GICS® changes are approaching. On Dec. 15, 2022, S&P Dow Jones Indices and MSCI jointly announced a full list of companies affected by the upcoming revisions to the Global Industry Classification Standard (GICS) structure. Although the 2023 GICS changes are not as extensive as the Communication Services sector change in 2018, there are still significant impacts to many sectors, industries and companies.

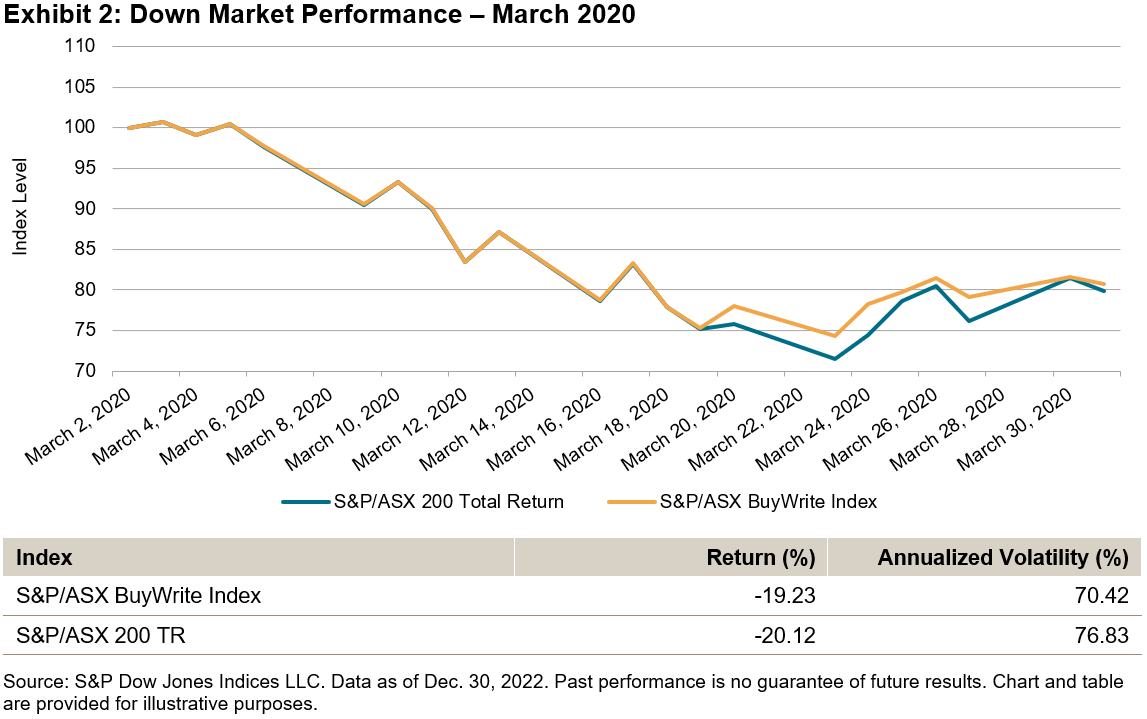

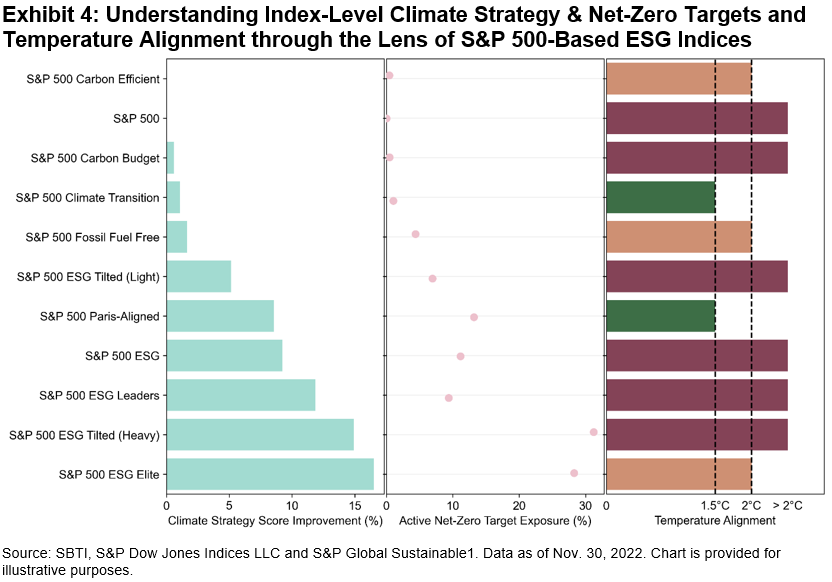

Exhibit 1 shows an overview of the expected impact on various U.S. equity indices. The “intra” changes refer to the reclassification of stocks within a sector, while the “inter” changes correspond to stocks being moved from their current sector to another under the new GICS structure. These U.S. equity indices have more intra than inter changes in this reorganization.

