The S&P GSCI (WTI) Crude Oil posted a 3-day gain of 14.4% ending Feb. 17, 2016. This is the biggest 3-day gain in about 6 months for the index, and gains of this magnitude have only happened near oil bottoms.

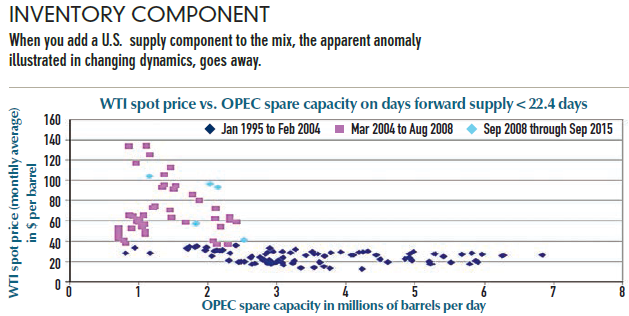

After the index hit its lowest since Nov 4, 2003, on Jan. 20, 2016, it capitulated, reaching near that level again, a few days ago on Feb. 11. Then oil spiked on news of the possibility of a production freeze from OPEC and non-OPEC producers, but quickly waned after hopes diminished and the reality of the lack of potential impact hit. OPEC has the ability to be the swing producer given its large market share, spare capacity, low production costs and capability of acting alone or in a cartel; however, U.S. inventories need to be low for it to matter.

The production coordination of U.S. shale producers is difficult since there are too many players that are always aiming to produce as much oil profitably as possible. Today, the American Petroleum Institute reported an unexpected decline in U.S. inventories that excited the market.

Without the decline in inventories from the U.S., the potential impact of an OPEC production freeze is far less. This makes the U.S. inventory arguably more important than the production decisions of the swing producer, Saudi Arabia, but as the U.S. inventory drops, the picture may shift the oil price power back towards Saudi Arabia.

The posts on this blog are opinions, not advice. Please read our Disclaimers.