The S&P 500® GARP (Growth at a Reasonable Price) Index just had its second anniversary since its launch in February 2019. During the latter half of this time, the world experienced the worst global pandemic in a century. Equities entered a swift V-shaped bear market and rebound.

In this blog, we review the index’s performance, characteristics, and relevant single-factor strategies.

Performance

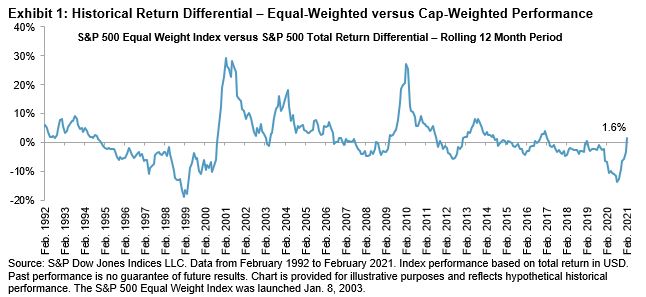

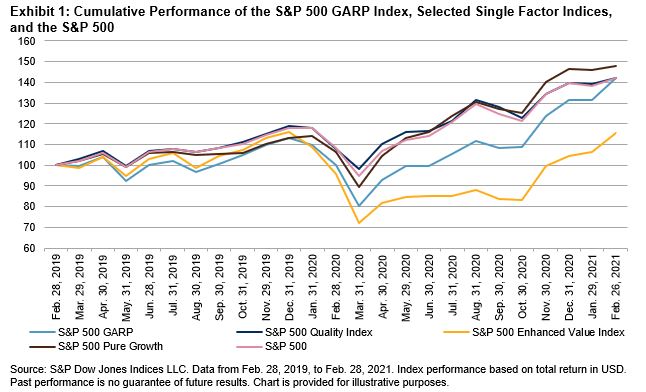

During the past one-year period, the S&P 500 GARP Index outperformed the S&P 500 and other selected single-factor indices by a wide margin. For the overall post-launch two-year period, the S&P 500 GARP Index again outperformed the S&P 500 and other selected single-factor indices, with the exception of the S&P 500 Pure Growth.

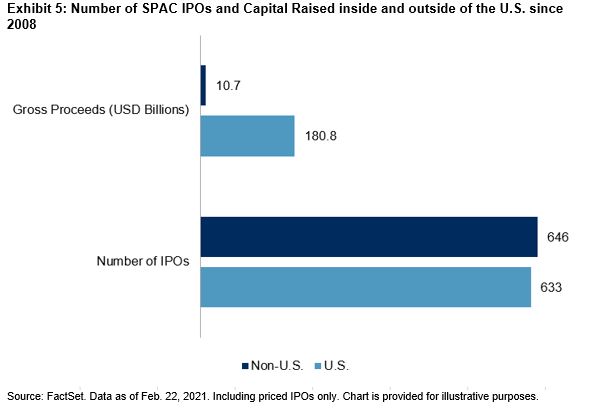

Rebasing the S&P 500 GARP Index, its associated single factor indices, and the S&P 500 to 100 on Feb. 28, 2019, the S&P 500 GARP Index, S&P 500 Quality Index, S&P 500 Enhanced Value Index, and S&P 500 Pure Growth reached 142.3, 141.9, 115.5, and 148.1, respectively, on Feb. 26, 2021, while the S&P 500 reached 142.0 (see Exhibit 1).

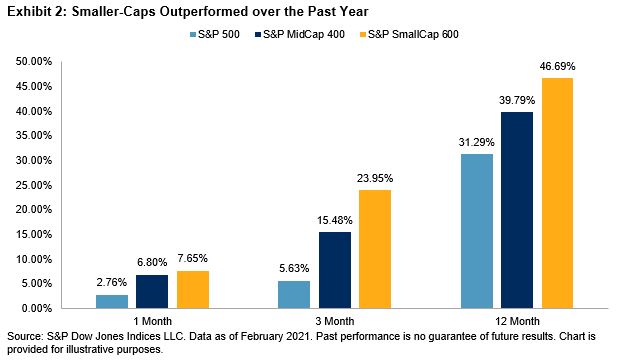

The outperformance of the S&P 500 GARP Index mainly came from the most recent 12-month period. During this time, the S&P 500 GARP Index outperformed the S&P 500 and selected single-factor indices, as shown in Exhibit 2.

Such results are not surprising given recent market development. First, with the vaccination rollout and decrease in new COVID-19 cases, investors expect real economic recovery on the horizon. Second, as yields of longer-term U.S. government bonds tick up, investors may start to rotate out of expensive growth stocks and favor value companies.

Strategy Characteristics

The S&P 500 GARP Index is designed to track growth companies with relatively high quality and good valuation. It aims to balance pure growth and pure valuation exposures, as the former tends to target high-growth, yet expensive stocks, while the latter may take a longer time to pay off.1

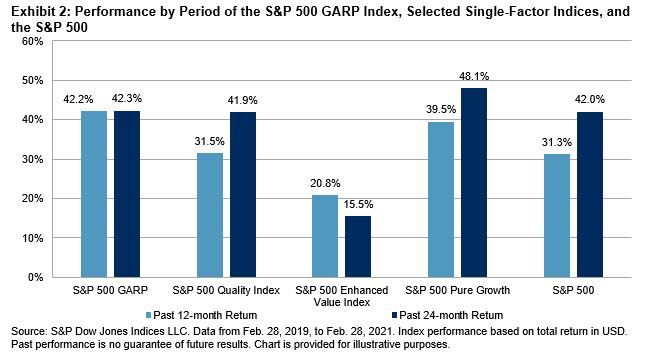

To achieve its goal, the S&P 500 GARP Index selects stocks using two layers of filters:2 a growth style and a composite style of quality and value (QV). Stocks are first ranked by growth z-scores, with the top 150 stocks remaining eligible for index inclusion. Then, these stocks are ranked by QV composite z-score. The top 75 stocks are selected and form the index. The factors used in the index design are shown in Exhibit 3.

Factor Exposure

Using the risk factors from a commercial risk model, we present the active exposures3 of four factors. The definitions of the four factors are in line with those used in the S&P 500 GARP Index. In comparison with the S&P 500, the GARP strategy has higher exposures to earnings, sales growth, earnings yield, and profitability,4 and lower exposures to leverage (see Exhibit 4). The factor exposure results align with the objective of the index design.

Conclusion

Aiming to balance pure growth and pure valuation exposures, the S&P 500 GARP Index selects growth stocks with relatively high quality at a reasonable price. Factor exposure analysis shows that the index’s multi-factor sequential filtering approach achieves its design objective. Moreover, during the post-launch period, the GARP strategy had better returns than the S&P 500 and other relevant single-factor indices, except the S&P 500 Pure Growth. The current market environment may present an opportunity for investors to consider the S&P 500 GARP Index as they diversify away from expensive pure growth stocks.

1 Refer to Indexing GARP Strategies: A Practitioner’s Guide for strategy rationale, designs, and attribution analysis.

2 See the S&P 500 GARP Index Methodology for more information.

3 Active factor exposure is defined as the strategy factor exposure minus the benchmark factor exposure.

4 Refer to Axioma United States Equity Factor Risk Models for more information about factor definitions.

The posts on this blog are opinions, not advice. Please read our Disclaimers.