In this blog (and in a subsequent post), we will introduce the S&P Global REIT Quality, Value & Momentum (QVM) Multi-Factor Index. This index integrates individual quality, value, and momentum factor scores into one composite and is designed to capture multi-factor equity premia. In essence, the strategy seeks to include companies with the following characteristics: solid financial strength combined with steady fund flow from operation (FFO) growth, attractive valuation, and lasting risk-adjusted momentum.

The S&P Global REIT QVM Multi-Factor Index is a rules-based, transparent index solution. In the following sections, we present the framework and strategy construction process.

Establishing the Multi-Factor Framework

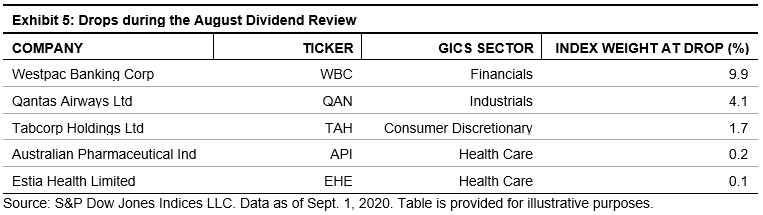

We use a systematic, bottom-up approach for stock selection and portfolio construction, as illustrated in Exhibit 1.

We start with the investment universe. Then we identify and select sensible factors for multi-factor metrics to capture the investment strategy. Furthermore, we select constituents with well-defined rules and construct a constituent portfolio with a predefined weighting methodology.

