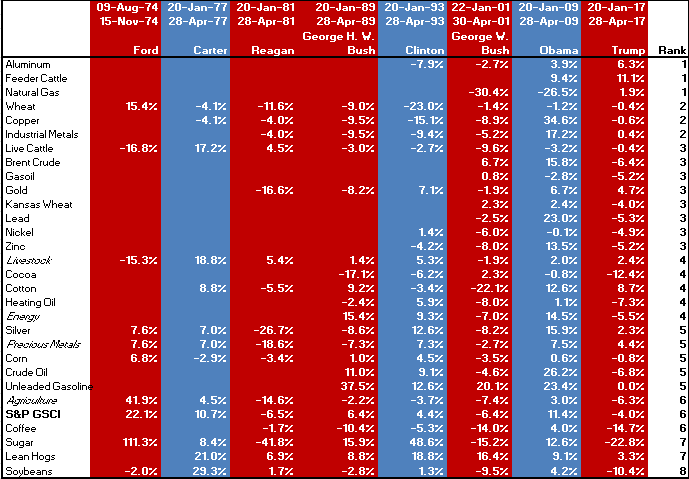

The short answer is no. The S&P GSCI (Spot) is down 4.0% since Jan 20, which is the 6th worst start of the 8 presidencies measurable by the S&P GSCI. Besides Trump, the data covers the start of the presidencies for Ford, Carter, Reagan, George H. W. Bush, Clinton, George W. Bush and Obama. However, not all the commodities and sectors have data going back to the start of Ford’s presidency but there are three sectors (precious metals only contained silver) and six single commodities with the full data set.

The table below shows that for the commodities with a full history, Trump has not done well. While silver is positive since Trump took office, its performance thus far only ranks 5th of the 8 presidents, performing better under all the democrats plus Ford. Though wheat and live cattle are negative, they are the only two commodities performing in the top half of their performance under the starts of other presidents. Wheat only did better under Ford and live cattle did better under Carter and Reagan. Like live cattle, livestock is also performing better under Trump than most presidents. On the other hand soybeans are performing the worst under Trump as compared to past presidents and sugar is worse under Trump than all others besides Reagan.

Again, the overall commodity performance under Trump is ranking only 6th of 8 presidents. However, Trump may be making aluminum, feeder cattle and natural gas great again as they are doing best under him; though, feeder cattle has only been included long enough to be measured under the start of Obama. Industrial metals are positive, up 0.4%, which may show market participants are optimistic about growth, but copper, if one believes is indicative of growth, is under-performing with a spot return of -0.6% since Trump took office, which is still better than copper’s performance under every president but Obama. Also, although natural gas is doing relatively well, energy is down 5.5% since Jan. 20 with its only negative start besides under George W. Bush. This mainly driven by the worst performance under Trump’s start than for any other president for (WTI) crude oil, down 6.8%, and Brent crude down 6.4%. Last, coffee, sugar and soybeans are all experiencing double digit losses under the start of Trump, and are severely under-performing versus their time under the beginnings of past presidents.

The posts on this blog are opinions, not advice. Please read our Disclaimers.