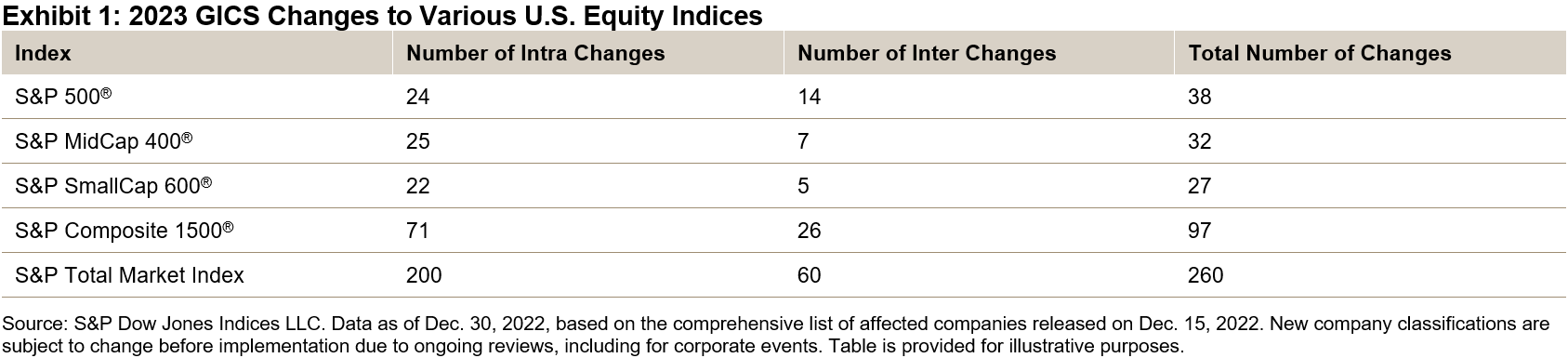

Exhibit 2 provides more detail on the S&P 500, showing that 6 of the 11 S&P 500 sectors will be affected by the upcoming GICS changes. Real Estate accounts for the vast majority of intra changes, reflecting the sector’s additional granularity in the upcoming restructuring. Hence, 17 stocks will be reclassified within the Real Estate sector, making up 60% of the sector market weight post-changes. Most changes will come from the current Specialized REITs and Residential REITs categories, which will be placed into more specific categories.

