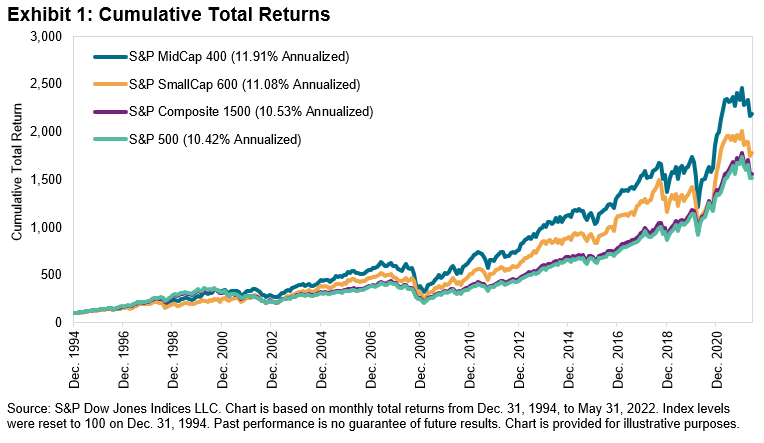

The S&P MidCap 400® is an often-overlooked member of the S&P Composite 1500® series, despite outperforming the S&P 500® and S&P SmallCap 600® since 1994 (see Exhibit 1).1 The mid-cap U.S. equity index also weathered the market volatility slightly better during the first five months of 2022 by falling less than 11%, compared to a near 13% decline for the S&P 500 and more than 11% for the S&P SmallCap 600.

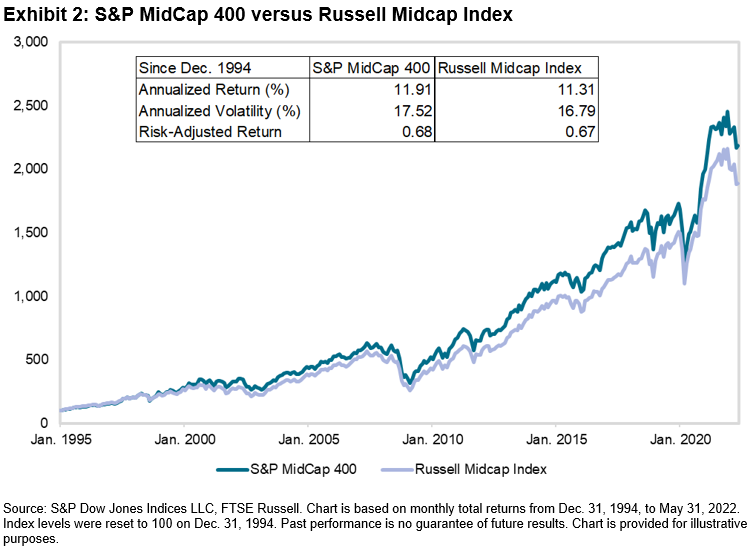

The S&P MidCap 400 is not the only index designed to represent the performance of mid-cap U.S. equities; the Russell Midcap Index also tracks this segment. Exhibit 2 shows that the S&P 400® has outperformed the Russell Midcap Index since 1994. Such outperformance has also been observed so far this year, with the S&P 400 beating the Russell Midcap Index by 1.9% through the end of May 2022. So, what helps to explain this difference?

As we have pointed out before, the S&P Composite 1500 series is constructed differently than the Russell 3000. One of the major differences is that the S&P Composite 1500 uses an earnings screen, which impacts the selection of companies in the indices. Exhibit 3 shows the results from a 2-Factor Brinson Attribution analysis by GICS® sectors between the S&P MidCap 400 and Russell Midcap Index from Dec. 31, 2021, to May 31, 2022.

The results show that the choice of constituents (selection effect) drove the S&P 400’s outperformance during the first five months of 2022, particularly in the Information Technology, Financials and Health Care sectors. Differences in sector weights (allocation effect) slightly detracted from relative returns. The S&P 400’s lower weight in Energy helped to explain this result.

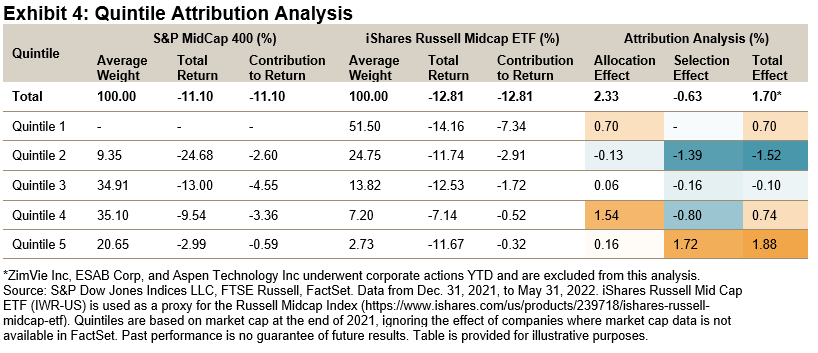

Another important difference between the two indices is they have different size exposures. For example, Exhibit 4 shows that more than 50% of iShares Russell Midcap ETF’s weight fell in the largest size quintile at the end of 2021. The S&P 400 had no exposure to these companies, which helped its relative performance in the first five months of 2022. The S&P 400 also benefited from its greater exposure to the smallest size quintile.

Overall, the S&P 400’s recent returns highlight the potential benefit of mid-cap U.S. equities—the index outperformed the S&P 500 and S&P SmallCap 600 since 1994, and YTD in 2022. The S&P 400’s outperformance compared to the Russell Midcap also demonstrates the importance of index construction and the potential impact on stock selection and size exposure.

1 For more information, see Bellucci Louis, Hamish Preston and Aye M. Soe. “The S&P MidCap 400: Outperformance and Potential Applications.” S&P Dow Jones Indices. June 2019.

The posts on this blog are opinions, not advice. Please read our Disclaimers.