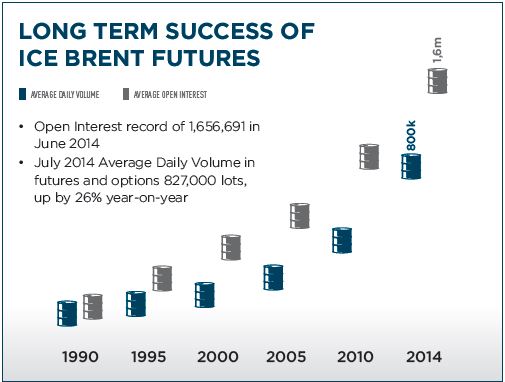

Will Scotland vote to become independent? That’s a big question, especially for the future of commodity indices. This is since one of the largest commodities in the indices is Brent crude oil – the oil produced in the North Sea off of Scotland’s coast. If Scotland separates from the United Kingdom, there may be consequences for the oil that is the arguable benchmark of the world. According the Intercontinental Exchange (ICE), since March 2012, ICE Brent has been the world’s largest crude oil futures contract with annual volume reaching a record 159 million contracts in 2013, doubling market share since 2008.

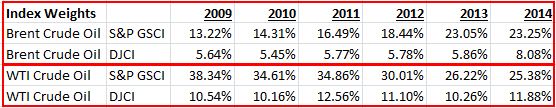

From this, commodity indices have increased their allocation to Brent. Over the past 5 years Brent has replaced WTI at a relatively high pace. Notice in 2009, Brent was less than half WTI and today the allocations are near equivalent, especially in the S&P GSCI. Also notice the big increase in Brent in 2014 in the DJCI.

Although the U.K. only produces about 4.2% of Non-OPEC OECD or 89 kb/d of the world oil supply as seen below, the great majority of offshore production is in Scottish waters.

If Scotland votes yes to independence, their local oil market may have a much bigger global impact. Despite it’s size, it is the oil used to set benchmark prices in London each day. Just 2.4 mb/d of the oil from the U.K. and Norway, set pricing for about 60 million barrels of oil or 60% of global supply that is priced based on Brent crude oil. It is the dominant benchmark rate against which daily oil trades are priced worldwide. The new uncertainty may place great pressure on the oil price which may be magnified by the weakened local currency since it is denominated in dollars.

Brent’s turmoil could reverse the trend of increasing weight in the indices, giving the opportunity for WTI to grow again, especially if the U.S. starts exporting oil. However, the change could be gradual since the indices use five year averages in liquidity and world production.

The posts on this blog are opinions, not advice. Please read our Disclaimers.