How can indices help investors understand what’s driving market trends amid inflation, rising rates, and volatility? S&P DJI’s Anu Ganti and Hamish Preston take a closer look at key trends and what they could mean for active management and asset allocation moving forward.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Tracking Trends with Indices

Equity Woes Continue

Defense and Volatility

Indexing the Performance of the E-Commerce Ecosystem

The Power of Style

Tracking Trends with Indices

Equity Woes Continue

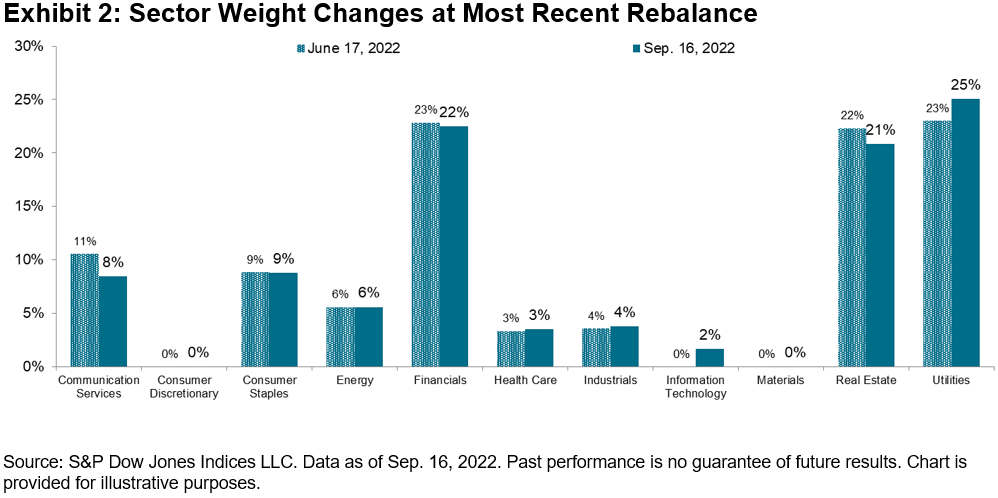

Canadian equities continued their decline, losing another 8.76% (through September 15, 2022) since the last rebalance of the S&P/TSX Low Volatility Index on June 17. Characteristically for a falling market, Low Volatility outperformed (by 13 basis points), declining 8.63%.

As it had done in June, volatility again increased for every sector of the S&P/TSX Composite Index. Energy, Health Care and Technology were among sectors with the biggest hike in volatility.

Despite this, the latest rebalance for the S&P/TSX Composite Low Volatility Index (effective at the close of trading on Sep. 16, 2022) either maintained or added to positions in these sectors. The index screens for the lowest volatility at the stock level, so these results suggest that there are pockets of relative stability even within higher-volatility sectors.

Financials, Real Estate and Utilities continue to be the most overweighted sectors in the Low Volatility index.

Defense and Volatility

As the equity market has waned and waxed in 2022, investor interest has naturally turned toward ways of mitigating portfolio losses. Some factor indices can serve this goal, but investors searching for a defensive strategy need to define their search carefully.

It’s natural to think that defensive strategies will be less volatile than the market as a whole, and this is a useful intuition. Some factor indices, in fact, have produced lower-than-market volatility with greater-than-market return. When such indices are combined with fixed income securities, the resultant efficient frontier often dominates combinations of fixed income with a cap-weighted market index.