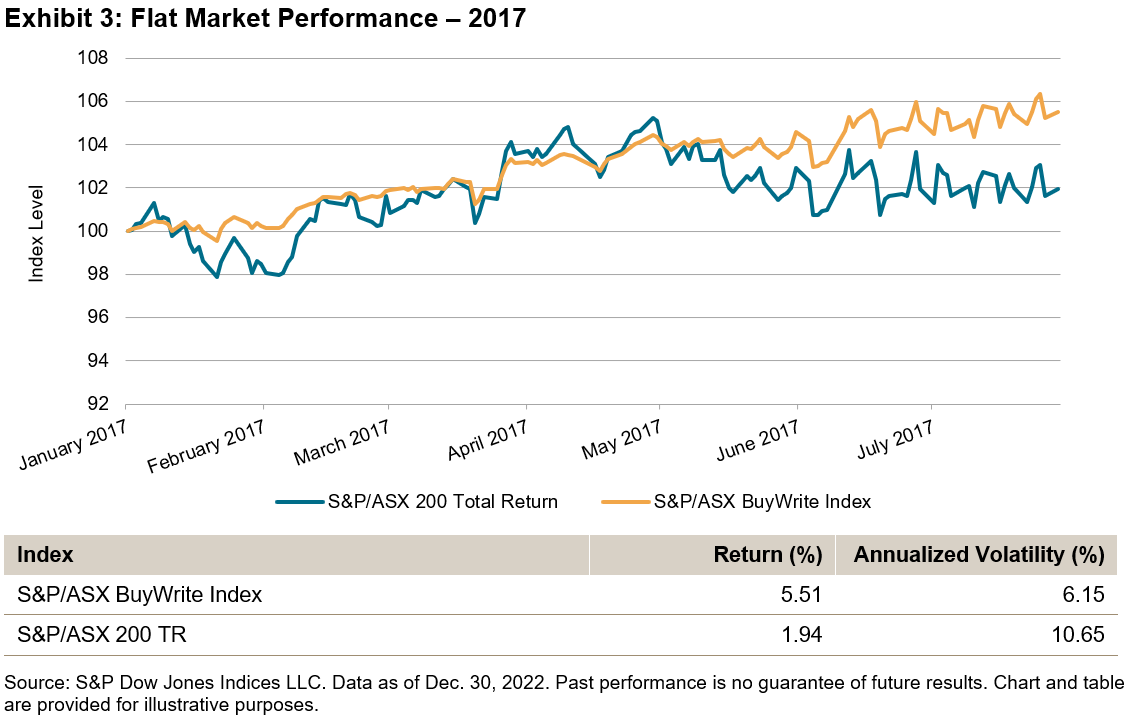

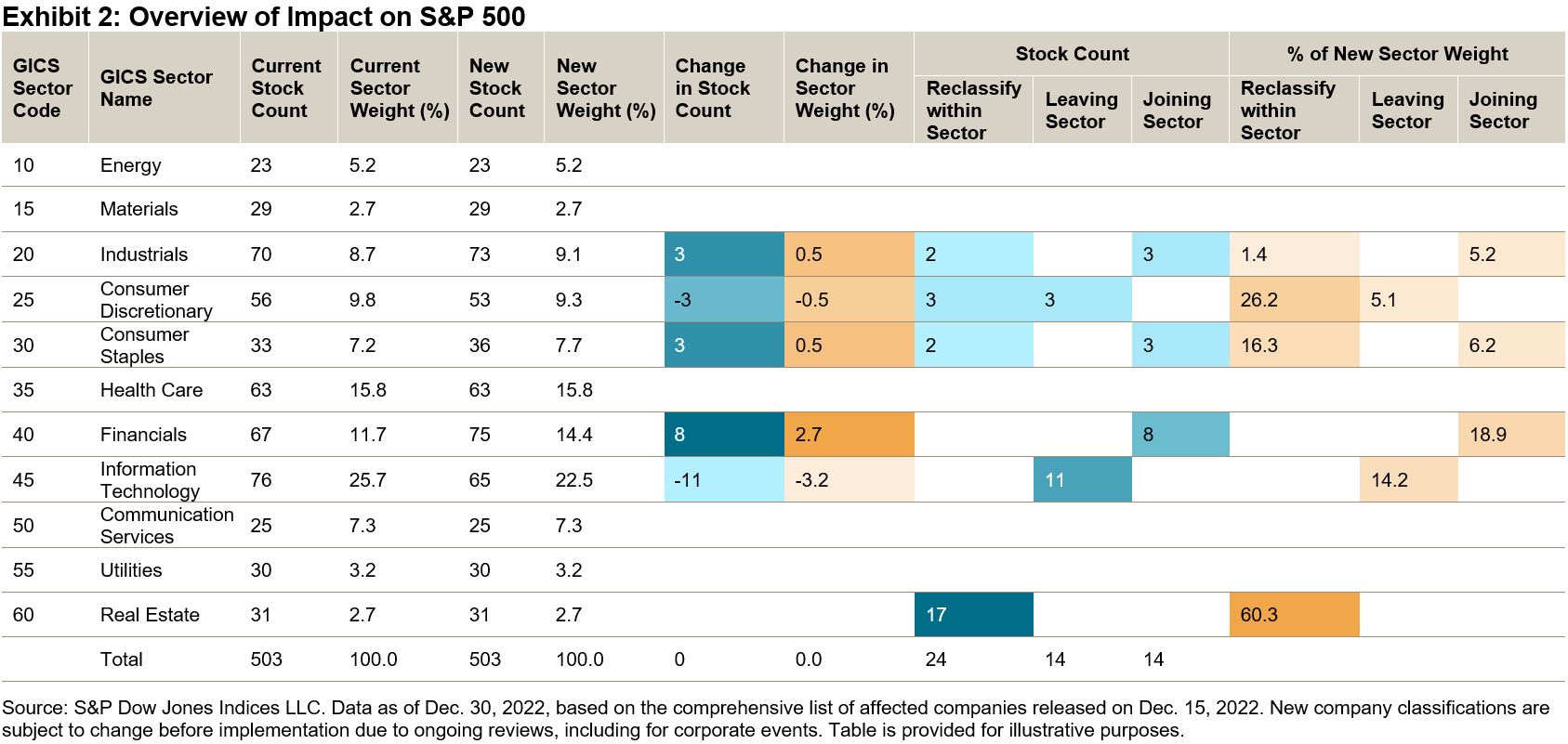

Exhibit 3 demonstrates how the impacted stocks are set to move between sectors. The current GICS sector is on the vertical axis, and the GICS sectors under the new structure on the horizontal axis. The boxes on the diagonal represent intra changes. For example, out of the 11 stocks leaving the Information Technology sector, three of them are moving into the Industrials sector and eight into the Financials sector.

