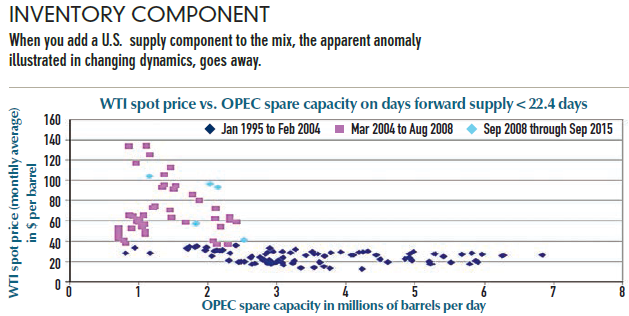

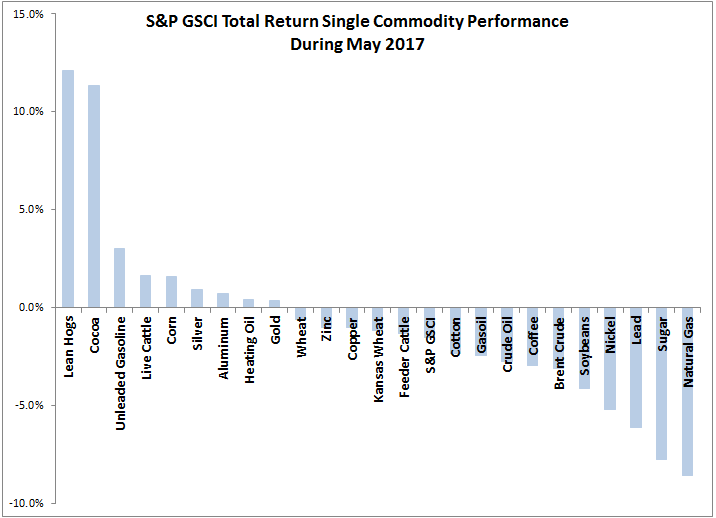

No single sector dominated commodity performance in May, which means the supply-side is currently more potent than macro factors like global aggregate demand, the dollar, interest rates or inflation. Each commodity is being driven by something in its own supply/demand model, mostly unrelated to one another. That is not just lowering the intra-commodity correlation that can create buying opportunities but has lowered the correlation between stocks and commodities, bringing to light the important role commodities can play in diversification.

In May, the Dow Jones Commodity Index Total Return fell 1.7% bringing its year-to-date performance to -5.3%, and the S&P GSCI Total Return fell 1.5%, pushing down its year-to-date performance to -8.5%. While livestock (+4.4%) and precious metals (+0.4%) were the only positive sectors in the S&P GSCI, 9 of the 24 commodities were positive, and were from all the sectors. Lean hogs (+12.1%,) cocoa (+11.3%) and unleaded gasoline (+3.0%) were the biggest winners while natural gas (+8.6%,) sugar (+7.7%) and lead (+6.2%) were the biggest losers.

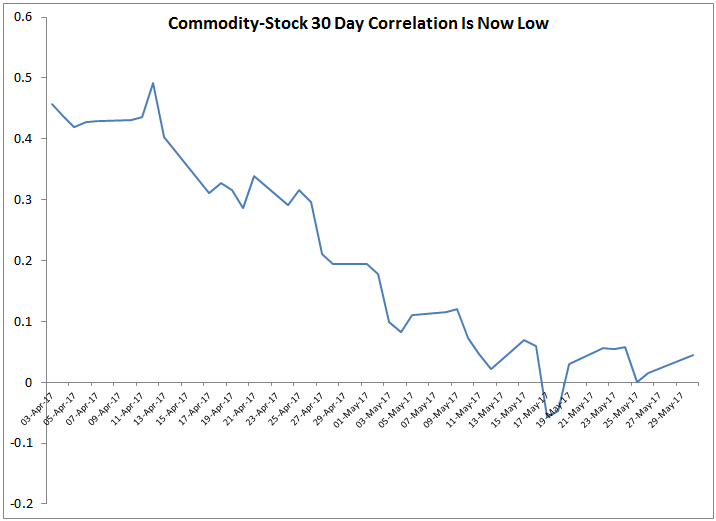

This disparity is important since the supply-shocks supporting it comprise the factor (expectational variance) that drives low correlation in between commodities and also between commodities and other asset classes. Notice the stock-commodity (S&P 500 vs S&P GSCI) correlation has fallen from 0.5 to 0.04 this month, making commodities strong diversifiers again.

