Investing in stocks can be risky. However, investing in a single stock tends to be far riskier than investing in a diversified basket of stocks. South African investors received a jarring reminder of this in early December, when Steinhoff International Holdings dropped more than 80% in the two days following the international retailer’s disclosure of accounting irregularities.

Mitigating the impact of these idiosyncratic risk events through the use of broad-based indices is one of the reasons that many market participants have turned to index-based investing over the years. However, all indices are not created equal when it comes to the extent of risk posed by single companies. Even among seemingly similar indices, it’s important to look under the hood to understand precisely how the index measures the market segment it seeks to represent.

South Africa’s large-cap equity indices provide an interesting case study in this. Over the past several years, the tremendous growth of Naspers has resulted in the company representing nearly a quarter of the market-cap-weighted FTSE/JSE Top 40. However, because the S&P South Africa 50 incorporates a single-stock cap of 10%, the influence of Naspers (or any other company for that matter) is reduced (see Exhibit 1).

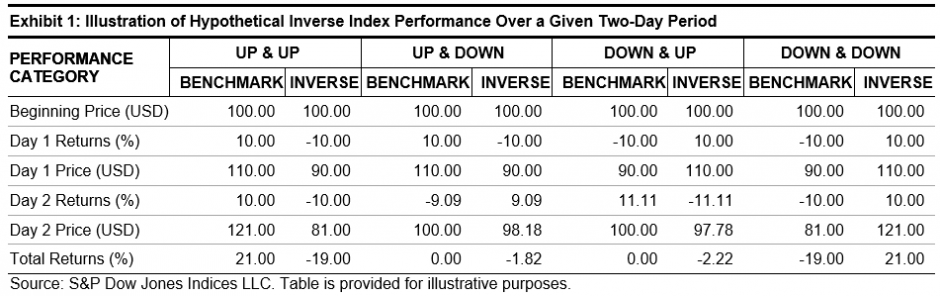

The potentially devastating impact of a large portfolio holding sharply dropping in price is obvious in a general sense. However, Exhibit 2 provides a simple illustration of the quantitative impact for a range of hypothetical scenarios. For example, if a company represents 50% of an index and its price drops 75%, the impact on the index—holding all else equal—would be a loss of 37.5%.

While Steinhoff is a component of the S&P South Africa 50, the overall impact was mitigated by the company’s relatively small weight. Prior to the accounting disclosure, the company represented less than 2% of the S&P South Africa 50, so its 80% decline translated to a loss of roughly 1.4% for the index.

However, what if Steinhoff was much larger and had a 25% weight in the index? An 80% decline in a stock that represents 25% of an index would have resulted in a much larger 20% overall index loss. In light of recent events, perhaps now might be a good time to check how much exposure there is to any one company in your index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.