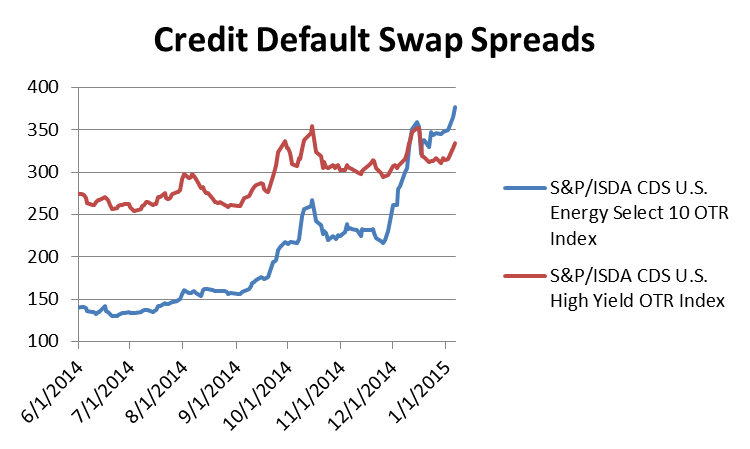

Data as of January 6, 2015

As oil prices have tumbled, the cost of buying default protection on the debt of energy companies has skyrocketed. The cost of buying default protection tracked in the S&P/ISDA CDS U.S. Energy Select 10 Index has nearly tripled from a low point in June 2014. As a result, default spreads for the energy sector are now higher than spreads for junk bonds indicating the energy sector is one of the riskiest sectors in the bond markets.

The S&P/ISDA CDS U.S. Energy Select 10 Index ended at 377bps up from 130bps in June 2014. Translated into dollars, the annual cost of buying default protection on $10million of debt on these entities has risen from $139,000 to $377,000. The S&P/ISDA CDS U.S. High Yield Index ended at 334bps.

The ten companies tracked in the S&P/ISDA CDS U.S. Energy Select 10 Index are:

- Anadarko Petroleum Corp.

- Apache Corp

- Chesapeake Energy Corp.

- ConocoPhillips

- Devon Energy Corporation

- Forest Oil Corp.

- Halliburton Company

- Peabody Energy Corporation

- Valero Energy Corp.

- Williams Companies, Inc. (The)

The posts on this blog are opinions, not advice. Please read our Disclaimers.