The outperformance of equal weight indices is well documented, especially for the S&P 500® Equal Weight Index’s 20 years of live history. Equal Weight’s relative returns reflect the impact of several important index characteristics. For example, smaller-size exposure and (anti-) momentum effects together account for around 75% of the historical variation of its relative returns.

Elevated sector dispersion has made sector allocations more important in explaining Equal Weight’s recent relative returns. Indeed, the S&P 500 Equal Weight Index’s greater exposure to Energy and lower exposure to Communication Services, Information Technology and Consumer Discretionary accounted for around two-thirds of its 7% outperformance in 2022. These exposures also helped to explain the index’s underperformance in Q1 2023.

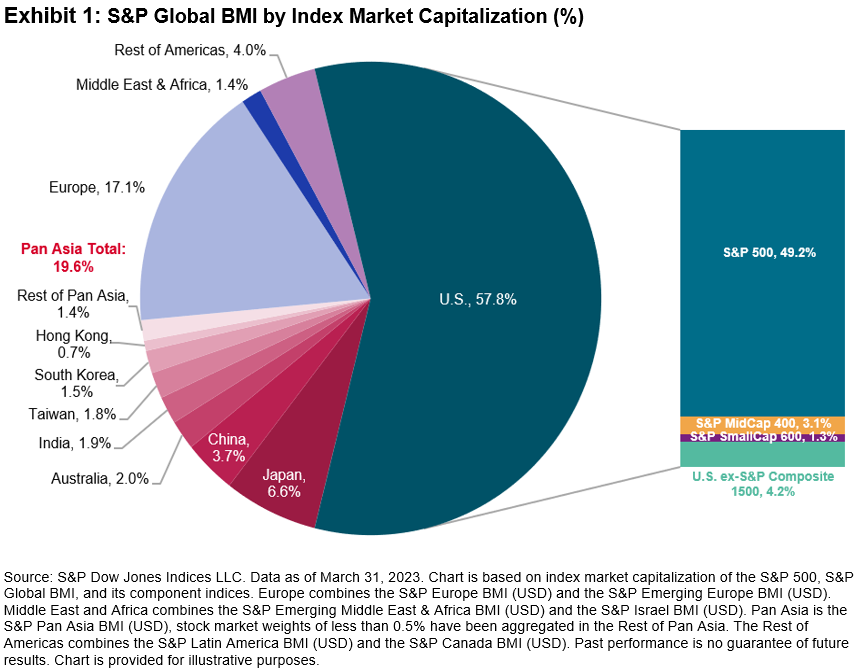

At the same time, it’s important not to overlook the impact of equal weighting within each sector. To see why, we construct hypothetical “intermediate” portfolios that represent steps along distinct paths between the S&P 500 and the S&P 500 Equal Weight Index. Exhibit 1 summarizes these two hypothetical paths.

The hypothetical “Sectors Matching EQW” portfolio adjusts S&P 500 sector weights so that they match those of the Equal Weight Index while ensuring that companies within the same sector remain float market-cap weighted. Alternatively, the hypothetical “EQW Within Sectors” portfolio retains the S&P 500’s sector allocations but weights every name equally within each sector.

Exhibit 2 shows that equally weighting within each sector mattered more when explaining the S&P 500 Equal Weight Index’s historical returns. Indeed, the cumulative total return for the hypothetical “EQW Within Sectors” portfolio is graphically indistinguishable from that of the S&P 500 Equal Weight Index. While the equal weight index may have sporadically benefited from its distinct sector allocations, having more exposure to the smaller names within each sector was the most important driver of the S&P 500 Equal Weight Index’s returns.

