The poet tells us that in spring, a young man’s fancy lightly turns to thoughts of love. Experience tells us that in January, an active manager’s fancy turns to thoughts of triumph.

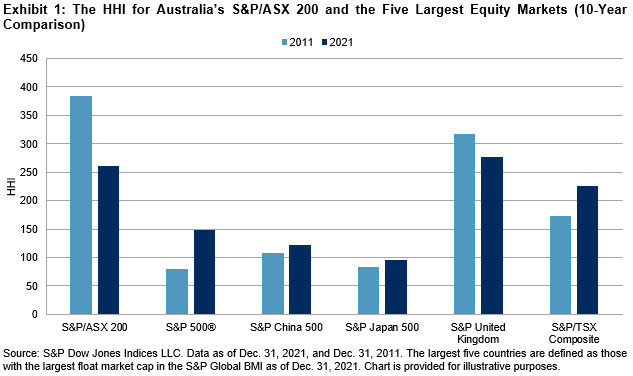

Earlier this month, we learned that 70% of the institutional investors questioned in a recent poll thought that “markets will favor active management” in 2022. A number of reasons were cited for this belief, prominent among them the high level of concentration in some equity indices. Interestingly, this forecast of imminent active success is just the latest link in a long chain of similar predictions. For example:

- We were told that falling correlations would produce a “stock-picker’s market” in 2014.

- A year later, some active managers asserted that, with the market near then-all-time highs, active managers in 2015 were needed to mitigate portfolio risks.

- More recently, it was claimed that active managers would outperform passive benchmarks due to the high level of volatility in 2019.

What did 2014, 2015, and 2019 have in common? In each of those years, a majority of U.S. large-cap active managers underperformed the S&P 500®. Indeed, of the 20 years for which SPIVA® data exist, a majority of large-cap managers outperformed only three times (most recently in 2009). The records for mid- and small-cap managers, and for active managers outside the U.S., are equally disappointing.

In other words—active managers frequently predict that we are, or soon will be, in a “stock-picker’s market,” but the stock-picker’s market, like the fabled Brigadoon, almost never arrives. Whenever you hear a forecast that this will be the year in which active management is vindicated, here are some questions for the forecaster: If you know that active management will outperform this year, did you know that passive would outperform last year? If you knew, why didn’t you say so then? And if you didn’t know then, why should we believe that you know now?

You may end up with fewer friends, but you’ll have more clarity on an important investment issue.

The posts on this blog are opinions, not advice. Please read our Disclaimers.