After 83% of euro-denominated pan-regional equity funds failed to outperform the S&P Europe 350® in the 10 years leading up to the start of 2022, last year brought an intriguing change in the market winds, including the end of near-zero interest rates and, along with it, higher hopes for stock-picking. There was higher dispersion and, with value stocks beating their peers, there were certainly opportunities for outperformance for those managers paying attention to fundamentals.

As it turns out, the year may well go down as one to forget for most active European equity managers, particularly in the pan-European equity category—in which 87% and 83% of funds underperformed in the euro-denominated and pound sterling-denominated categories, respectively.

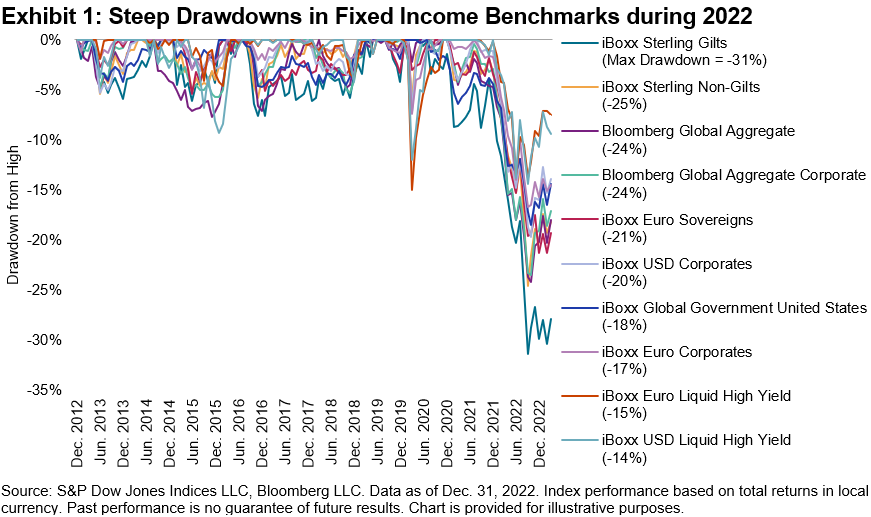

While most major markets finished the year with declines, for managers with a “go anywhere, do anything” approach, there were also stark opportunities to generate relative value. Even in adjacent categories—large- and small-cap U.K. equities, for example—there were significant differences in performance. Exhibit 1, reproduced from the scorecard, summarizes full-year 2022 performance across a range of popular fund benchmarks.

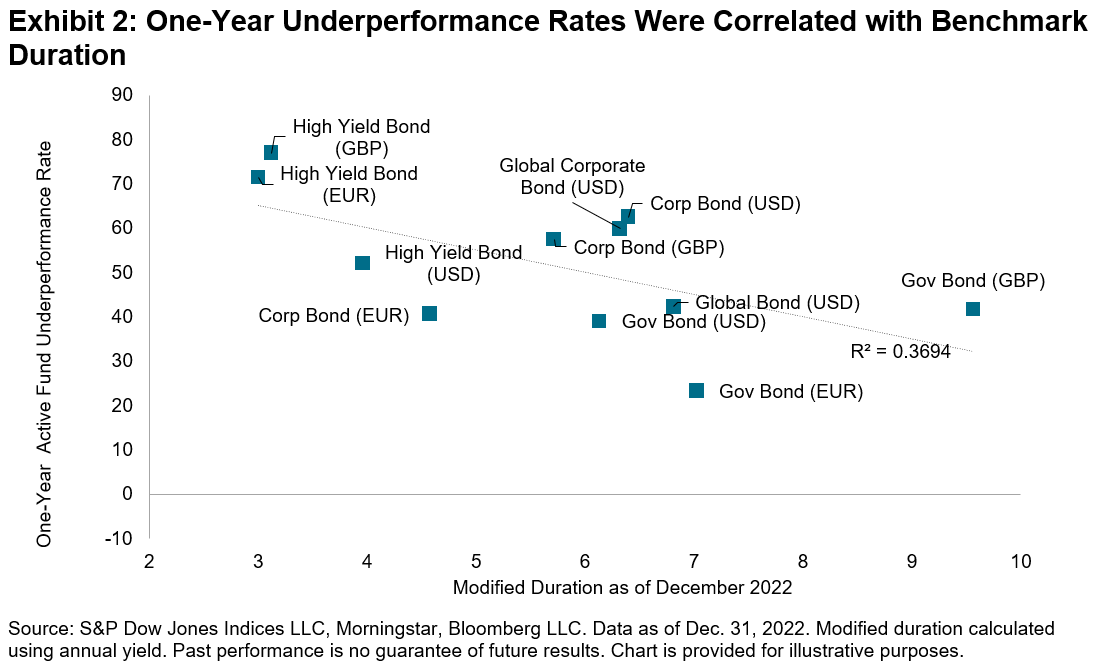

Against this backdrop, Exhibit 2 summarizes the one-year underperformance rates across all the fund categories included in the year-end 2022 scorecard.

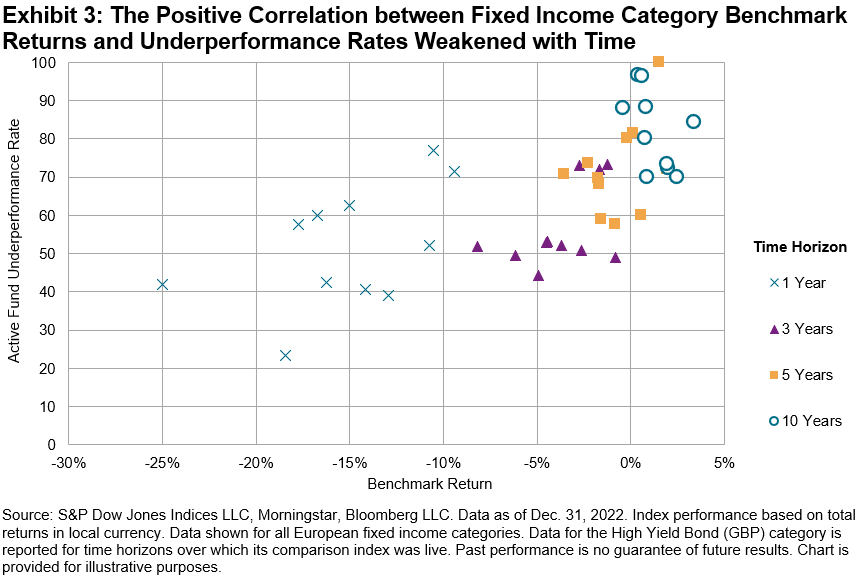

The scorecard also provides a raft of further data and analysis on the market conditions that accompanied such performance, as well as deeper statistics on the performance of actively managed funds. Readers can also dig deeper into the short- and long-term data on actively managed fixed income funds—included in our European scorecard for the first time this year—in a supporting blog by the report’s main author.

However, it is sometimes worth stepping back from the granular data to make a broader, simple observation, and there is a clear one hinted at by the SPIVA Europe Year-End 2022 Scorecard. In short: while volatile and falling markets might offer active managers greater opportunities to add value, there is no guarantee that they will be able to do so. As compared to European active managers in particular, the year-end 2022 scorecard adds to a growing library of evidence that, contrary to the common conception, an index-based approach to investing can be far better than “settling for average.”

The posts on this blog are opinions, not advice. Please read our Disclaimers.