As a believer in the power of diversification and inflation protection a basket of commodities can provide in a passive index framework, it is hard to grasp how much investors love oil and gold. It must be that oil is the biggest, most economically significant commodity, and gold is the shiniest, most prized metal – arguably a currency in its own right. From the largest pensions in the world to the smallest mom-and-pop retail investors, oil and gold dominate the conversation.

In Taipei this week, gold and oil were louder than ever. It is an exciting time for greater China as the first commodity futures ETFs are soon to be launched. This opens the possibility for investors in this region to get access more easily to the commodities they love, but for the commodity lady that loves passive, singling out gold and oil is a difficult task. Besides the star-power of these two commodities, why are they worth highlighting differently than the rest?

Gold lost -28.3% in 2013, its worst drop since 1981, and it has been relatively flat since. Oil clearly is top of mind from the price drop of 58.4% that most analysts did not expect. Taken together these historical drops, for some, create the buying opportunity of a lifetime. While these two commodities may not represent the entire asset class, (Brent and WTI) crude oil is most heavily weighted at about 40%, and has provided the most inflation protection of any commodity since it is the most volatile component of the Consumer Price Index (CPI) and is required to produce other commodities. Further, oil has had little correlation of 0.3 to the S&P 500 in the past 10 years while gold has had almost zero correlation to the S&P 500 – plus oil and gold have had only 0.2 correlation with each other. There is a diversification and inflation case using gold and oil if an investor is only buying two commodities.

However, understanding the implications of the ratio of gold to oil is important if choosing to use only the two commodities. Comparing the relative value of the two has revealed some interesting insights as I discussed in a video with Bluford Putnam, Managing Director and Chief Economist of the CME Group. The gold:oil ratio now suggests the oil price collapse may be more driven by supply than demand and that fears of deflation may be exaggerated.

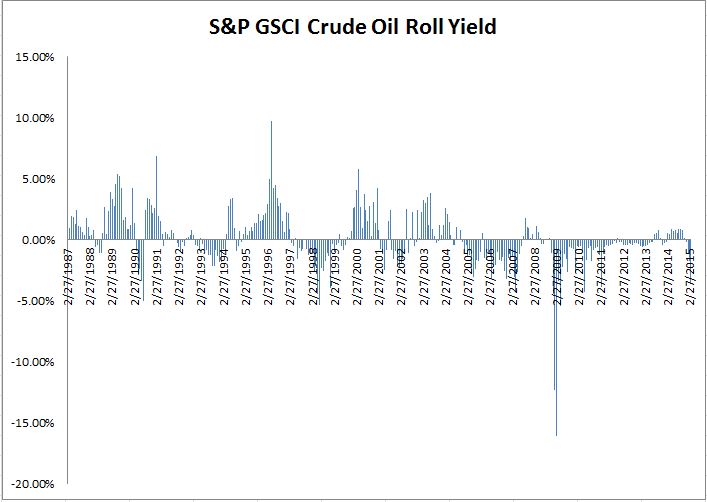

Below is a chart of the ratio of the S&P GSCI Gold in terms of the S&P GSCI Crude Oil with the index levels overlaid. Notice the red arrows showing that gold is remaining stable while oil falls.

This in conjunction with the changing term structure of oil from contango to backwardation in 2013-14 suggests the recent oil price drop oil is more of a production story than a consumption one.

It follows that if deflation is mostly due to production increases, including commodities, then a mild deflation may not indicate a future global recession. Still many believe with the decelerating growth in China, the slow growth in emerging markets and stagnation in Europe that the demand side is weak.

Even with a growth of around 6.5%, China’s real GDP growth rate still exceeds virtually all other major mature industrial countries. The world is not in a global recession, and with the exception of the oil-producing emerging market countries, there are signs of incremental increases in real GDP growth for 2015, according to Blu in this paper.

If oil prices remain low versus gold for an extended period of time, as was the case in the 1986-88 period, the elevated gold:oil ratio may indicate that the energy production boom (whether U.S. or Saudi Arabia) is much more responsible for oil’s price collapse than fears of global deflation, lack of demand, and recession, which probably would have caused the gold price to fall too. That said, it doesn’t mean gold is protected from the pressures of economic growth, an interest rate hike, and the highly accommodative monetary policies of Europe and Japan.

The posts on this blog are opinions, not advice. Please read our Disclaimers.