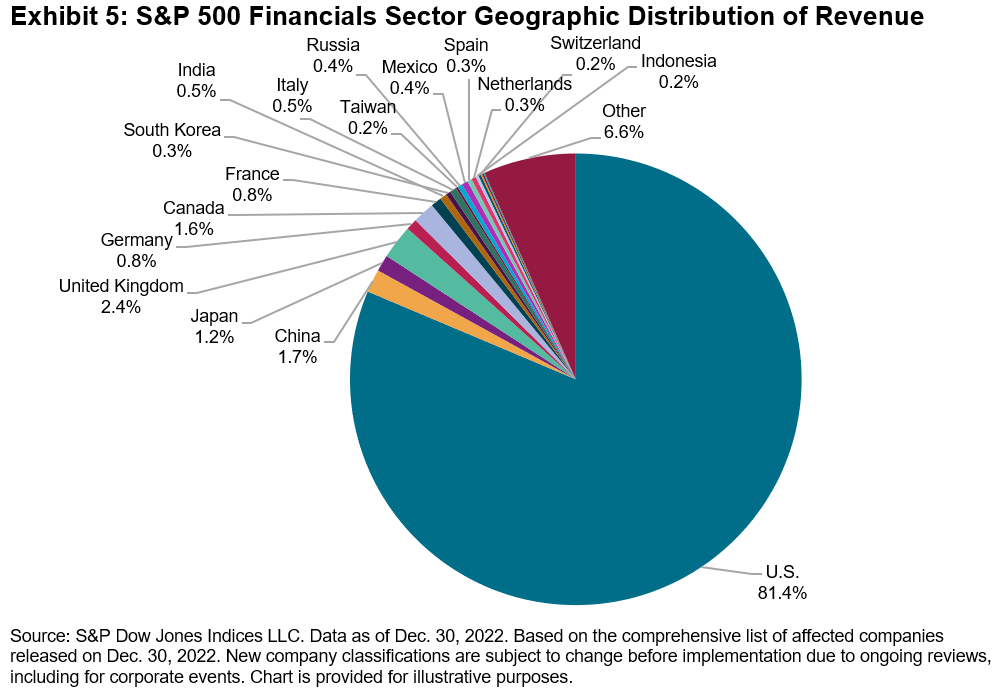

Revisions to the Global Industry Classification Standard (GICS®) structure are primed to go into effect after the close of business on Friday, March 17, 2023. While the changes are not as extensive as in previous iterations, they affect the GICS structure at all levels and this article examines the impact of the changes on the S&P Global 1200.

Exhibit 1 shows the expected updates at the sector level for each index included in the S&P Global 1200. Inter-sector changes refers to reclassification of constituents to a different sector under the new GICS structure, while changes within sector refers to firms being reclassified (i.e. sub-industry updates) within their current sector.

The S&P 500 is set to experience the greatest number of both inter-sector changes and changes within sector. More information can be found in the prior blog written by Fei Wang, 2023 GICS Changes: S&P 500 Impact Analysis.

Exhibits 2a and 2b examine modifications broken down at the sector level. Five out of the 11 GICS sectors will increase or decrease their constituent count, while four will experience intra-sector changes. Six sectors have been left untouched by the March 2023 GICS changes. The exhibit also incorporates any adds or drops stemming from index rebalancing that affect the overall sector compositions.

Inter-Sector Changes

The Information Technology (IT) sector will experience the largest decrease in constituents due to companies changing sector, while Financials will increase the most. Current IT sub-industry Data Processing & Outsourced Services will be discontinued, and current companies will either be re-classified to the new Transaction & Payment Processing Services sub-industry within the Financials sector or moved to the Industrials sector under a new Data Processing & Outsourced Services sub-industry.

The changes in the Consumer Discretionary sector are based on the nature of goods sold. Some retailers will be reclassified within the Consumer Staples sector. The discontinuation of the Internet & Direct Marketing retail, as well as the merger of the General Merchandise Stores and Department Stores into a new sub-industry called Broadline Retail, account for the majority of changes. Firms affected by these changes include Amazon, Alibaba and Prosus.