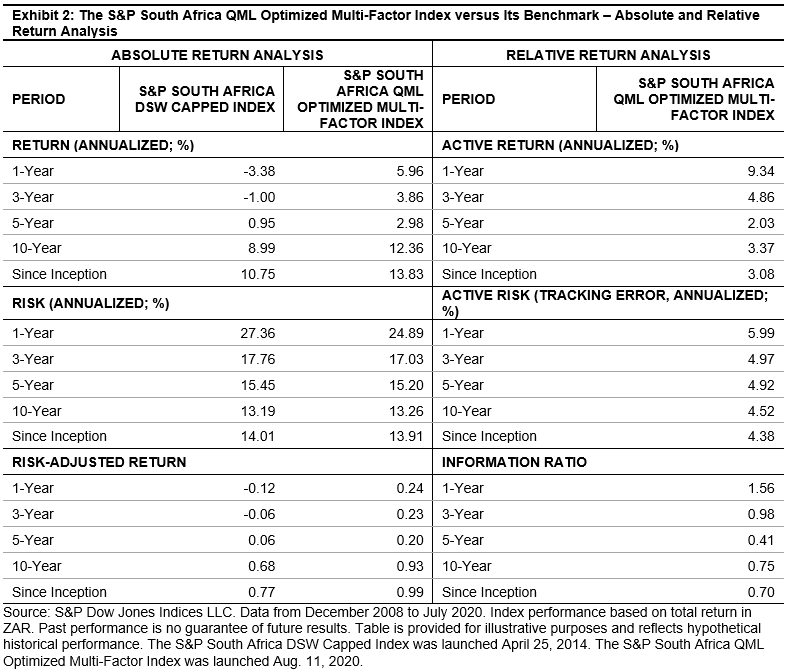

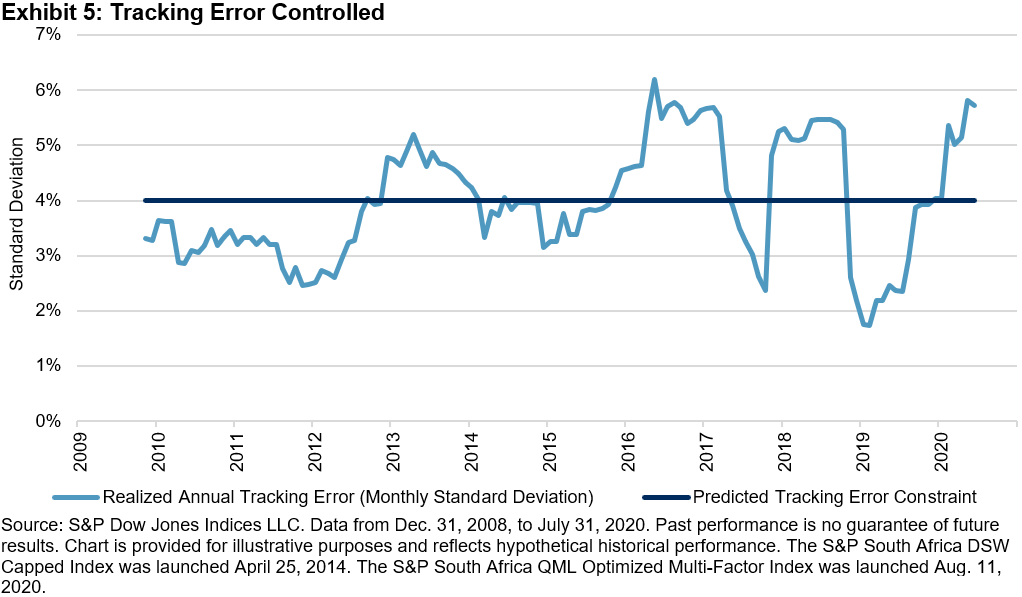

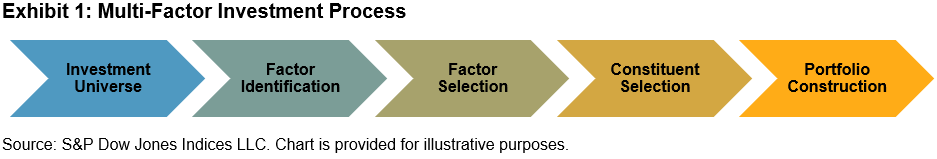

For our S&P Global REIT QVM Multi-Factor Index, we use the S&P Global REIT Index as the investment universe and an integrated approach to select constituents. The strategy is to invest in all-around winners in quality, value, and risk-adjusted momentum metrics. Exhibit 2 shows the factors and factor components for the QVM multi-factor strategy.

In the REIT industry, properties are depreciated for accounting purposes, which contrasts to the reality that property values generally increase over time. To better capture the unique character of the REIT industry, we use FFO per share rather than simple or derived earnings per share.

We use financial leverage ratio[i] and FFO growth variability[ii] metrics to capture a firm’s quality. In order to maintain sustainable and steady FFO growth, a firm shouldn’t build on excessive leverage. Moreover, we use the FFO to price ratio[iii] to gauge a firm’s reasonable valuation. In addition, we use 12-month risk-adjusted price momentum[iv] to select recent performance winners. With these metrics, we implement a hypothetical QVM multi-factor strategy.

