In a year with strong equity returns in India, the S&P BSE 100 ended in the black with a 33.3% annual return. However, the S&P Indices Versus Active (SPIVA) India Year-End 2017 Scorecard shows that a majority of active funds in the Indian Equity Large-Cap and Mid-/Small-Cap categories lagged their respective benchmarks over the one-year period ending in December 2017.

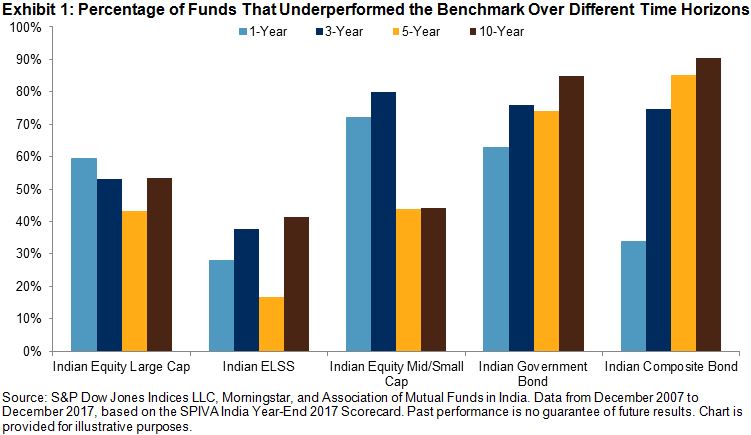

The biannual SPIVA India Scorecard attempts to capture the performance of active funds (both equity and bond funds) domiciled in India against the S&P BSE benchmarks over different time horizons. The study revealed that over the one-year period ending in December 2017, 59.4% of Indian Equity Large-Cap funds, 27.9% of Indian ELSS funds, and 72.1% of Indian Equity Mid-/Small-Cap funds underperformed their respective benchmark indices. Additionally, the majority of the Indian Composite Bond funds underperformed the S&P BSE India Bond Index over the 3-, 5-, and 10-year periods, and the majority of Indian Government Bond funds underperformed the S&P BSE India Government Bond Index over the 1-, 3-, 5-, and 10-year periods (see Exhibit 1).

In the three equity fund categories—Indian Equity Large-Cap, Indian ELSS, and Indian Equity Mid-/Small-Cap—the asset-weighted average fund returns were higher than their respective equal-weighted average fund returns over the 10-year horizon. This difference was most pronounced in the Indian Equity Large-Cap category (87 basis points) among the three equity categories, indicating that the larger funds by AUM in this category performed better over the 10-year period (see Exhibit 2). However, an opposing trend was observed for the one-, three-, and five-year periods, when the equal-weighted average fund returns exceeded their respective asset-weighted average returns, in the Indian Equity Mid-/Small-Cap category, which implies that the alpha generation from mid- and small-cap selection was more constrained for the large funds, due to the low investment capacity of mid- and small-cap stocks in recent years.

| Exhibit 2: Difference Between Asset-Weighted and Equal-Weighted Fund Returns | ||||

| FUND CATEGORY | 1-YEAR (%) | 3-YEAR ANNUALIZED (%) | 5-YEAR ANNUALIZED (%) | 10-YEAR ANNUALIZED (%) |

| Indian Equity Large-Cap | -0.16 | -0.09 | 0.29 | 0.87 |

| Indian ELSS | -0.33 | -1.03 | -0.32 | 0.53 |

| Indian Equity Mid-/Small-Cap | -2.40 | -0.68 | -1.00 | 0.12 |

Source: S&P Dow Jones Indices LLC, Morningstar, and Association of Mutual Funds in India. Data from December 2007 to December 2017, based on the SPIVA India Year-End 2017 Scorecard. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

In the year-end 2017 report, the number of Indian Equity Large-Cap active funds at the start of the three-year period shrunk to 100 from 155, a drop of 55 funds in the universe compared with the figures reported in the SPIVA India Mid-Year 2017 Scorecard. This drop was mainly caused by the introduction of a new fund category, Flexicap, by Morningstar in the second half of 2014. The Flexicap category includes funds that invest at least 65% of their total assets in Indian equities but invest no more than 65% of total assets in either large-cap stocks or small-/mid-cap stocks. Of these 55 large-cap funds, 46 were reclassified to Flexicap while the seven other funds were merged during this six-month period.

Additionally, the number of Indian Equity Large-Cap active funds at the start of the one-year period in the SPIVA India Year-End 2017 Scorecard decreased to 64 from 87, a drop of 23 funds in the universe compared with the figures reported in the SPIVA India Mid-Year 2017 Scorecard. This drop was due to a change in the definition of large-cap funds in the second of 2016 by Morningstar. The minimum requirement for percentage of assets in large-cap stocks for large-cap funds was changed from 65% to 75%. As a result, 20 large-cap funds were reclassified to Flexicap funds.

To discover more about the performance of Indian active funds versus their benchmarks, check out the SPIVA India Year-End 2017 Scorecard.

The posts on this blog are opinions, not advice. Please read our Disclaimers.