In anticipation of S&P Dow Jones Indices’ ETF Masterclass for Canadian Advisors on June 23, 2016: A Bright Future for Financial Advisory, it helps to revisit some of the company’s involvement in the country. Our firm has always been committed to Canada, with an office on King Street West, and the company has always shown an eagerness to serve the country’s investment community. Through the partnership with the Toronto Stock Exchange, the S&P/TSX Composite Index has been the headline index for the Canadian equity market since 1977. In addition to equity performance measurement and design of strategic investing approaches, S&P DJI has provided Canadian market participants with products for other areas of investment. The S&P/TSX Preferred Share Index launched on June 12, 2007 and is designed to measure the performance of Canadian preferred stock.

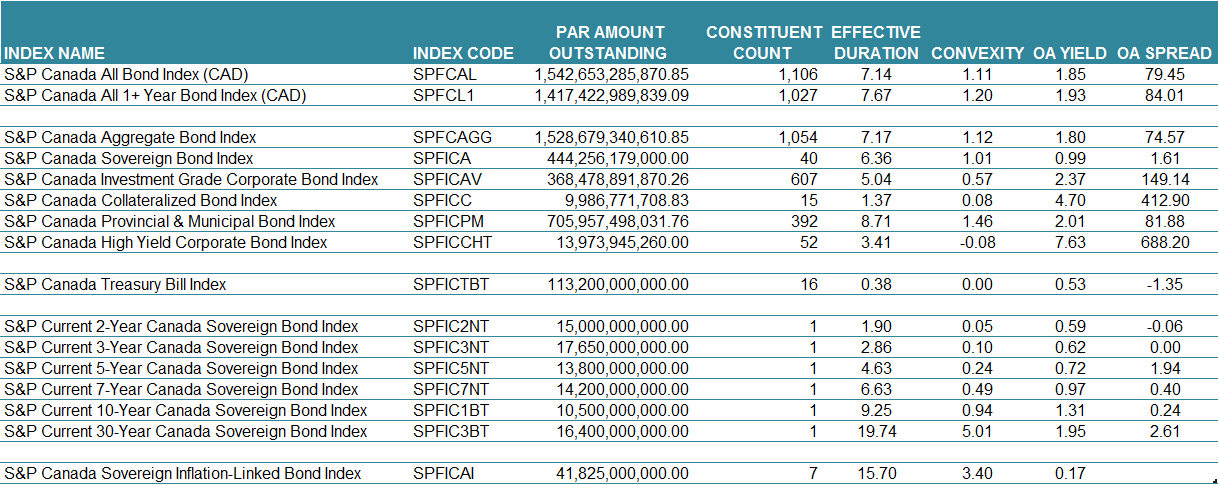

Recently, a Canadian fixed income family of indices was introduced, expanding S&P DJI’s product offerings. The index series seeks track the entirety of Canada’s fixed income market by providing performance measurement tools that range from Treasury bills, benchmark sovereigns (through core fixed income products) to Canadian high-yield and real-return bonds.

The S&P Canada All Bond Index is a broad, market value weighted index that is designed to measure both high-yield and investment-grade bonds. The index has been broken down into respective subindices (the S&P Canada Aggregate Bond Index and S&P Canada High Yield Corporate Bond Index) that match the different money management styles between the high-yield and investment-grade categories. Within each of these indices, the segments of fixed income have been broken down further into subindices that measure the characteristics and performance of each respective fixed income product group.

Notably, the March 30, 2016 launch of an ETF product by Toronto Dominion Asset Management has added to the ability of investors to track the performance of the S&P Canada Aggregate Bond Index.

In upcoming blog posts, we’ll analyze more of the sovereign, provincial and municipal (quasi-government), corporate, and collateralized subindices in regard to total return performance, index characteristics, and issuer composition.

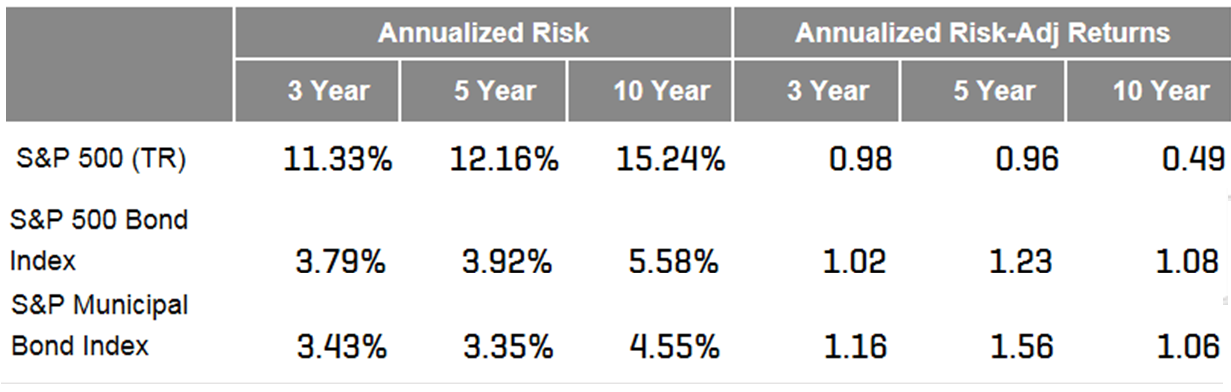

Exhibit 1: S&P Dow Jones Canadian Indices

If you would like to hear more on our Canadian fixed income indices, attend our upcoming event in Toronto on June 23, 2016.

The posts on this blog are opinions, not advice. Please read our Disclaimers.