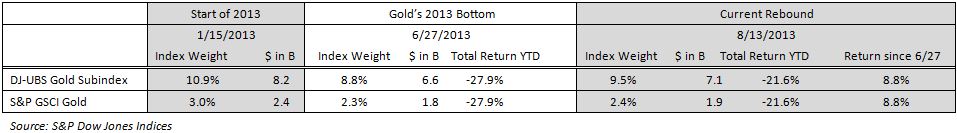

In light of much negative news about the bust in gold, I thought it might be interesting to share the impact the gold drop has had on dollar exposure in the two most widely used commodity indices, the S&P GSCI and DJ-UBS. Below is a note we published today in a media bulletin:

Good afternoon –

Jodie Gunzberg, Vice President at S&P Dow Jones Indices has issued the following research note:

Gold’s Bear Market Impact on the Commodity Market

Gold is down 21.6% YTD in the S&P GSCI and DJ-UBS

What does that mean in dollars? The indices lost about $1.6B in gold in 2013.

BUT it’s not all bad news. Gold has actually gained almost $600m in the indices since its bottom on June 27, 2013.

There are approximately $155B tracking the two most widely followed commodity indices S&P GSCI and DJ-UBS. While the assets tracking are closely split with about $80B tracking the S&P GSCI and $75B tracking the DJ-UBS, the amount in gold is quite different. The S&P GSCI has been impacted far less from the lower exposure resulting from the world-production weight.

The posts on this blog are opinions, not advice. Please read our Disclaimers.