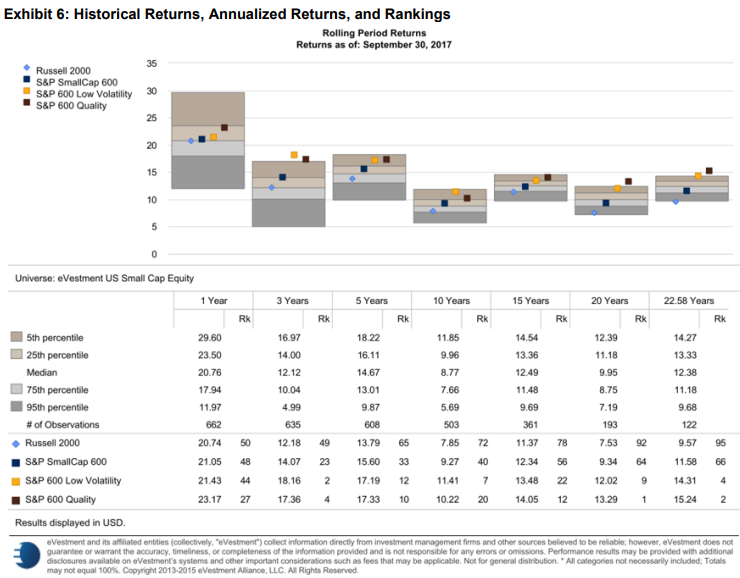

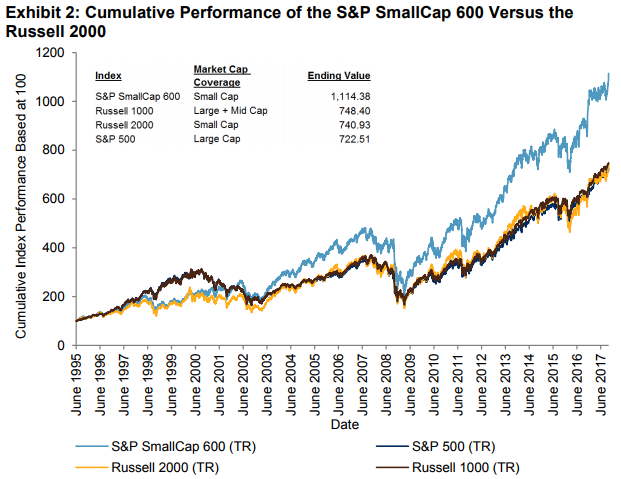

Though the large-caps continue to rally more than the small-caps on the back of their biggest annual outperformance since 1999, small-caps persistently outperform mid and large-caps over longer periods of time, as shown below in the chart and in part 2 of this blog series.

based on total return in USD. Past performance is no guarantee of future results. Chart is provided for

illustrative purposes.

This has been shown by many researchers, most notably by Fama and French, as the small cap premium. It makes sense since smaller companies may be more nimble, entrepreneurial, and less well followed and invested in by big institutional investors. However, these companies may also be more risky so quality matters, and as quoted in this post, quality is THE factor that allows the small cap premium to emerge. This with the annual reconstitution effect are the keys to why the S&P SmallCap 600 outperforms the Russell 2000.

This is the 4th and final part of our blog series containing excerpts from our new paper where we discuss the outperformance of the S&P SmallCap 600 versus the Russell 2000, the performance of the indices compared with active managers, and the case supporting the performance.

WHY THE S&P SMALLCAP 600 OUTPERFORMS THE RUSSELL 2000

The title “Big Things Come in Small Packages” refers to quality over quantity, and often things that have the most value or quality are small. The S&P SmallCap 600 only has 601 stocks, while the Russell 2000 has 2,010, and the weighted average market cap of the S&P SmallCap 600 is USD 1.77 billion compared with USD 2.05 billion for the Russell 2000 (Source: S&P Dow Jones Indices LLC, FactSet. Data as of June 30, 2017. The Russell 2000 was represented by the iShares Russell 2000 ETF ticker IWM.)

Also, the ROE may contribute to the performance differential, with an ROE of 9.7 for the S&P SmallCap 600 versus 5.9 for the Russell 2000. Extensive research has been done on the small-cap risk premium and how it has changed over time. In addition to the research done at S&P Dow Jones Indices on the factors that drive small-cap performance, Asness et al. made a strong case that, once what they define as “quality” is controlled for, a stable and significant small-cap premium emerges.

There are important construction differences between the S&P SmallCap 600 and the Russell 2000. One key difference may be the earnings requirement that the S&P SmallCap 600 implements, which plays an important role in how the index defines quality.

The S&P SmallCap 600 quality effect can be observed in the four-factor regression that adds quality to the three original factors that Fama and French identified: market, size, and value.

Here we are using AQR Capital’s definition of “Quality Minus Junk,” which is based on various

measures of profitability, growth, safety, and payout. The coefficient to the quality factor is statistically significant for the S&P SmallCap 600 but not for the Russell 2000. This shows the power of quality in driving the outperformance of the S&P SmallCap 600.

