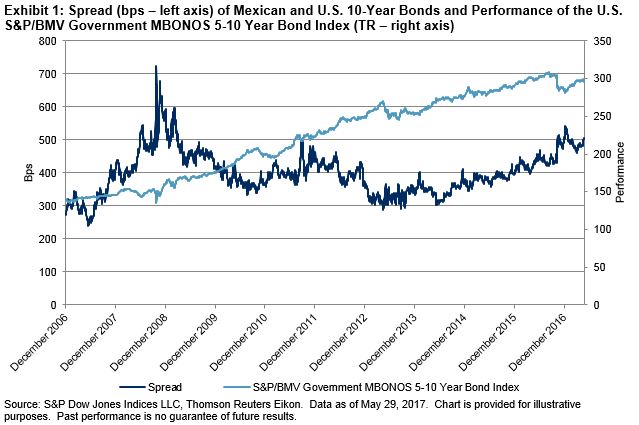

In an environment of increasing rates, Mexico has not been left behind. As seen in my last blog, since December 2015, Mexico’s Central Bank (Banxico) has increased the reference rate by 375 bps, with the last 25 bps being a surprise for analysts and the market on May 19, 2017. I remember the days when everyone was saying that Banxico would move with the U.S. Fed, but as of the same date, the U.S. Fed has increased its reference rate by only 75 bps. Their next meeting is in June 2017, and many analysts estimate an increase of 25 bps. Exhibit 1 shows the spread between the Mexican 10-Year Bond and the U.S. 10-Year Treasury Bond for the 10–year period ending May 29, 2017, along with the performance of the S&P/BMV Government MBONOS 5-10 Year Bond Index.

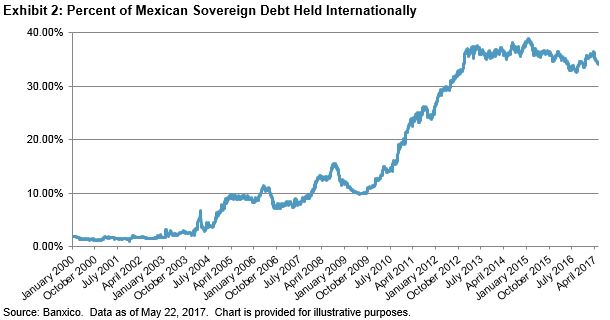

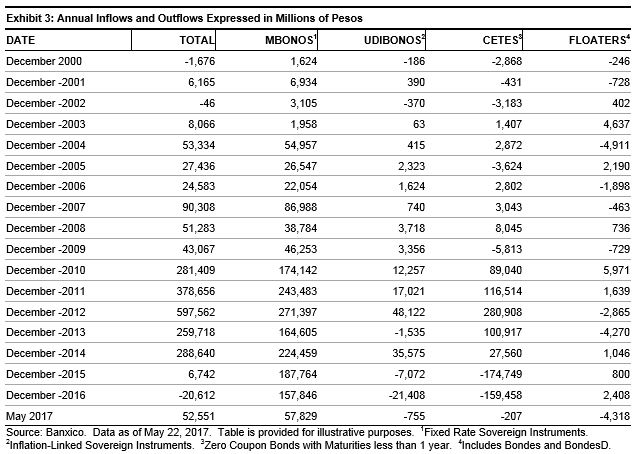

For the past three years, the spread trend has been positive, with the most recent data above 500 bps. Has this affected the inflows and outflows for sovereign instruments? People often talk about Mbonos (fixed-rate sovereign instruments) that are held by non-residents, but let’s dig further into other issuances and total assets. First, Exhibit 2 shows the historical behavior of the total percentage of sovereign debt held outside of Mexico. As of May 22, 2017, a little bit more than one-third was held outside the country. We also see a rapid increase between 2010 and 2012, from nearly 10% to 35%. Exhibit 3 shows the annual inflows and outflows, expressed in millions of Mexican pesos, from January 2000 to May 22, 2017.

The trend for Mbonos is still positive, but by this time last year, the inflows were double what they are now. For Udibonos and Cetes, the trend for the past three years has been downward, making 2016 the first year with total outflows since 2002.

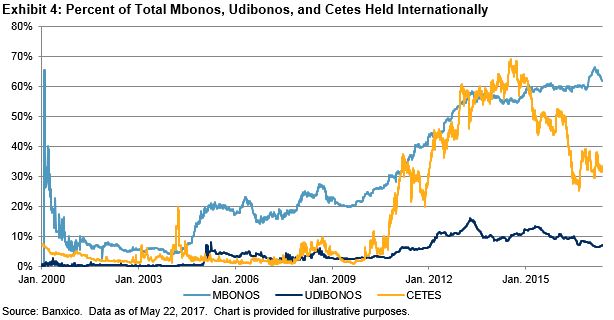

Exhibit 4 shows the percentage of Mbonos, Udibonos, and Cetes held by international market participants; note that since September 2012, one-half of the total Mbonos have been held internationally, and at one point non-resident holdings of Cetes hit nearly 70%.

Sovereign bonds are still attractive to foreigners, but not to the same degree as in 2010 to 2014, when the search for yield spiked. Over the past few years, no new inflows were presented, and we can assume that the position from Cetes moved to Mbonos. Inflation instruments might be more attractive now, since, as shown in my last post, inflation has increased significantly, reaching 5.86% year-over-year in April 2017.

For more information about the indices following these instruments, please see: S&P/BMV Government CETES Bond Index, S&P/BMV Government MBONOS 1-5 Year Bond Index, S&P/BMV Government MBONOS 5-10 Year Bond Index, S&P/BMV Government Inflation-Linked UDIBONOS 1+ Year Bond Index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.