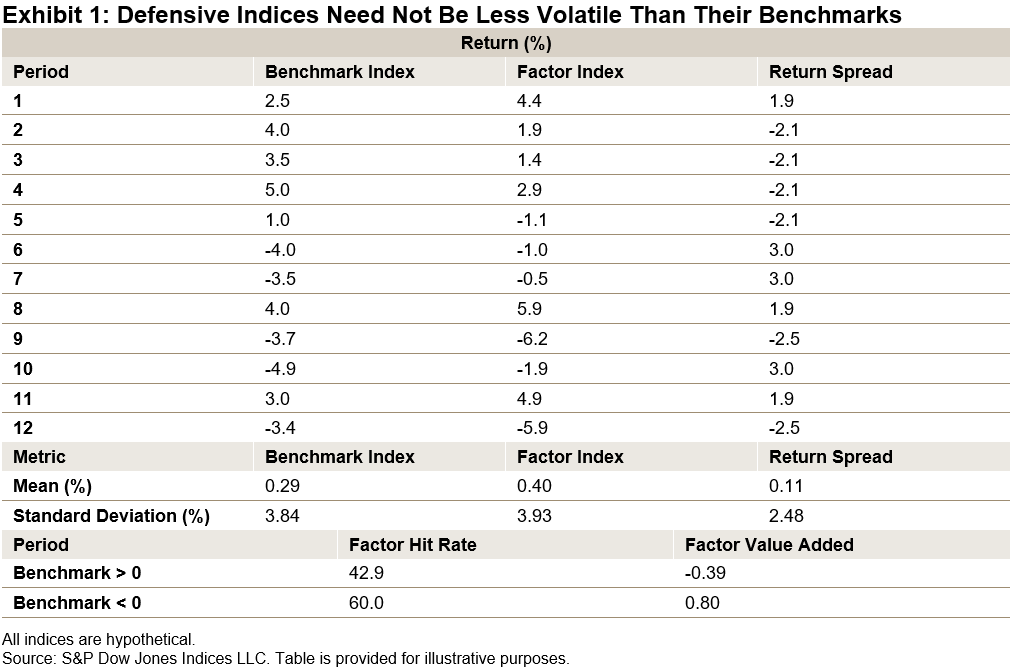

That said, the essential requirement of a defensive index is not that it reduce volatility, but rather that it demonstrate a particular pattern of relative performance. Defensive factor indices aim to reduce losses in a declining market while also participating in rising markets. We often summarize this by referring to the “two Ps”—protection (in down markets) and participation (in up markets), while stressing that neither P is perfect.

Importantly (and counterintuitively), defensive indices are not necessarily less volatile than the benchmark from which they are derived, as Exhibit 1 illustrates.

The hypothetical factor index in the exhibit outperformed its hypothetical benchmark, although with higher volatility. Yet it is clearly a defensive index. When the benchmark rises, the factor is more likely to underperform than to outperform, and its average value added is negative. When the benchmark declines, the factor is more likely to outperform, and its average value added is positive. It delivers, in other words, on both Ps, participating in up markets and protecting in down markets.

Defensive indices will typically be less volatile than their parents. But not always. Investors seeking a defensive profile should take care not to rely on volatility statistics alone.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Indexing the Performance of the E-Commerce Ecosystem

Introduction to the E-Commerce Ecosystem

E-commerce is the abbreviation for electronic commerce, which is the purchasing and selling of goods and services, or the transmitting of funds or data, using the internet for the whole or part of a transaction. Usually, sellers utilize e-market platforms to open online storefronts, and buyers use the platform to shop for specific items. Sellers rely on technology companies to build infrastructures such as websites, analytics tools and cloud services. They also utilize social media to drive traffic, promote offerings and gain insights. Digital payment solutions enable buyers and sellers to close the transaction without offline interaction. These components together form the e-commerce ecosystem.

The history of e-commerce can be traced back to 1969, when Dr. John R. Goltz and Jeffrey Wilkins established the first e-commerce company, CompuServe.1 In the 1990s, many game-changing events in this industry happened, such as the arrival of the World Wide Web and the launch of online marketplaces like Amazon (1995), eBay (1995) and Alibaba (1999). PayPal rolled out the first e-commerce payment system to process fund transactions in 1998. Meanwhile, search engines such as Yahoo! and Google were established, which made online searching and marketing easier. Post-2000, e-commerce developed rapidly. UNITAD’s data shows that e-commerce’s share of global retail trade went from almost 0% 20 years ago to about 17% in 2020.2

The COVID-19 pandemic in 2020 forced most consumers to shift from offline to online shopping. However, in the past 18 months, e-commerce companies faced strong headwinds from the reopening of the economy, tightening regulation and lowered valuation under rate hikes.

Index Construction

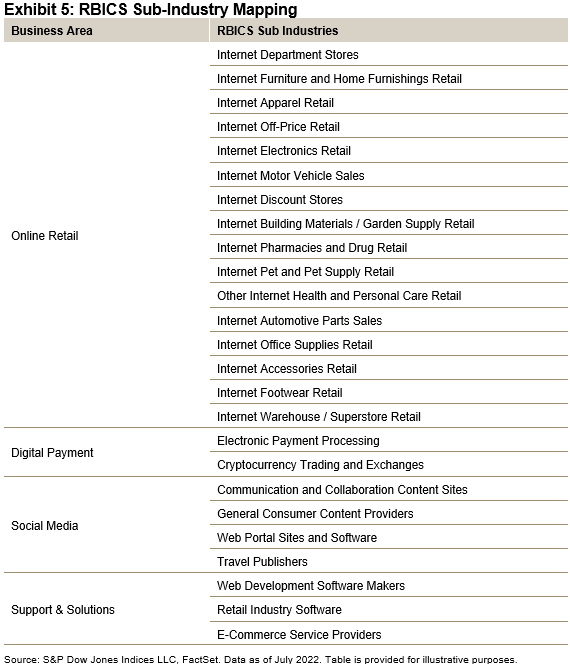

S&P DJI recently launched the S&P Global E-Commerce Ecosystem Index, which is designed to track the performance of companies that have business exposure to e-commerce. In order to capture the whole value chain, the index identifies four business areas relevant to the ecosystem: online retail, social media, electronic payment and direct e-commerce support and solutions. Exhibit 1 shows the index weight breakdown of business areas.