The Real Estate sector will be affected by an increased granularity of company classifications within Real Estate Investment Trusts (REITs). Retail properties, data centers, telecom towers and others will be reclassified at the sub-industry level.

Exhibit 3 analyzes the movement between sectors of the S&P Global 1200. On the left side are the current sectors of the impacted constituents, while the right side represent the destination following the GICS restructuring.

Breakdown of Changes by Country and Region

Exhibit 4 breaks down the changes by constituent index and country of domicile for the affected constituents, for both inter-sector and changes within sector.

Company-Level Changes

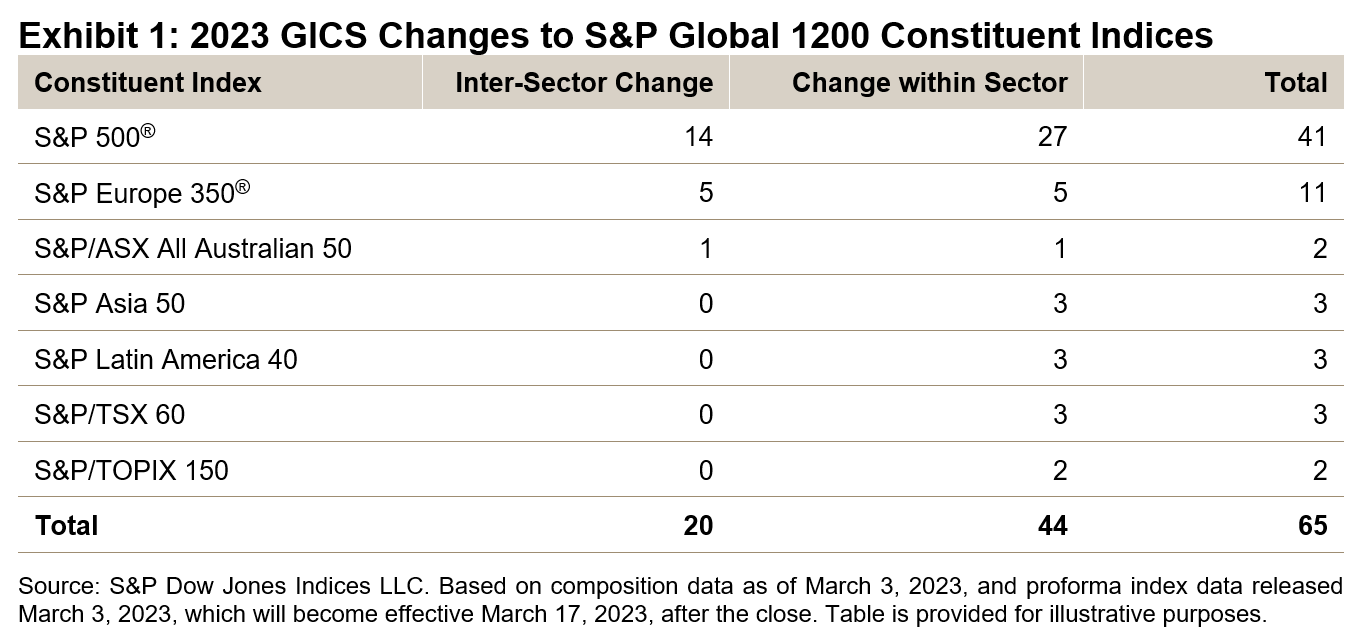

Visa and Mastercard represent the most significant inter-sector change, moving from Information Technology to Financials and entering as the third- and fourth-largest constituents in the sector by index market cap, respectively. Target leads the changes from the Consumer Discretionary sector, followed by Dollar General and Dollar Tree.

Exhibit 5 shows all companies affected by updates to sector definitions, along with their new assignments.

The posts on this blog are opinions, not advice. Please read our Disclaimers.