Corporate bonds have garnered a lot of attention lately, as the Federal Reserve continues to stabilize markets by establishing multiple facilities that support both the primary and secondary corporate bond markets. As a result, credit spreads have tightened significantly from where they were in March. Since March 23, 2020, the option-adjusted spread on the S&P U.S. Investment Grade Corporate Bond Index tightened more than 150 bps, and yields were within only 50 bps of their all-time lows as of April 30, 2020.

Meanwhile, municipal bonds experienced greater spread widening in March and did not see the extreme tightening that investment-grade corporate bonds did. As of April 30, 2020, the yield of the S&P National AMT-Free Municipal Bond Index was still more than 100 bps above its pre-COVID-19 low.

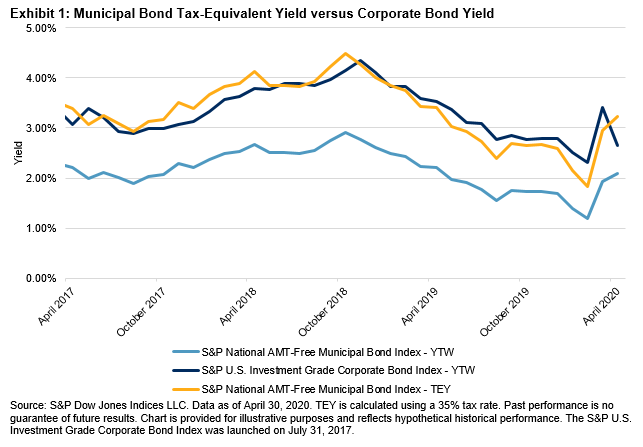

Given the recent rally in the corporate bond market, the tax-equivalent yield (TEY) of the S&P National AMT-Free Municipal Bond Index now exceeds the yield of the S&P U.S. Investment Grade Corporate Bond Index. Less than two months ago, the yield-to-worst of corporate bonds was more than 50 bps higher than the TEY of the S&P National AMT-Free Municipal Bond Index. Exhibit 1 compares the yield of the two indices over the past three years.

Muni Credit Quality Remains High

On April 27, 2020, the Federal Reserve announced it would be expanding its Municipal Lending Facility to provide support to smaller municipalities and local governments, as well as extending the duration of bonds it will cover. Undoubtedly, issuers of state and local debt will have to grapple with potentially large budget gaps as income tax, sales tax, and other revenue sources have been severely affected by the virus fallout.

However, the overall credit quality of the municipal bond market is much better positioned to weather such potential hardships. Exhibit 2 compares the credit quality distribution of the S&P National AMT-Free Municipal Bond Index to that of the S&P U.S. Investment Grade Corporate Bond Index. While 55% of the investment-grade corporate bond market is ‘BBB’-rated, less than 9% of municipal bonds fall into the lowest rung on the investment-grade ladder.

Compared to corporate bonds, market participants can find relatively competitive yields in the municipal market while also benefitting from much higher credit quality. Additionally, as corporations continue to cut or suspend dividends for an unknown length of time, increasing exposure to municipal bonds provides participants with an opportunity to potentially supplement that missing yield.

The posts on this blog are opinions, not advice. Please read our Disclaimers.