Commodities have continued their slump in April with the S&P GSCI Total Return losing 2.1% and Dow Jones Commodity Index (DJCI) Total Return losing 1.7% for year to date performance of -7.1% and -3.6%, respectively. Only 2 of 5 sectors and 7 of 24 commodities were positive in April. In the S&P GSCI, livestock gained 8.6%, its best monthly performance since July 2007, making it the best performing sector, while energy was the worst performing sector, losing 3.6%. Feeder cattle posted its biggest monthly gain ever of 15.1%, making it the best performing commodity in the index, while cocoa was the worst performer, losing 12.9%. All metals except gold lost in April, which hasn’t happened since May 2010 and has only happened 6 times in history (since lead, the last metal was added in Nov. 1994.)

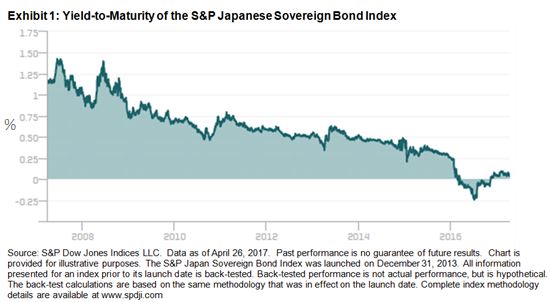

Gold was not just the only positive metal in April, but was the only commodity of all 24 in the S&P GSCI in backwardation. This is the first time in history that gold was the only backwardated commodity (since 1978 when gold was added into the index.) Backwardation is a condition describing the forward curve where the contract with a nearer expiration date is priced higher than the contract with a later expiration date. It is profitable for market participants rolling out of expiring contracts and into later dated ones, and it reflects a shortage where demand is greater than supply. Gold’s forward curve has only been backwardated in 28% of months historically since it is relatively abundant.

So, what does this mean? The backwardation in gold reflects high demand for the metal, which many investors flock to as a safe haven. Since gold has historically zero correlation to the S&P 500 (0.02) and very little to the S&P GSCI (0.18) (using monthly data since Jan. 1978,) it has provided a diversification benefit to investors using equities and other commodities. However, since the correlation is not negative, the high demand for gold may or may not reflect fear in risky assets like equities and other commodities. That said, gold has performed relatively well in the equity downturns during 2000-2002 (-44.7%, +15.3%,) 2007-2009 (-50.9%, +18.5%,) and also in shorter ones like in 2011 (-16.3%, +4.2%,) Aug.-Sep. 2015 (-8.4%, +1.8%) and Dec. 2015-Feb. 2016 (-6.6%, +15.9%.) Another interesting observation in the chart below is that there was higher frequency of backwardation (32% of the months) before the global financial crisis than after (25% of the time,) but the market is much further from equilibrium, showing about 3.6x more backwardation, or in other words, 3.6x greater relative demand to supply. Perhaps the market is not as frequently jittery but when it fears, it fears more than it has in the past, adding to the gold demand.

The posts on this blog are opinions, not advice. Please read our Disclaimers.