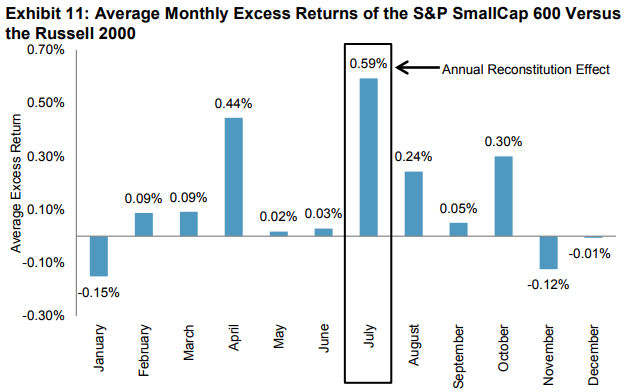

The other key methodology difference that drives the outperformance of the S&P SmallCap 600 versus the Russell 2000 is the annual reconstitution effect that dilutes Russell 2000 returns. It, too, has been well documented, not only in a report by S&P Dow Jones Indices showing the significant t-stat of the return difference of the indices, but also by several other well-known researchers.

As winners from the Russell 2000 graduate to the Russell 1000, and losers from the Russell 1000 move down to the small-cap index, fund managers are forced to sell winners and buy losers, thereby creating a negative momentum portfolio. Jankovskis and Chen, Noronha, and Singal estimated that the predictable nature of the June Russell rebalancing process biases the return of the index downward by an average of approximately 2% per year. Similarly, Chen, Noronha, and Singal found the rebalancing impact to be 1.3% per year.

Together, quality and reconstitution account for most of the S&P SmallCap 600’s outperformance over the Russell 2000. Some of the return difference may also be associated with the liquidity criterion of the S&P SmallCap 600 that is not applied to the Russell 2000. Within the S&P SmallCap 600, a small percentage of stocks, roughly 3%, have a three-month average daily trading volume (ADVT) of less than USD 1 million, compared with about 15% of stocks in the Russell 2000 that have a three-month ADVT of less than USD 1 million.

In conclusion to this series:

- It can be argued that the broad adoption and makeup of the Russell 2000 do not make it more valuable as a performance benchmark or for active to passive replacement.

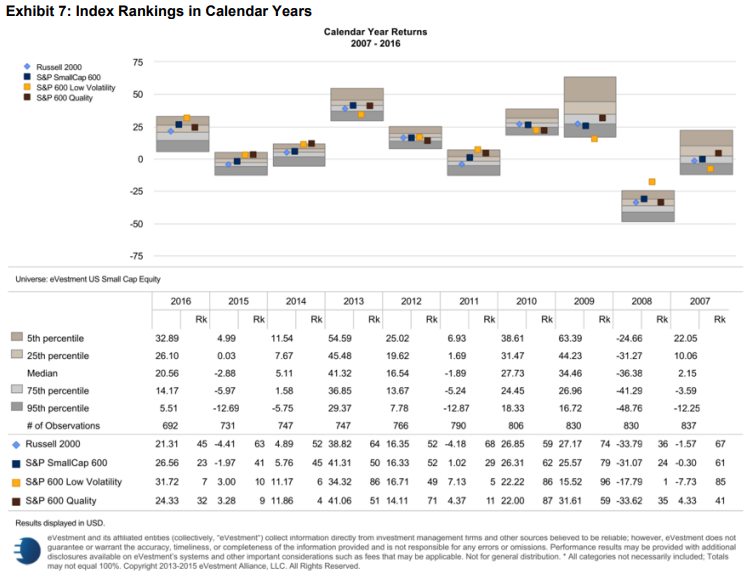

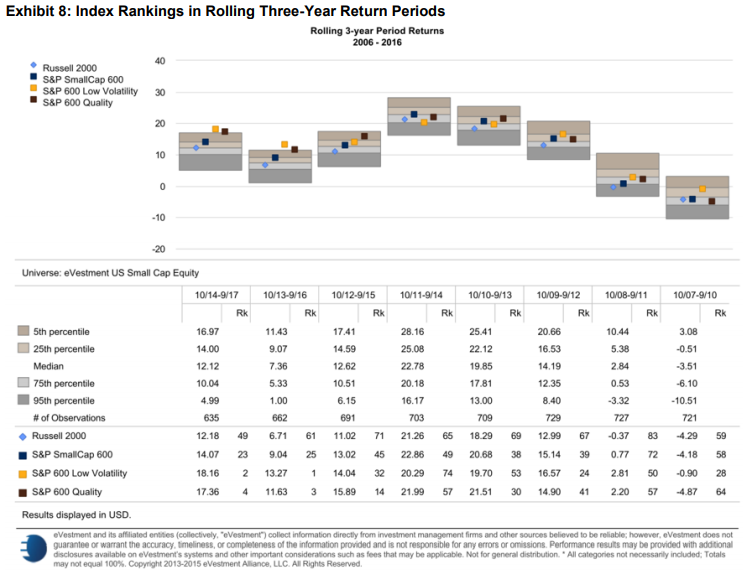

- S&P SmallCap 600 has outperformed the Russell 2000 over short and long time horizons, through various bear and bull markets, and largely on a monthly and annual basis.

- S&P SmallCap 600 ranks higher than the Russell 2000 in peer group analysis and has provided returns on par or better than active managers in many time periods.

- These results are not a coincidence, given that the S&P SmallCap 600 has quality built into its eligibility criteria.

In a move to increase transparency and liquidity, and to provide lower fees to market participants, we believe the S&P SmallCap 600 should be considered the small-cap benchmark of the industry. Based on its performance, the S&P SmallCap 600 may set the bar higher for active managers and increase the quality of passive small-cap investing.

The posts on this blog are opinions, not advice. Please read our Disclaimers.