The semiannual S&P Indices Versus Active (SPIVA®) Scorecard1 measures the performance of actively managed funds against their corresponding benchmarks in various markets around the world. The latest Australian edition, the SPIVA Australia Mid-Year 2022 Scorecard, provides a number of interesting insights about the performance of active versus passive across active fund categories.

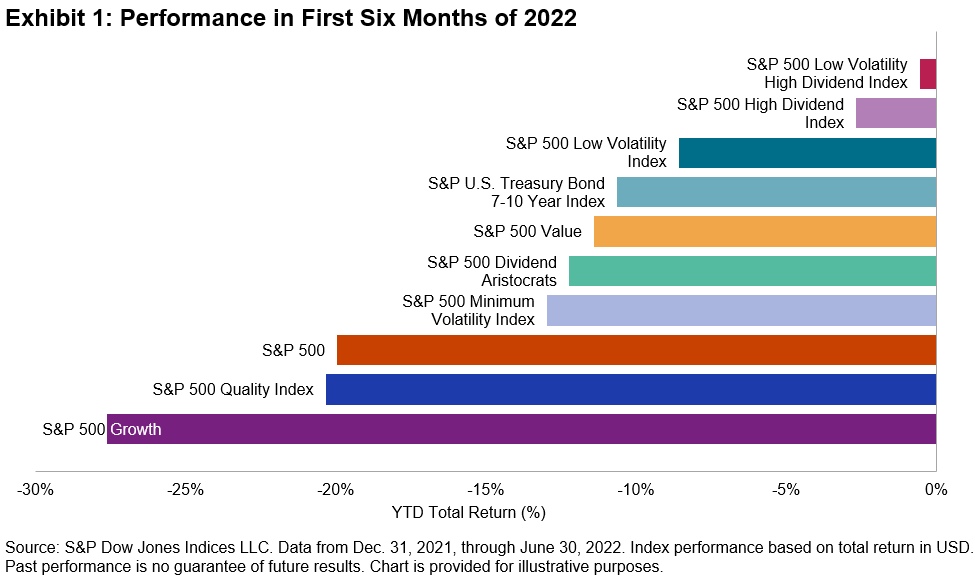

Although the long-term performance statistics remain grim reading for fund selectors, the first half of 2022 contained some bright spots for active managers: a slim majority of active Australian Equity General funds outperformed the S&P/ASX 200 in H1 2022. Ranging over time horizons and fund categories, we can see marked differences in the track records. Of active Australian international equity funds, 95% underperformed over the 15-year horizon, while domestic mid- and small-cap managers had greater success, with just over one-half of them underperforming the S&P/ASX Mid-Small over the same period. Large-cap domestic active managers landed in between, with 83% of active managers underperforming the S&P/ASX 200 in the past 15 years.

Digging deeper, underperforming funds tend to suffer withdrawals, which can lead to the affected funds’ eventual demise. Exhibit 2 shows survivorship rates of actively managed Australian funds across all categories over time. There is a strong downward-sloping trend, and in general, there was little divergence in the patterns of the decline of various fund categories; survivorship rates declined moving in near-lockstep across the board.

As Exhibit 3 shows, survivorship interacted with outperformance. In the Australian Equity Mid- and Small-Cap fund category, the majority of surviving funds outperformed the S&P/ASX Mid-Small, and even in the Australian large-cap segment, over one-third of surviving funds outperformed the S&P/ASX 200. However, the laws of natural selection did not seemingly apply to International Equity General funds, with almost 90% of surviving funds underperforming the S&P Developed Ex-Australia LargeMidCap.

Why might we see such differences between international and domestic equities? One reason may be that investors are more familiar with domestic than international performance standards; it may be easier for an Australian investor to judge the performance of domestic funds compared to international ones. This is not an issue limited to finance—they may also be better at judging surf than snow; they might also enthusiastically demolish a pizza that would bring a Neapolitan to tears.

While it can be challenging for a local investor to assess the performance of active managers, the semi-annual SPIVA Australia Scorecard brings transparent and objective assessments of international and domestic active fund performance, using industry-standard benchmarks that are recognized around the world. You can access the latest report here.

1See SPIVA Scorecards: An Overview. https://www.spglobal.com/spdji/en/education/article/spiva-scorecards-an-overview

The posts on this blog are opinions, not advice. Please read our Disclaimers.