Sorry, grains and meats, you are not one of the four main food groups.

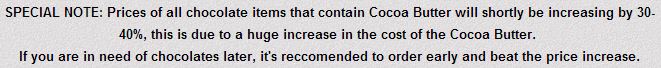

Since this is the case, eating may have just become more expensive, especially for the high-end chocolate lover. Not me of course… but once again, as a commodity lady, when I consume goods (or goodies) and notice that prices are increasing or decreasing I think about the prices of the raw materials and how the indices are impacted. I have noticed the price of chocolate increasing, so decided a deeper dive into the softs might be interesting.

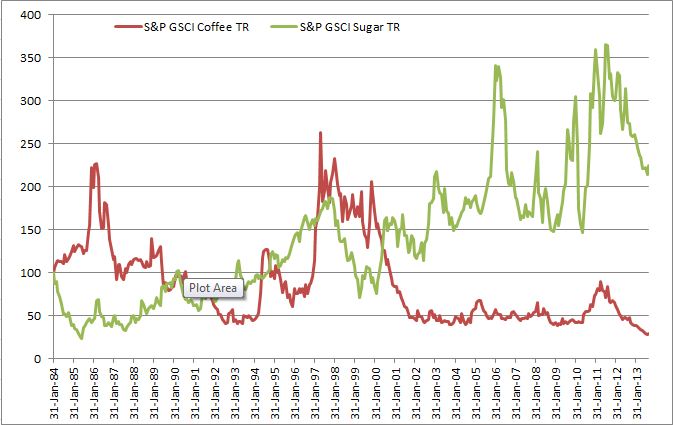

So far in September, sugar, coffee and cocoa are hot. While the S&P GSCI Sugar and the S&P GSCI Coffee are up 5.1% and 3.2%, respectively, MTD through Sept 13, 2013, both are coming off of bear market draw-downs. From Jan 31, 2013- Aug 30, 2013 the S&P GSCI Coffee lost 26.5% and going back to its high in April 2011 the index lost 68.2%. The S&P GSCI Sugar lost 31.8% since July 31, 2012.

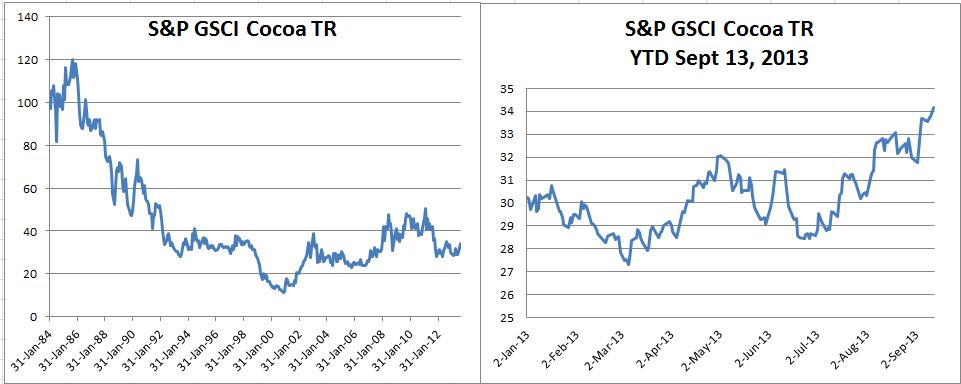

The story for the S&P GSCI Cocoa looks a bit different, and rather than a rebound from a bear market, it looks more like a bull. From its low on June 27, 2013, the S&P GSCI Cocoa is up 20.1%.

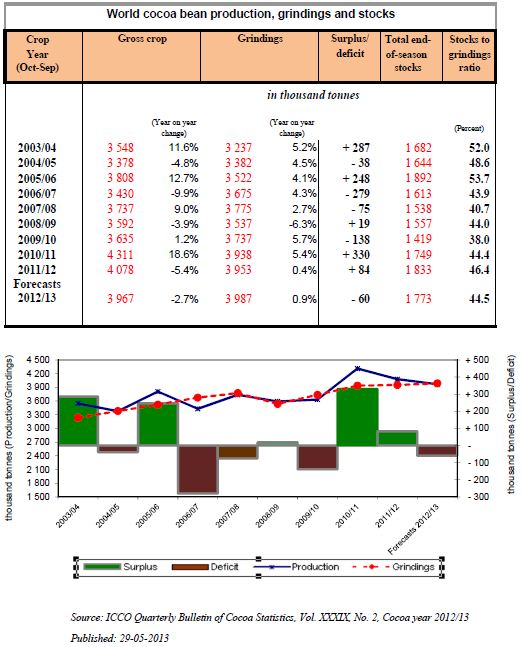

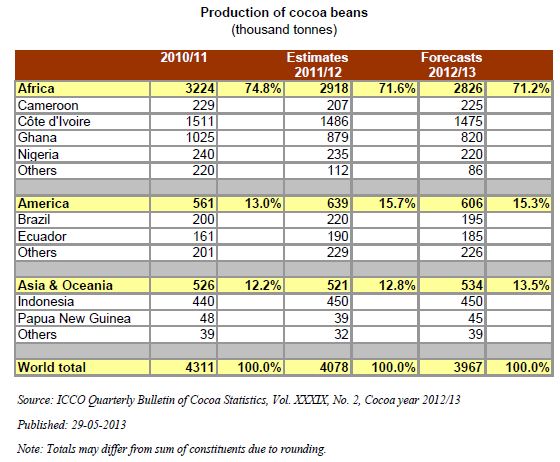

There have been strong fundamentals supporting the price, both on the supply and demand sides.

Producers have cut capacity because when the cocoa beans are ground, roughly equal parts of cocoa butter and cocoa powder are produced, but consumers have demanded butter over powder, leaving producers with excess powder. The uneven demand profile can be blamed on greater high-end consumer demand, which requires more cocoa butter than powder. Normally, as the cocoa butter-to-powder ratio increases, cocoa futures drop and the production evens out; however, this time is different since there are worries about a global bean shortage, especially from the Ivory Coast, one of the world’s top producers.

http://en.wikipedia.org/wiki/Beta_(finance)

http://en.wikipedia.org/wiki/Beta_(finance)