The performance of S&P 500®-based factor indices in May 2022 was generally favorable. Most factors outperformed the S&P 500, with the league table dominated by value and dividend tilts. The overall results for the month, however, obscure the intra-month dynamics: between the end of April and May 19, the S&P 500 fell by 5.5%, compounding the loss of 12.9% it had incurred in the first four months of the year. Despite briefly trading in bear market territory, in the last seven trading days of May, the index rallied 6.0% to finish the month with a small gain.

It should surprise no one that the relative performance of factor indices varied widely between these two distinct periods. What’s remarkable is that investors’ changing preference for dividend yield explains a great deal of that variation.

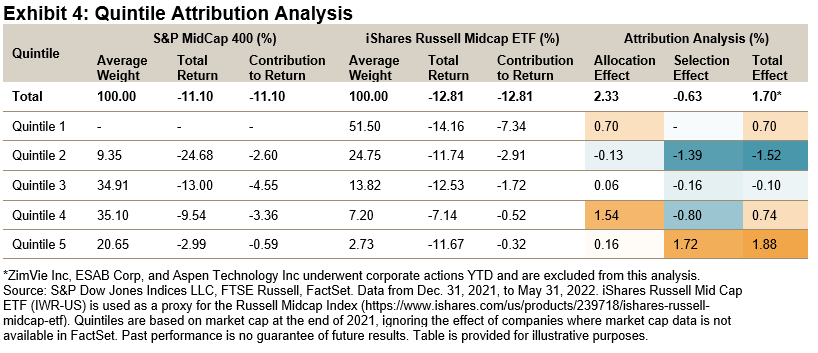

Exhibit 1 shows the relative performance of several significant factor indices for the first 19 days of May. With the S&P 500 down, the best relative performers were defensively oriented. High Dividend and Low Volatility High Dividend took the lead, with the year’s consistent laggard Growth at the opposite end of the distribution.

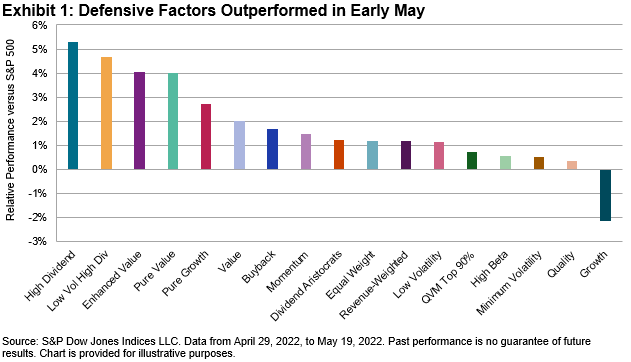

When the market began to rally, however, investors’ factor preferences shifted. Exhibit 2 shows us the same factors’ relative performance during the late-May rally. Growth and Quality, the worst performers early in the month, assumed the top positions, as defensive factors underperformed. The two periods are not exact mirror images, but there’s a clear tendency for the outperformers of Exhibit 1 to underperform in Exhibit 2. (The correlation of relative returns across the two periods is -0.47.)

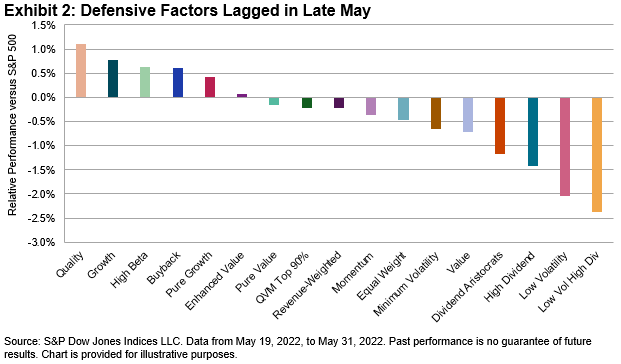

Understanding the impact of fundamental explanatory variables on factor index returns can help us understand May’s reversal in factor behavior. For example, a factor index’s growth or value score, and some sectoral over- and underweights, can shed light on performance. The most consistently useful indicator, in both the market decline in early May and the rally at the end, was dividend yield.

Exhibit 3 shows the relationship between each factor index’s beginning yield with its performance during the first 19 days of May. The relationship is strong, and upward-sloping; higher yield produced better relative performance.

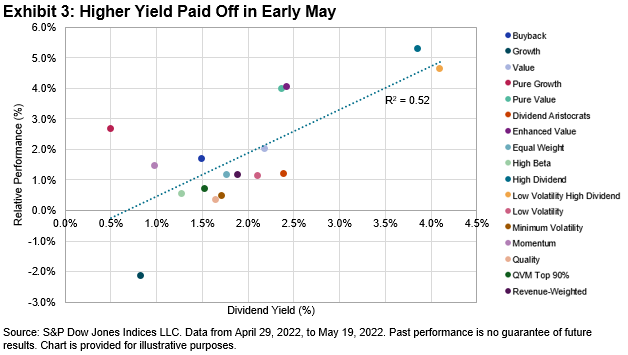

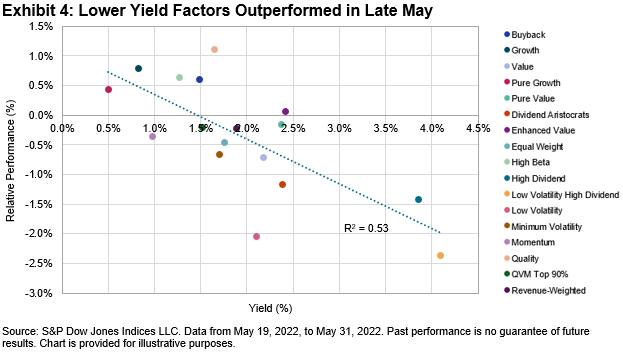

The worm turned, however, after May 19, as Exhibit 4 illustrates. As the market rallied during the last seven trading days of the month, the highest-yielding factors underperformed, while their lower-yielding counterparts assumed a leadership position.

It’s no surprise that dividend yield tends to pay off in the long run, but its short-run explanatory power in May was also impressive. It’s perhaps too facile to observe that yield was a good proxy for the shift of market emphasis from risk-off early in the month to risk-on at the end. How long yield’s predictive power will last, and in which direction, remains to be seen.

The posts on this blog are opinions, not advice. Please read our Disclaimers.