Goal oriented monetary policy and hidden sources of volatility, discussed at the US Monetary Policy Forum last Friday, sparked articles in the New York Times, the Financial Times and the Wall Street Journal over the weekend. With investors seeking income in bond and money markets while nervously watching for when Fed policy will shift to higher interest rates, the discussions offer some interesting hints.

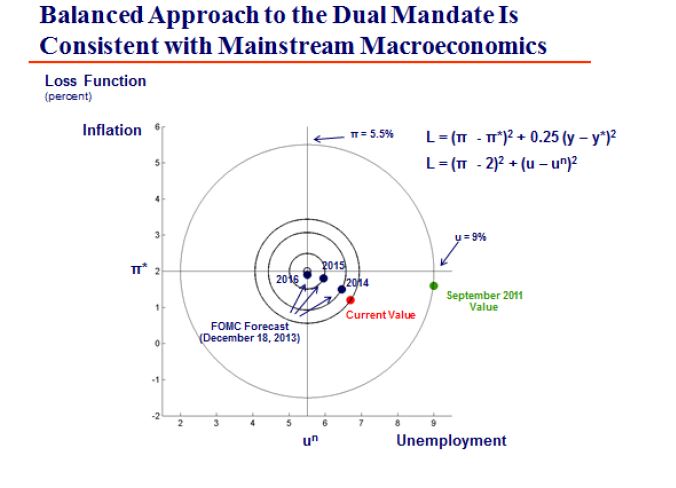

In the last year or so the Fed repeated that it wants inflation at 2% and will not raise interest rates until the unemployment is under 6.5%. The unemployment rate is now a tenth of a percent away from the target but arguments that it is sending misleading signals are widespread. Inflation, as measured by the Fed’s preferred gauge of the deflator on personal consumption expenditures, is well below is its goal. In one presentation Charles Evans, president of the Chicago Fed, proposed that an explicit function could be used to show the trade-off between the inflation and unemployment targets. He suggested that Fed policy would minimize the loss function:

V=(Inflation – 2%)2 + (unemployment – 5.5)2

The farther unemployment is from its target or the farther inflation is from its target of 2%. The 5.5% unemployment is the Fed’s forecast for 2016; there is no agreed target for unemployment. This is an improvement over the Taylor rule which chooses the Fed funds rate based on inflation. The Evans approach gives an explicit goal and shows the trade-off between the Fed’s dual – but sometimes conflicting – mandates of inflation and employment. In the spirit that a picture is worth 10,000 words, the chart (from Evans’ speech at the conference, available at the Chicago Fed’s web site) gives the target.

One other comment by Charles Evans is worth mentioning: the inflation objective is two sided: being below 2% is as bad as being above 2%. If getting closer to the bull’s eye in the diagram means pushing inflation over 2% to get a larger reduction in unemployment, that would be part of the approach. There were times in the past, such as 1979-1982, when high unemployment was seen as the necessary price to pay for low inflation.

The turmoil experienced last summer after the Fed first hinted at tapering is now termed a market tantrum. One of the papers presented at the Forum explored what might cause the kind of turmoil seen last summer and what might be done to prevent it. Unlike the financial crisis, the problems would not be caused by banks or excessive debt. Rather, a combination of a long period of low interest rates, the resulting search for yield and competition among fixed income mutual funds can conspire to create volatile fast moving markets. The key ideas revolve around the way mutual funds and other asset managers react which makes interest rate movements and markets asymmetric: when rates fall the reactions are slow and measured, when they rise the response is accelerate by positive feedback.

The story – stylized here – goes like this: The Fed cuts interest to extremely low levels to support the economy. Investors and fund managers search for yield, extend maturities, reach for lower credit quality and shift assets from short term floating rate money market funds to bonds, bond funds and similar investments. Mutual funds compete for investors’ assets and a key component of the competition is performance, especially in the search for yield. When the Fed hints that rates may rise, a “musical chairs” or “rush to the exits” mentality seizes the mutual funds – no one wants to be the last one out of bonds as the prices fall and their performance collapses. The preferred strategy in this game is getting out first. This rush, (or run in the traditional banking lingo) accelerates the market shift. Further, rising rates and falling prices encourages investors to withdraw money from the same mutual funds, pushing rates further up. All this is modeled and described in more detail, in the paper presented at the Forum.

The puzzle for monetary policy is how to tame this possible run on the market. Never using low interest rates to support the economy is not the answer. Maybe more transparent policy would help. One conclusion is that bank regulations would have no effect have no effect on these tantrums.

The posts on this blog are opinions, not advice. Please read our Disclaimers.