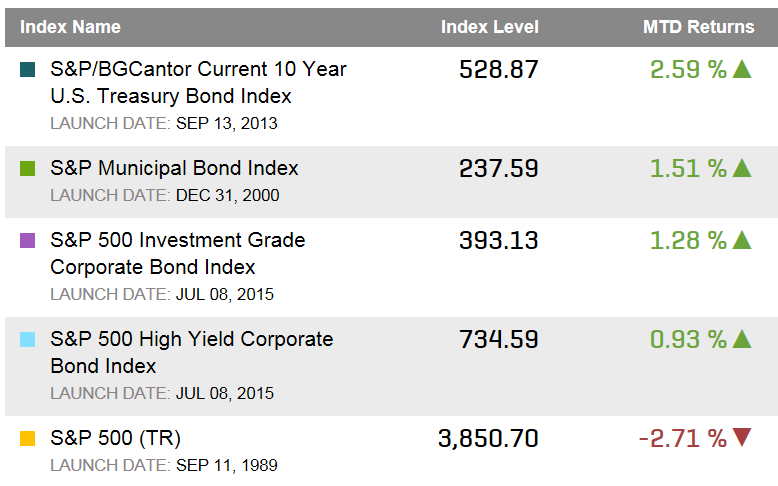

According to my colleague, Howard Silverblatt, Senior Index Analyst, “The S&P 500 posted a $317.2 billion fall, after Friday’s $656.9, making the two-day fall $974.2 billion – the third worst on record. The 2-day point drop of 112.79 was the second worst point drop on record, and on a percentage basis, the 5.37% decline for 2-days is ranked 154.” Sounds like a bad two days for the stock market and understandably so from the uncertainty of Brexit.

In the meantime, The S&P GSCI Gold Total Return gained 4.9% on Jun. 24-27, 2016, the most in two days since Aug. 8-9, 2011. It is ranked the 31st biggest 2-day gain out of 7,644 and of these 31 times gold returned this much, the S&P 500 was only positive 10 of the times. On the other hand, when the S&P 500 lost as much as 5.4% in 2 days in history the average drop was 7.2%, while gold gained 0.4% on average during these down stock market days.

Now may be a good time for gold and gold miners not only for it’s diversification properties but for its ability to hold up to a strengthening dollar and that it is seasonally a good time for gold. Gold holds up well independently of the stock market. It also rises 32.5 basis points on average for every 1% the dollar rises, even though it rises much more, 3.5% for each 1% the dollar falls. Last, the 3rd quarter is historically the best for gold, gaining 4.7% on average, which is 40 basis points more than the S&P GSCI index in past 3rd quarters.

Here are some thoughts from a recent Bloomberg radio appearance about Brexit on commodities including gold and North Sea Oil. Also here is why the relationship between Scotland and England matters for Brent Oil.

For the inside scoop, and for anyone having trouble tuning in, here are my notes to the radio producer about Brexit on commodities:

1. Fundamentally, it is too early to tell the impact of Brexit on commodities. Basically supply and demand should not change in the short term, but if Great Britain’s independence strengthens their productivity in the long run, the impact should be positive.

Interest rates and the dollar

Two potentially positive impacts on commodities would have been rising interest rates and a falling dollar. However the likelihood of either happening now is less so that is a bad sign for commodities.

Market Risk

Brexit is and may continue to drive market fear that bleeds across risky assets.

When this happens, commodity investors typically pull out since they don’t feel like they are getting compensated for the risk to “sell insurance” in the futures markets. The result is increased volatility and then a drop and open interest which is actually a force to make suppliers pullback that can drive up commodity prices in the long term despite short-term pain.

How to play

Right now the dollar strength and summer are the two key factors for commodities. Luckily the rising dollar doesn’t hurt commodities as much as a falling one helps; however, energy and industrial metals get hurt most. That said, gold, sugar and cattle tend to rise regardless of the dollar direction.

Hot weather in the summer is the other main factor driving commodities right now and q3 is typically best for the asset class. Historically unleaded gasoline, crude oil, precious metals and wheat do best in summer.

This may be time for gold

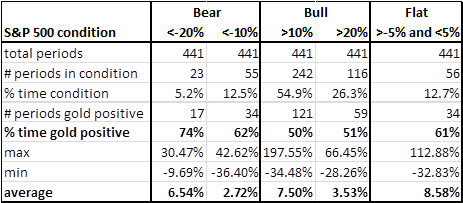

What is interesting is Brexit may be the cherry on top of the volatility crisis that will drive up gold. Gold has always been a diversifier, with nearly zero correlation to the stock market and protects nicely. In history when the S&P 500 has fallen more than 10%, gold has gained about 60% of the time rising about 3% per month. Also if stocks fall more like 20% then gold gains more than double returning about 6.5% monthly. This plus its positive performance with the rising dollar and its best quarter coming, could drive it gold higher than in prior index history (gold levels at about $1800) given we haven’t seen an event like Brexit before.

The posts on this blog are opinions, not advice. Please read our Disclaimers.