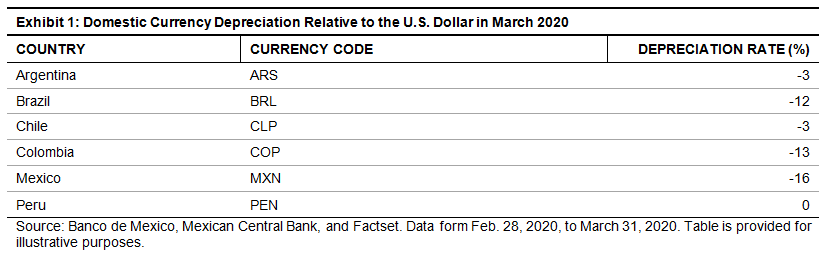

With oil prices falling and the spread of the COVID-19 pandemic, volatility is back in action. In Latin America, Forex valuations are a key barometer. Local currency depreciation is one of the most common reactions to uncertainty (see Exhibit 1).

This blog highlights the recent volatility in the Mexican peso and possible ways to mitigate this risk.

Mexican Peso: Liquidity, but with Volatility

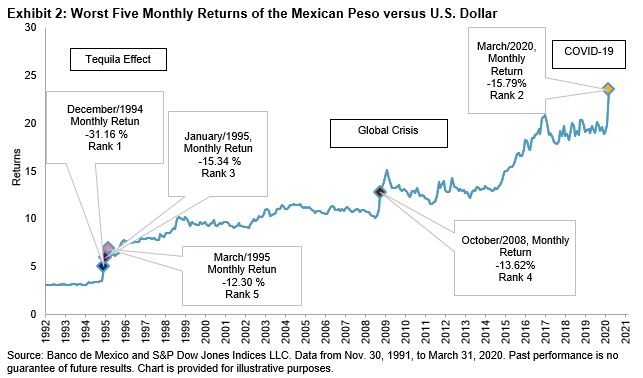

The Mexican peso was the most affected LatAm currency of March 2020. It had the worst monthly return since the “Tequila Crisis” or the error of December 1994 (see Exhibit 2). The March 24, 2020, closing price of MXN 25.1185 per USD 1 was the worst official closing level for the Mexican peso in March.

The Mexican peso is one of the most liquid and deep currencies among emerging markets, frequently used as a vehicle to hedge long positions, as a diversification strategy, and to take bearish tactical positions.

Conclusion: Investors Can Hedge

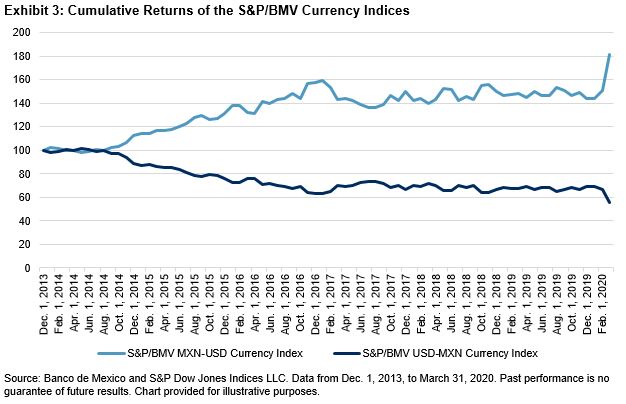

In the recent Mexican peso sell-off, our S&P/BMV USD-MXN Currency Index, which tracks U.S. dollar-Mexican peso spot rates, sold off; however, its inverse, the S&P/BMV MXN-USD Currency Index, as expected, gained. Having two options for indices measuring these currencies ensures that investors no longer have to just take one side of the trade and can use both sides to tactically hedge.

The S&P/BMV MXN-USD Currency Index returned 20.23% in March 2020 and 25.52% YTD.

For different asset classes, for tactical purposes, for long-term and diversification strategies, for hedging; whatever your needs may be, we likely have an index for that!

The posts on this blog are opinions, not advice. Please read our Disclaimers.