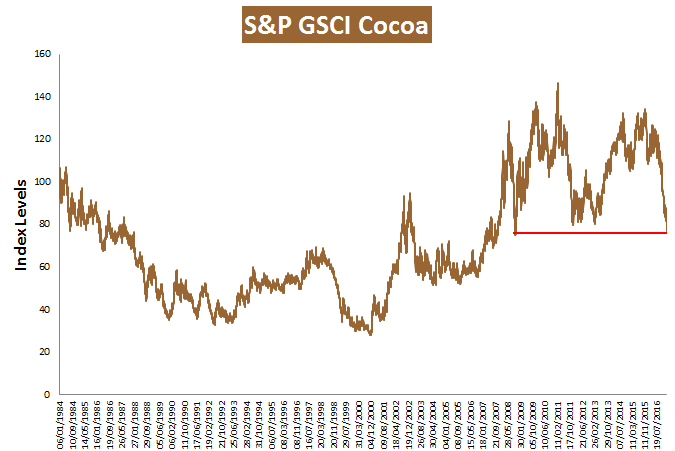

If you buy a little extra chocolate this year for your Valentine, your wallet will be as happy as your sweetheart. The S&P GSCI Cocoa is at its lowest level (closing Feb. 10, 2017) since Nov. 13, 2008. It is down 31.3% since last year and is the single commodity with the biggest loss in the past 12 months.

According to the International Cocoa Organization (ICCO), the cocoa prices decline was initiated from market expectations of a production surplus for the ongoing 2016/2017 cocoa season; mainly resulting from the prospects of a strong recovery in West African and Latin American production. Also, light rains mixed with hot weather and mild Harmattan winds in most of Ivory Coast’s main cocoa growing regions may boost next year’s crop according to farmers.

One thing to love about cocoa besides the fact that it is relatively cheap now, is that it is the commodity with the most favorable dollar movement ratio of commodities that lose from a rising dollar. It has very little sensitivity to a rising dollar, losing on average just 6 basis points for every 1% rise in the dollar, yet it gains nearly 3.5% for every 1% the dollar falls.

The posts on this blog are opinions, not advice. Please read our Disclaimers.