It was a flattish February for commodities with the S&P GSCI Total Return up 23 basis points for a year-to-date return of -1.2%, and the Dow Jones Commodity Index up 11 basis points bringing its year-to-date return to 78 basis points. Overall in the S&P GSCI TR, 3 of 5 sectors were positive and 14 of 24 commodities were positive. The S&P GSCI Precious Metals TR was the best performing sector, gaining 3.7%, and the S&P GSCI Nickel TR was the best performing single commodity up 10.2%. The worst performing sector was the S&P GSCI Energy TR with a loss of 26 basis points, led by the biggest single commodity drop of 13.1% from the S&P GSCI Natural Gas TR.

Before discussing what a difference one year makes and interest rate impacts on commodities, a few stats from inside the S&P GSCI TR are interesting from this forgettable February:

- Aluminum had its biggest consecutive 2-month gain of 13.5%, in 5 years when it returned 13.9% in Jan.-Feb. 2012.

- Cocoa lost for the 6th consecutive month, its longest losing streak since the 9 months ending in May 1999. Only four times in history since 1984 has cocoa been down this long. Also it is cocoa’s 2nd biggest drop in history, down 34.2% since Sep. 2016. Cocoa lost most, -48.2%, in Sep. 98 – May 99. Its other big losses occurred from Jan. – Jun. 1986 (-25.4%) and Dec. 92 – Jun. 93 (-17.9%.)

- Gold posted its first consecutive 2-month gain, 8.7% since Jun.-Jul. 2016, when it gained 10.9%.

- Kansas Wheat and Wheat posted the first positive consecutive 3-months ending April 2014 for Kansas Wheat and Dec. 2014 for Wheat. For the 3 months ending Feb., Kansas Wheat gained 10.0% and Wheat gained 7.3%.

- Natural gas lost 27% in Jan.-Feb. 2017. its worst 2-month loss since Jan. – Feb. 2016 when it fell 29.2%.

- Nickel had it best month, up 10.2%, since July 2016 when it gained 12.4%.

- Unleaded gas is down 10.5% in Jan. – Feb. 2016, the most since Jun. – July 2016 when it lost 19.3%.

While energy has struggled to start the year, losing 4.9%, all other sectors are up, reflected in the year-to-date performance of the S&P GSCI Non-Energy Total Return of 5.1%. As a reminder of how far commodities have come from this time last year, there were 10 commodities in a bear market that caused both the S&P GSCI TR and energy sector to be down more than 20% for the 12 months ending in Feb. 2016, and every single commodity and sector were negative except lead and gold. Now for the 12 months ending in Feb. 2017, every one of those bears are positive except for Kansas wheat. Further, there are 11 bulls plus the sectors of energy and industrial metals are each up over 20% and only cocoa is in a bear market.

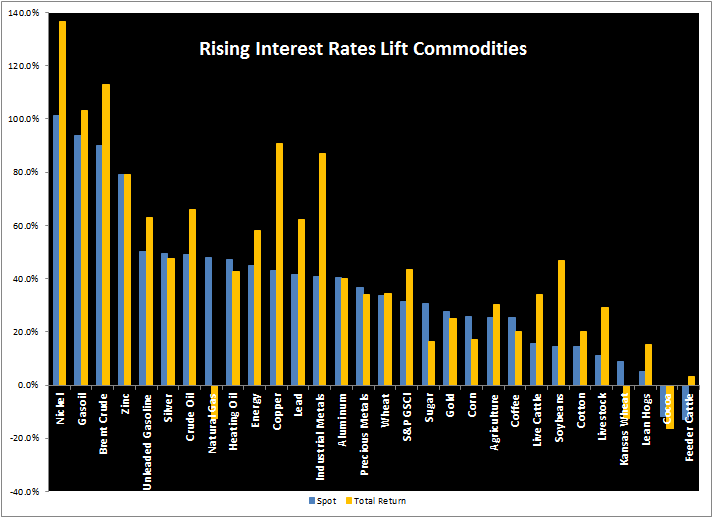

If commodities performance going forward depends on interest rates, there may be more of the bulls charging. Historically rising interest rates are positive for commodities. On average in rising rate periods, the S&P GSCI TR has gained 43.5%, more than the spot index that has gained on average 31.3%, showing that rising rates may drive carrying costs higher and making it less beneficial to hold inventory.

Which commodities benefit most from the rising rates? Energy and metals. Only cocoa and feeder cattle lose in rising interest rate environments. Additionally, for natural gas and wheat that are both difficult to store, the total return that includes the storage costs declines with rising rates.