We recently introduced the concept of dispersion, which measures the average difference between the return of an index and the return of each of the index’s components. In times of high dispersion, the gap between the best performers and the worst performers is relatively wide; when dispersion is low, the performance gap narrows. Today’s dispersion levels are quite low by historical standards, which implies that:

- The degree to which the average skillful (or lucky) manager should be expected to exceed index returns is below average, and

- The degree to which the average unskilled (or unlucky) manager should be expected to lag index returns is also below average.

One consequence of low dispersion, in other words, is that the gap between the best and the worst performers is smaller than it would be if dispersion were higher. If that’s the case, then the current environment is not especially good for demonstrating stock selection skill.

On the other hand, it’s frequently been argued in recent weeks that since the correlation of stocks within the U.S. equity market is falling, 2014 is poised to be a “stock-picker’s market.” Correlations have indeed been declining — which means that correlation and dispersion seem to be delivering inconsistent messages. Is one “right” and the other “wrong?”

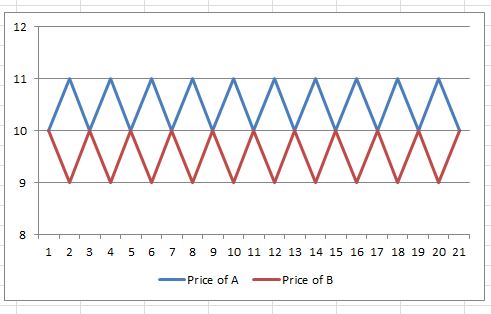

The reason for this apparent contradiction is that correlation and dispersion measure two different things. Consider a simple example, examining the behavior of two stocks over a 20-day holding period:

The correlation between A and B is -1.00. The two stocks are ideal diversifiers, since moves in one completely offset moves in the other. The return of both stocks, however, is the same 0%. Regardless of which one the investor bought, his return would be the same. (The only reward available for selection strategies is in fact a penalty, since holding either stock entails more volatility than holding both.) That doesn’t sound like a good environment for stock picking.

The correlation between A and B is -1.00. The two stocks are ideal diversifiers, since moves in one completely offset moves in the other. The return of both stocks, however, is the same 0%. Regardless of which one the investor bought, his return would be the same. (The only reward available for selection strategies is in fact a penalty, since holding either stock entails more volatility than holding both.) That doesn’t sound like a good environment for stock picking.

Now consider stocks C and D:

The correlation between C and D is 1.00, which is to say that both stocks always move in the same direction. Holding both has the same volatility as holding either stock individually. Does that mean that stock selection is irrelevant? Hardly, since C’s return (9.2% as shown) is more than double D’s return (4.5%).

The correlation between C and D is 1.00, which is to say that both stocks always move in the same direction. Holding both has the same volatility as holding either stock individually. Does that mean that stock selection is irrelevant? Hardly, since C’s return (9.2% as shown) is more than double D’s return (4.5%).

Correlation is primarily a measure of timing. High correlations mean that things go up and down at the same time; negative correlations mean that they offset. C and D always move in the same direction (hence the 1.00 correlation), while A and B always move in opposite directions (hence their -1.00 correlation). But low correlation does not necessarily mean that the environment is favorable for skillful stock pickers.

Dispersion is a measure of magnitude. It tells us by how much the return of the average stock differed from the market average. In our hypothetical exercise, there’s no dispersion at all between A and B, and a considerable dispersion between C and D. High dispersion gives skillful stock pickers a better chance to showcase their abilities.

Correlation is an essential tool in understanding portfolio diversification. But as a measure of the magnitude of opportunity available to selection strategies – dispersion is the better metric.

The posts on this blog are opinions, not advice. Please read our Disclaimers.