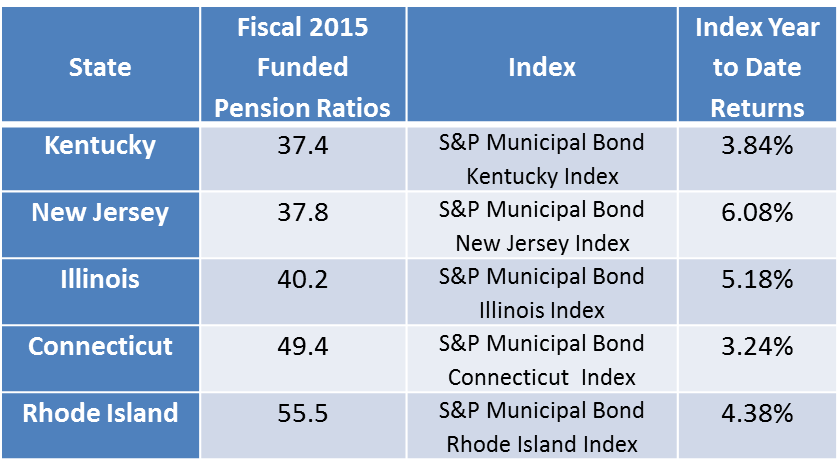

S&P Global Ratings released a report on September 12th 2016 U.S. State Pensions: Weak Market Returns Will Contribute to Rise in Expense. Importantly, the report identified the five worst and best funded state pensions. You might think that an underfunded pension liability would mean the market would avoiding the municipal bonds issued by or within those states. The market has determined otherwise.

Of the five states with the worst-funded pension ratios, three have outperformed the S&P Municipal Bond Index which has returned 4.16% year-to-date. Limited supply of bonds and the ever present hunger for yield have a lot to do with the returns.

- New Jersey, Illinois and Rhode Island municipal bonds started the year with impressive incremental yields over bonds from other states drawing attention from the yield starved market place. As a result, the S&P Municipal Bond New Jersey Index has returned over 6% and the S&P Municipal Bond Illinois Index has returned over 5.1% year-to-date .

- Kentucky has the worst-funded pension fund. However, the lack of supply of bonds from Kentucky, including no state general obligation bonds, keep any bonds from Kentucky in the sites of mutual funds seeking to further diversify away from the larger issuers. The S&P Municipal Bond Kentucky Index has only modestly underperformed returning 3.88% year-to-date.

Table 1) Fiscal 2015 Five Worst-Funded Pension Ratios and Bond Returns (YTD)

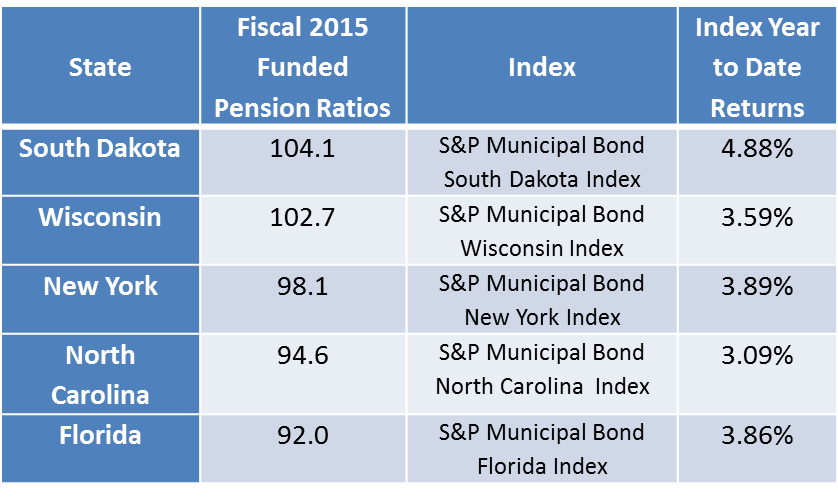

Bonds from only one of the five states with the best-funded pension ratios have outperformed the S&P Municipal Bond Index. The S&P Municipal Bond South Dakota Index has seen a return of over 4.8% year-to-date with the lack of supply being a major factor.

Table 2) Fiscal 2015 Five Best-Funded Pension Ratios and Bond Returns (YTD)

Bottom line: supply and demand imbalances and yield hungry markets appear to be outweighing the fundamental factor of potential pension shortfalls.

Additional perspectives on this phenomenon in the municipal bond market are encouraged and welcomed.

The posts on this blog are opinions, not advice. Please read our Disclaimers.