We utilize FactSet’s Revere Business Industry Classification System (RBICS) data to select and assign scores to companies. Companies must generate at least 20% of revenue from e-commerce-related business or have an RBICS focus on any of the determined sub-industries (see details in the methodology). Then, companies will be assigned an exposure score of 1/0.75/0.5, depending on their aggregated percentage of revenue related to e-commerce (see Exhibit 2). Each of the RBICS sub-industries is mapped to one of the four business areas in the ecosystem (see details in Exhibit 5). The top 50 constituents are selected and weighted based on the product of total market capitalization and exposure score to balance the index capacity and exposure purity.

Exhibit 3 shows that e-commerce-related companies have experienced a challenging period since 2021. The index lost over 42% in the 12-month period ending July 31, 2022. From a country allocation perspective, 68% the index weight was allocated to companies in the U.S., and China had the second-highest weight at 17% (see Exhibit 4).

The recent drawdown was not unique to e-commerce companies; it prevailed in the growth sector. The S&P 500 Growth lost 28% in the first six months of 2022, and the Dow Jones Internet Composite Index lost 44% during the same period. Despite the performance headwind this year, e-commerce is not leaving our lives. In October 2021, Facebook announced its new endeavor into the Metaverse, which could introduce a new era for how people shop in the virtual world. The S&P Global E-Commerce Ecosystem Index is one possible way to track the evolution of e-commerce businesses in the long run.

1 Shiprocket, The History Of eCommerce & Its Evolution – A Timeline

2 UNITAD, How COVID-19 triggered the digital and e-commerce turning point

The posts on this blog are opinions, not advice. Please read our Disclaimers.The Power of Style

At some risk of oversimplification, the 16.1% decline in the S&P 500® for the first eight months of 2022 can be divided into three intervals, as the market fell by 20.0% through June, rallied in July, and then resumed its decline in August. This story, of course, is still evolving: for all we now know, the market might continue to decline, penetrating its June lows. Alternatively, we might already be in the early stages of the next bull market. Some things, these among them, are knowable only well after the fact.

Exhibit 1 shows this year’s pattern of returns for the S&P 500, as well as for its Growth and Value components. When the market declined, Value outperformed, while Growth was the better-performing style in July’s rally. Neither of these behaviors is particularly surprising. Growth typically outperforms when the market rises, and Value when the market falls (although Value’s defensive credentials are much less impressive than those of such stalwarts as Low Volatility or Dividend Aristocrats®).

Although the direction of the style indices’ performance is unsurprising, the magnitude of the spread between their returns was remarkably large, as Exhibit 2 shows.

Taken over all six-month intervals in the history of our style indices, the 16.2% spread between Value and Growth in the first six months of the year was at the 97th percentile. The tables turned in July, as the spread was at the opposite extreme of all one-month intervals. Results in August looked like those from the first six months. (If we calibrate the Value-Growth spread in dispersion units, the results are even more extreme.)

Given the size of the spreads (both positive and negative) between Value and Growth indices, it’s reasonable to ask what impact value and growth scores had on the performance of other factors. We regularly score every stock in our database, and we therefore can compute aggregate value and growth scores for our most prominent factor indices. Exhibit 3 shows, for the first six months of 2022, the relationship between each factor index’s relative performance and the difference between its value and growth scores. Given the size of the Value-Growth spread in the first six months, the upward slope in Exhibit 3 is unsurprising.

Exhibit 4 shows that the relationship ran in the opposite direction in July, whereas in August we again see a strong upward-sloping relationship. The predictive power in both cases is impressive for a single month.

We said earlier that it was too soon to say whether the bear market that began in January was over or merely quiescent, and the same is true about the influence of style on returns. What seems reasonable to say is that if the differential performance of Value and Growth indices remains wide, the influence of style on other factors is likely to continue.

The posts on this blog are opinions, not advice. Please read our Disclaimers.