The key driver behind the inter changes of the Information Technology sector is the discontinuation of the Data Processing & Outsourced Services sub-industry. Companies will be reclassified to Financials and Industrials sectors to better align with their business support activities. For instance, all eight stocks that are set to join the Financials sector— including Visa and Mastercard—will be classified under the newly created Transaction and Payment Processing sub-industry. Likewise, all three stocks joining the Industrials sector will go to the Human Resources & Employment Services sub-industry with its updated definition.

Changes to the Consumer Discretionary and Consumer Staples sectors indicate that retailers will be classified based on the nature of goods sold. For instance, Amazon, being the largest affected stock in the S&P 500, will be reclassified within the Consumer Discretionary sector, from a discontinued Internet & Direct Marketing Retail sub-industry to a newly created Broadline Retail sub-industry.

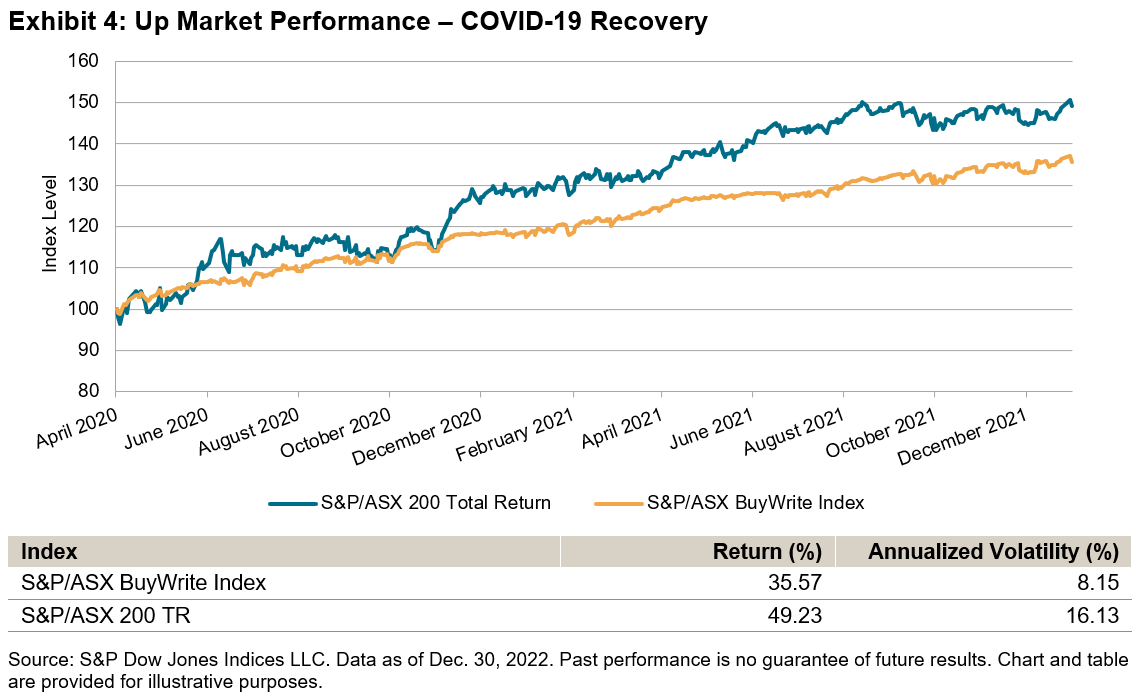

Exhibit 4 shows how the upcoming GICS changes are set to affect the largest 10 stocks in the impacted sectors, based on the data as of Dec. 30, 2022. Target Corp will move from Consumer Discretionary to Consumer Staples, displacing Estee Lauder from the largest 10 corporations in the Consumer Staples sector, while Visa and Mastercard will move from Information Technology to Financials.

Other than the major changes described above, the March GICS changes also include updates to Transportation, Banks and Thrifts & Mortgage Finance, which are more prevalent in smaller caps. The analysis on the flagship S&P 500 shows how other U.S. equity indices can be similarly assessed by the upcoming GICS changes.

The posts on this blog are opinions, not advice. Please read our Disclaimers.