Factor Z-Score and Multi-Factor Z-Score Calculation

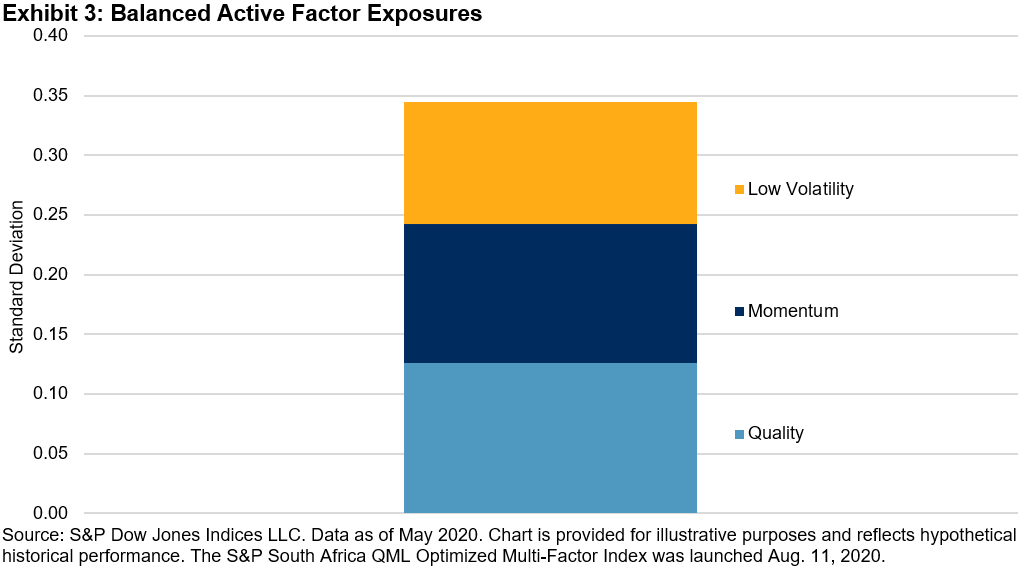

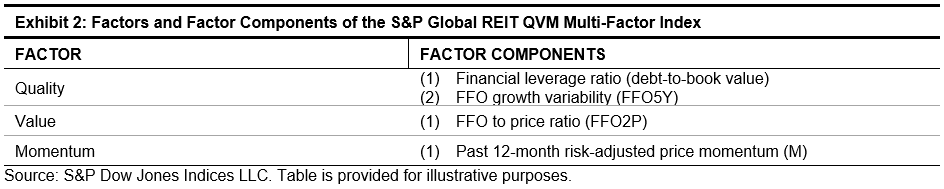

The factor score calculation is an integral step of any multi-factor strategy. We calculate the quality, value, and momentum z-scores for each of the stocks in the eligible universe.[v] A integrated QVM multi-factor z-score is calculated for each constituent by taking the average of the quality, value, and momentum z-scores. Exhibit 3 shows their relationships. The benefit of multi-factor investing is more consistent performance due to diversified factor exposure.

Constituent Selection and Weighting

With integrated factor scores in place, we utilize an integration approach to construct multi-factor portfolios. The stocks are selected based on their combined QVM scores. For U.S. and non-U.S. companies, we select the top-ranked 20% stocks within each region. The target count of the U.S. group is set to 60% of the total index, and the non-U.S. group is set to 40%. Constituents are equal-weighted, with the resulting weights in U.S. and non-U.S. markets approximate to the relative market size of the benchmark for each group. In addition, a 20% buffer rule is applied to reduce portfolio turnover.v

In this blog, we discussed our QVM multi-factor strategy construction process. In our next blog, we will present the empirical results of the strategy’s performance, its country composition, and its factor exposure.

[i] The financial leverage ratio is calculated as a company’s latest total debt divided by its book value per share (BVPS) for each security in the index universe as of the rebalancing reference date.

Financial Leverage Ratio = Total Debt / (BVPS * Common Shares Outstanding)

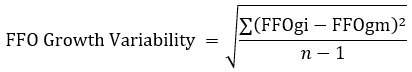

[ii] FFO growth variability is calculated as the standard deviation of year-over-year FFO growth per share over the past five fiscal years. If five-year data is not available, then we use four-year data. If four-year data is not available, we use three-year data. A minimum of the last three comparable GGO growth values are needed to compute FFO growth variability.

Where

FFOgi = (FFOi-FFOi-1)/ FFOi-1

FFOgm = mean (FFOgi)

n = number of years of growth

[iii] FFO to price ratio (FFO2P) is calculated as a company’s trailing 12-month funds flow from operation per share divided by its price.

![]()

[iv] 12-month risk-adjusted price momentum is computed as the 12-month price change, excluding the most recent month of the security in local currency. If 12 months of price history is not available, the momentum value is calculated from nine months of price history. For more information on momentum calculation, please refer to the S&P Momentum Indices methodology.

[v] Please refer to the S&P Global REIT QVM Multi-Factor Index methodology for more details.

The posts on this blog are opinions, not advice. Please read our Disclaimers.