Income-seeking investors have always had to compromise between the level of dividend payments and the safety of dividend payments. The importance of this tradeoff has recently gone viral, as governmental actions in response to COVID-19 have suppressed global economic activity, causing many companies to suspend or reduce their dividend payments.

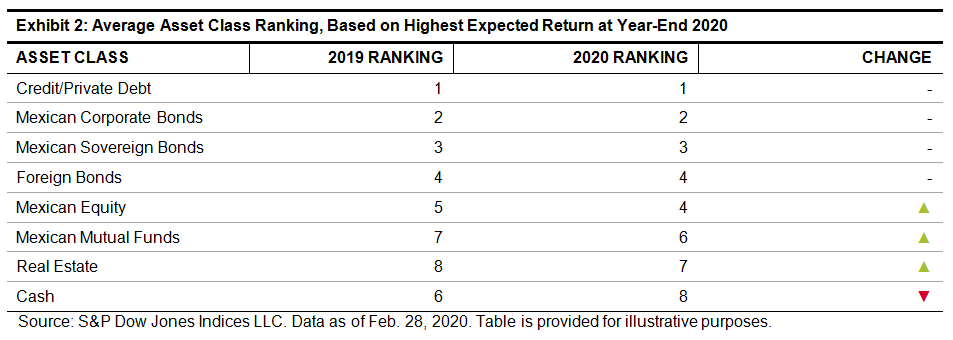

Launched in 2005, the S&P High Yield Dividend Aristocrats Index comprises S&P Composite 1500® members that have increased their dividends annually for at least 20 years. The market has rewarded consistent dividend payers: Exhibit 1 shows that the High Yield Aristocrats have outperformed the S&P 1500 over the long term.

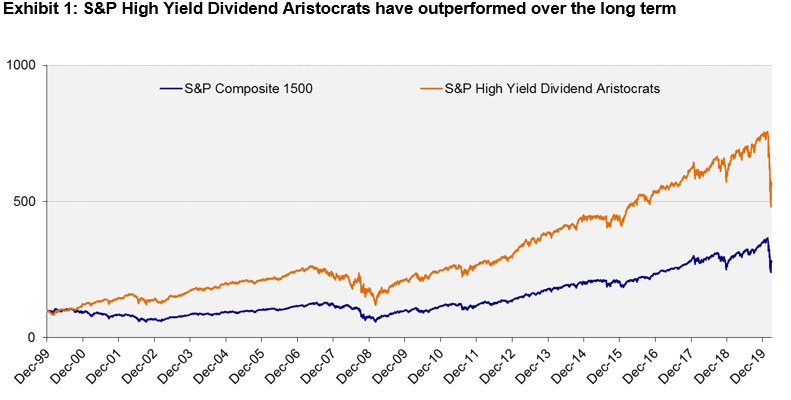

As of the beginning of 2020, the aggregate capitalization of the High Yield Aristocrats amounted to 18% of the S&P 1500 Composite. For comparison’s sake, we identified a list of “High Payers” — the 18% of the 1500 Composite with the highest dividend yields. Exhibit 2 compares the median values of these two portfolios on a number of fundamental metrics that measure the strength of companies making dividend payouts.

The High Yield Dividend Aristocrats appear stronger across the board. For example:

- Earnings were double last year’s dividend payouts for the Aristocrats, vs. only 1.2x dividends for the high payers. Cash on hand was also a higher multiple of last year’s dividends.

- The Aristocrats used buybacks to return cash to shareholders to a greater degree than the high payers did. Since buybacks are likely to be reduced before dividends are cut, their usage provides a larger cushion for the Aristocrats.

- The Aristocrats are larger (median capitalization $12 billion) and more profitable (median ROE 15.5%) than their higher-paying counterparts.

There obviously can be no guarantees in a pandemic; if a company’s business is affected badly enough, dividend reductions are always possible regardless of how strong the income statement and balance sheet appeared a year ago. What this analysis tells us, though, is that the dividends of companies with consistent dividend growth are better protected from headwinds.

The posts on this blog are opinions, not advice. Please read our Disclaimers.