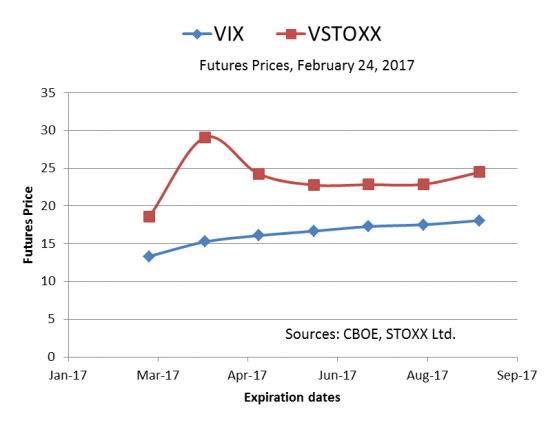

Futures tied to VSTOXX, the Eurozone’s version of VIX, are signaling risk ahead. The French elections, which take place April 23 (first round) and May 7 (run-off election) and the possibility of Marine Le Pen leading France’s exit from the Eurozone appear to have spooked European options investors. They are now paying higher premiums for put options expiring near the election. As a result, the term structure for VSTOXX futures has assumed an unusual shape.

VSTOXX is usually higher than VIX (on average by 10.6 points over the past five years) but the two benchmarks tend to move in near lockstep.

Should U.S Investors Care?

Here’s a quick quiz for you. What percentage of S&P 500 company sales come from Europe? According to a report issued by S&P Dow Jones Indices last year, 7.8% of S&P 500 sales revenue in 2015 came from Europe. If France were to leave the Eurozone, this could affect the U.S. in ways beyond those captured in direct sales figures. Still, 7.8% is a good statistic to keep in mind. Leading U.S. companies are less tied to the European economy than many investors would expect.

A Look Back at the Brexit Vote

Traders, policy experts, and journalists are comparing the French elections to the Brexit vote. It’s worth looking back to see how VSTOXX and VIX moved when British voters chose “Leave.”

VSTOXX and VIX are notoriously noisy signals – the “vol of vol” is high – but we can note the following:

- Though most economists predicted “Remain” would win, VSTOXX traded at elevated levels before the election, indicating greater uncertainty in financial markets about the outcome.

- When “Leave” prevailed, both VSTOXX and VIX jumped, but U.S. options investors were more surprised. One day after the Brexit vote, the VSTOXX closed only 8.7% higher than the day before (36.4 to 39.6). In comparison, VIX increased 49.3% between closings.

- Options investors in both markets quickly focused forward and VSTOXX and VIX declined to normal levels in the course of a week.

The French election and Brexit are of course different, but VSTOXX and VIX look like they did leading up to the Brexit vote: VSTOXX is elevated and VIX is low. On April 23 and May 7, we will learn whether U.S. investors have been too complacent.

The posts on this blog are opinions, not advice. Please read our Disclaimers.