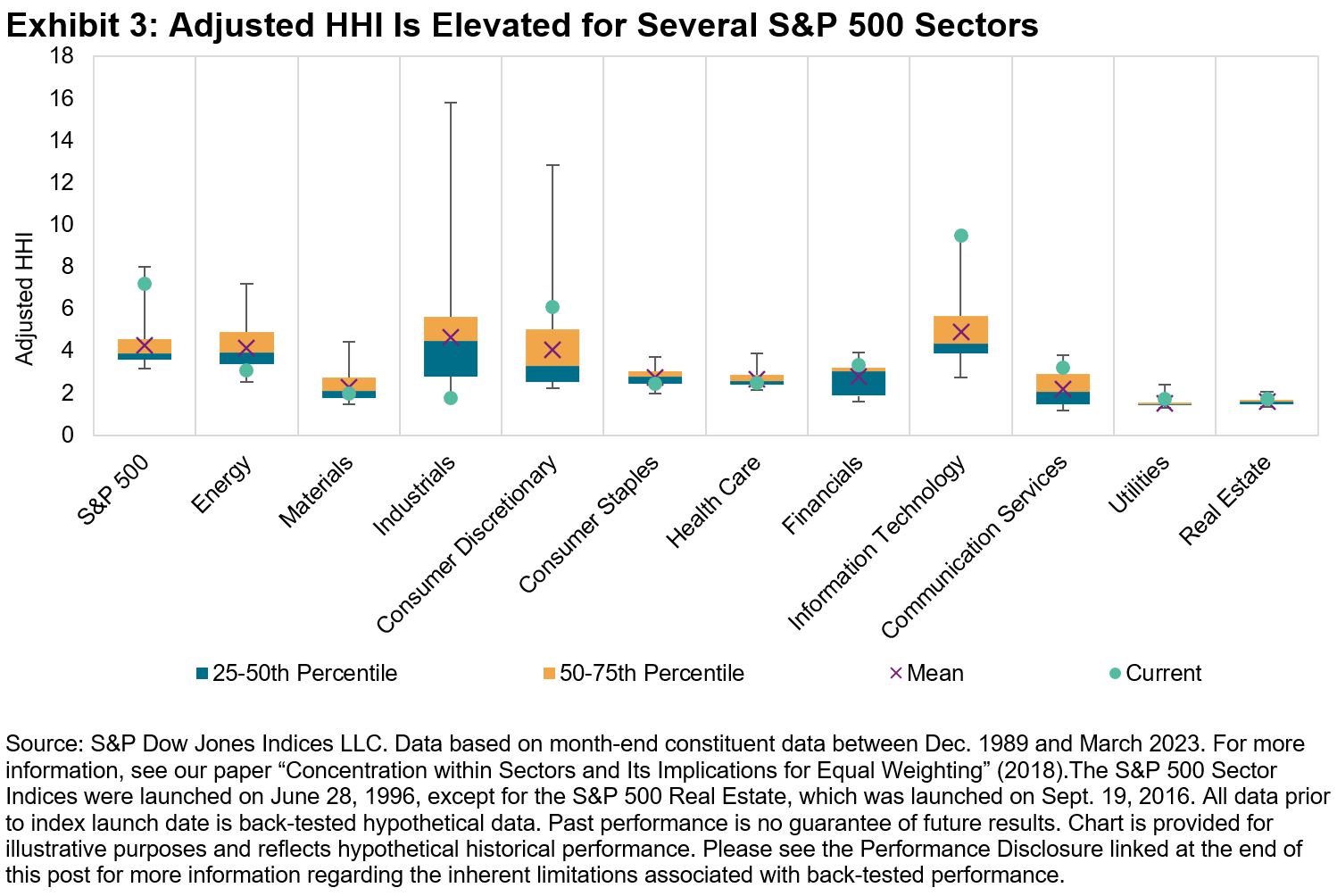

The relative degree of concentration within sectors suggests a potential tactical application. Exhibit 3 shows the distribution of adjusted Herfindahl-Hirschman Index (HHI) figures for the S&P 500 and its 11 GICS sectors; a higher adjusted HHI figure means that concentration is higher, independent of the number of stocks in each index. The current concentration is elevated in several sectors, particularly in Information Technology.

By definition, equally weighted sector indices have less exposure to larger names than do their float market-cap counterparts. All else equal, falling concentration indicates underperformance from the largest names, and vice-versa. Hence, one would expect equally weighted sectors to outperform when concentration falls.

Exhibit 4 confirms this expectation: the S&P 500 Equal Weight Information Technology Index typically outperformed its float market-cap counterpart when the sector’s adjusted HHI declined. Hence, to the extent that current concentration levels decline, market participants may wish to consider the potential applications of an equally weighted sector strategy.

For more information on the interaction between concentration and equal weight performance, and to celebrate the S&P 500 Equal Weight Index’s 20th birthday, check out the replay of our Index Investment Strategy call from April 20, 2023.

The posts on this blog are opinions, not advice. Please read our Disclaimers.