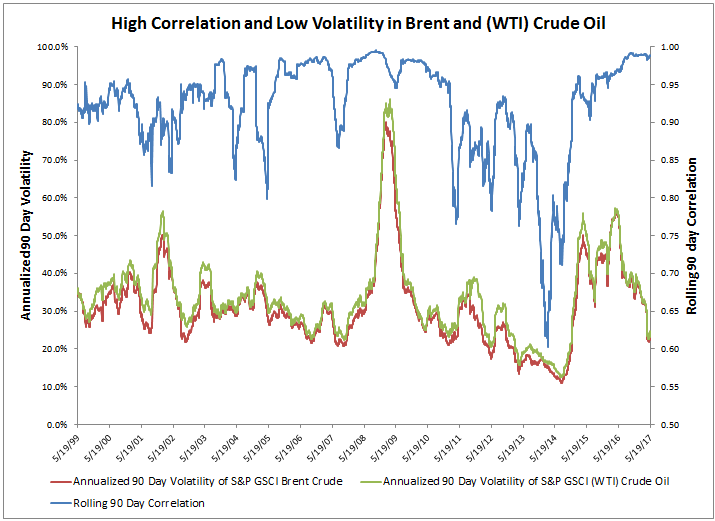

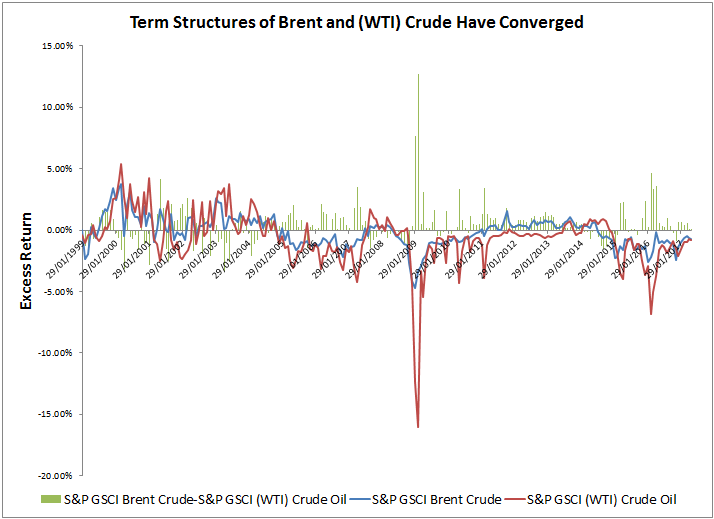

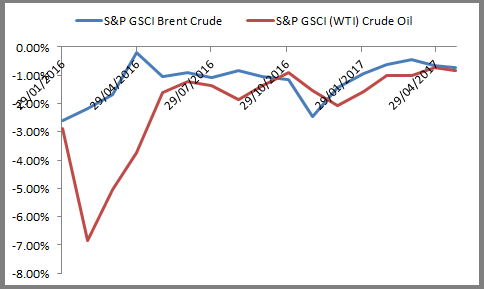

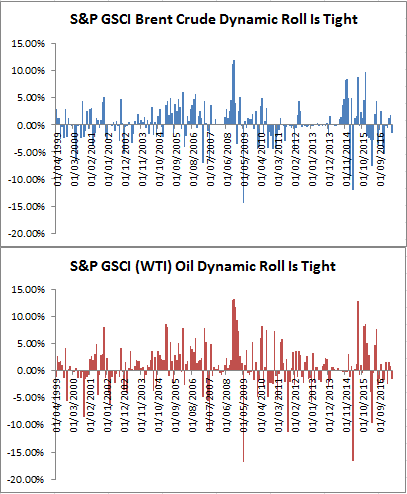

Not only is the diversification an important result but the supply issues matter to the inventory re-balancing process In May, there were a record 9 new commodities with a positive roll return, reflecting backwardation from shortages. There have never been this many commodities swinging simultaneously from negative to positive term structures, so that might be a bullish sign ahead of the summer. However, the term structure hasn’t turned positive yet for unleaded gasoline despite its rise in May even in the face of falling oil. Typically if Brent crude falls, unleaded gasoline falls slightly more with a down market capture ratio of 107, but when Brent crude rises unleaded gasoline typically increases with an up market capture 109. If commodities of not just the same sector but the same component are decoupling, and Brent crude is not dragging down unleaded gasoline, not only is that bullish, but it makes a more compelling diversification argument.

The posts on this blog are opinions, not advice. Please read our Disclaimers.