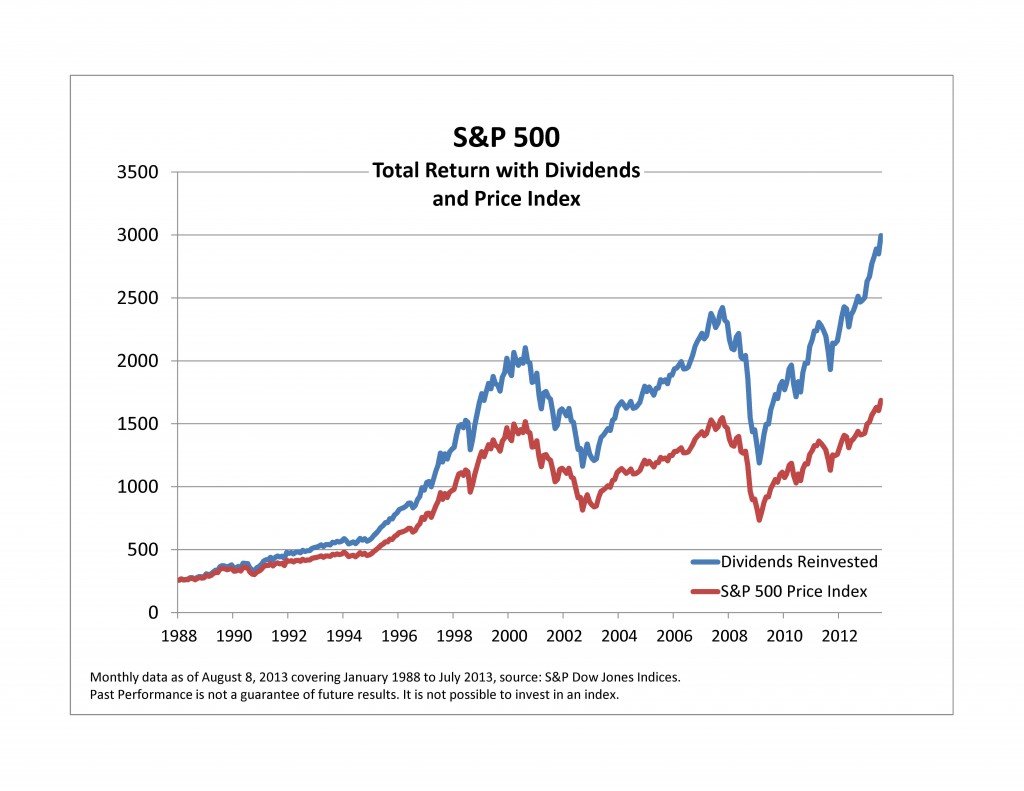

Slightly more than 400 of the 500 companies included in the S&P 500 pay dividends. At the current rate, these dividends will be a bit over 2% of the value of the index. In a strong market like the one enjoyed in the last 12 months when the index price rose over 20%, an extra 2% may not seem like a lot. In a declining market where every little bit counts, the 2% is very welcome. However, the impact can be a lot more than just two percent over time.

S&P Dow Jones Indices calculates a total return index for the S&P 500 that includes the impact of investing dividends back into the index itself. In the calculation, dividends are invested in the entire index, not just in the stock that paid the dividend. The invested dividends then grow (or fall) as the overall index grows (or falls), rather than tracking the stocks that paid the dividends. This index-wide reinvestment approach is typical in most indices.

The cumulative impact over time can be substantial: the chart shows the S&P 500 price index in red and the S&P 500 total return index in blue. The two data series are calculated to start in January 1988 at the same level. One thousand dollars invested in the S&P 500 at the end of January, 1988 would have been worth $5557 at the end of July, 2013. However, if the dividends were reinvested in the index, the investment would be worth $10,635 by the end of July. Reinvesting the dividends roughly doubled the value of the investment. Looking at the same time period, the annual return earned by the total return index was 9.71% and by the price index was 6.96%, a spread of 2.75%.

The posts on this blog are opinions, not advice. Please read our Disclaimers.