What is your long term outlook for gold and where do you see prices moving in the months ahead?

This is one of the questions I was recently asked in a Reuters CCTV2 interview. While we are not in the business of forecasting, we are in the indexing business where we measure markets – and gold is one of those markets.

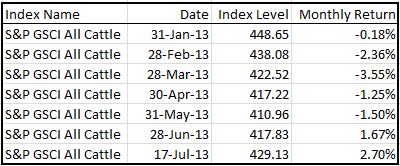

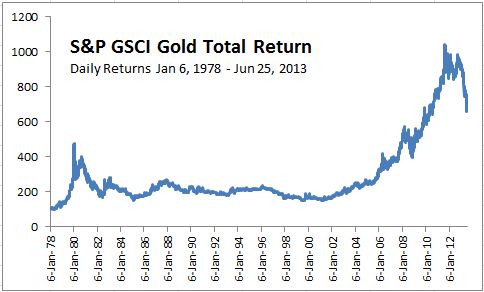

Oftentimes the future follows history, so historical index levels are a reasonable place to look in order to get a feel for how prices have behaved in the past. Please see below for a chart of historical levels of the S&P GSCI Gold.

As I pointed out in a previous post, gold is having its worst year since 1980. From Jan 1980 until June 1982 gold in the index lost 65%, then rebounded 69% by Jan 1983. This time gold’s bottom – so far – was on June 27, down 37% from its peak in Aug 2011. This month it is up 8.5% so if the rally looks like last time, there may be about 30% left, but that is only if the rally this time follows the symmetry of history. Another possibility is that gold could fall another 30% and have a loss like in the 1980-82 period.

What prompted the interview on July 22 was the biggest one day move of gold since June 29, 2012. See the Q&A below for the OTHER GOLDEN QUESTIONS:

1. Gold reached a one month high earlier today – it was the biggest 1-day rally in over a year. What triggered today’s rally? Gold gained 3.6% in the S&P GSCI and DJUBS mainly on some weaker than expected data from the Fed that drove the price higher than 1300, an important point for technical traders. It went further and broke 1307, then 1315.

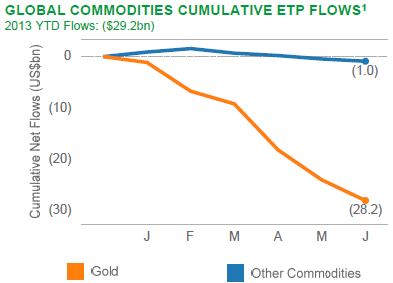

2. Why has gold dropped precipitously this year? Gold had it worst two days since 1980 mainly since the US Fed announced in June it would slow its quantitative easing. The demand for gold as a safe haven may have disappeared after that announcement.

3. And – what’s behind the 10% rebound this month? The rebound is on the fundamental story of expanding reserves from the banks, whether it’s the Fed, ECB or Bank of Japan, the demand is picking up while the ETF selloff seems to have eased.

4. Why have commodities become more sensitive to supply shocks? And what does this mean for an investor’s strategy? The world’s economy may be shifting from one driven by expansion of supply to one driven by demand. In that case, inventories may be lower so commodities will be more sensitive to supply shocks. For investors, it means they may benefit from strategies that are more flexible to change weights or contracts based on the fluctuations of inventory and price.

5. Why are we seeing an unprecedented summer surge in exports of gasoline, diesel and other fuels? There is an oversupply from a demand decline from Asia’s slowdown. Gasoline exports may slow as refiners hit their sales quotas before the government decides whether to increase allocations. Read more from this Bloomberg article.

6. Who is benefiting from this surge? International consumers benefit from the supply spillover into their respective regions. Generally, the higher the inventory, the lower the prices.

7. And how is this export boom affecting pricing in the oil market? The refiners are the consumers of oil to make the gasoline so if demand slows the impact on oil is negative. However, it varies by regional fundamentals as evidenced by the 14.3% gain in the S&P GSCI (WTI) Crude Oil versus only 80 basis points in more international S&P GSCI Brent Crude. Read more from this Reuters article.

The posts on this blog are opinions, not advice. Please read our Disclaimers.