Think your gas prices are cheap? Think again.

The oil price drop since June 2014 has moved to become one of the most important factors in the global economy. Despite agreement on a chance to change policy, it has divided the world into winners and losers based on importers and exporters. Presumably the winners are the importers, but the countries that can highly benefit are the ones whose refiners pass through the price drop of the cheaper oil input down to the customers at the pump.

The U.S. Energy Information Administration (EIA) performed a study in Nov. 2014 concluding U.S. gas prices are more related to Brent than WTI. Further, the study noted U.S. crude exports could impact Brent prices and that gasoline is a globally traded commodity, so prices are highly correlated across global spot markets. The S&P GSCI Brent Crude and S&P GSCI (WTI) Crude Oil are highly correlated at 0.94 that shows the prices are highly related.

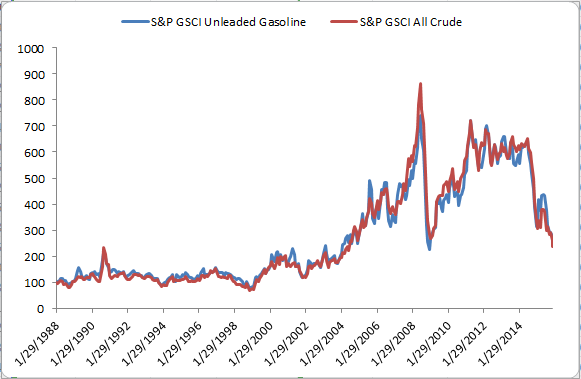

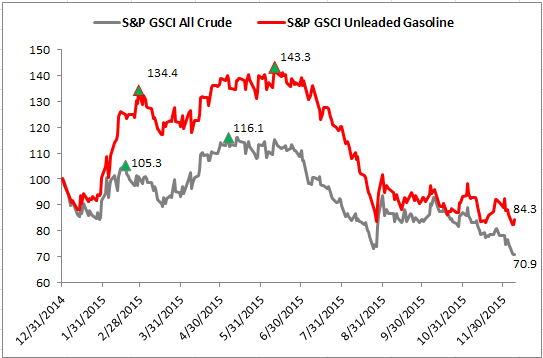

Historically, using monthly data back to Jan. 1988, the S&P GSCI All Crude (that is comprised of both WTI and Brent) has dropped in 156/336 months and the S&P GSCI Unleaded Gasoline has dropped in 127 of those 156 negative months, in other words they fall together about 82% of the time. Also, generally, unleaded gasoline has moved slightly less than the all crude index, losing 5.9% on average in a negative oil month where the average oil drop is 6.7%, producing a down market capture ratio of 87.2, meaning unleaded gasoline drops about 87.2% as much as oil. Conversely, in months when oil rose, it gained 7.1% on average but unleaded gasoline only rose 6.6% for an up market capture ratio of 93.1, meaning gas gains 93.1% as much as oil. Notice how closely unleaded gasoline and crude oil move together in the chart below:

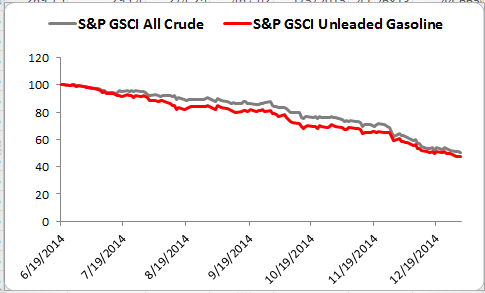

Consistent with history, from the top of the oil market in June 2014 through the end of 2014, both oil and gas fell similarly, down 49.5% and 52.4%, respectively. The chart below shows this:

That’s a painful drop for both, but the producer holds more risk than the processor since the processor can make choices the producer can’t. For example, if prices fall, producers lose if they are unhedged; however, if the prices rise, processors can substitute or pass through price hikes to the retail consumer.

Gas refiners sure took advantage once the market turned up in the beginning of 2015 as it seems they needed to make up some of their losses from passing through savings on the cheaper oil. Now, the relationship changed. When oil gained just over 5% in the first six weeks of the year, unleaded gasoline increased almost 35% or seven times oil. Then as oil continued to rise another 10% through May, gas rose another 7%. In total unleaded gasoline’s increase almost tripled the increase in oil. Since the peak, both oil and gas have dropped significantly, but the drop is more in-line with history with oil falling 38.9% and gas falling 41.2%. The net result is that unleaded gasoline’s drop is only half of oil’s for the year with gas down just 15.7% versus oil’s loss of 29.2%. This is shown in the chart below:

The result is that while oil is the cheapest in more than 11 years, since June 2004, gas is only at its cheapest in six years, since Jan 2009. Based on the historical similarities, one might think their gas price should be 6% cheaper, back down to levels seen in 2004, rather than just back to 2009 levels.

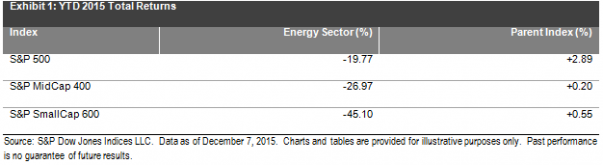

Another place you can observe this relative refiner gain is in the market values of the energy stocks in the S&P 500 Energy Sector. As of Dec. 7, Valero, a major refiner, gained $9.4B in market value this year (+36%) versus a sector loss of $359B where Exxon lost $71B (-18%), followed by Kinder Morgan’s loss of $53B (-60%).

Again, this relationship is global. For example, in the UK, Morrisons has cut petrol to the lowest level since 2009. This level is precisely where the unleaded gasoline index level is now, so arguably this news is not a race for promotion ahead of the holidays. In fact, the news story points out that this drop is EXCLUDING SPECIAL PROMOTIONS. The price cut is just bringing Morrisons price to the global average. If the retailers really wanted to give you a deal, they might bring the gas price back in line to match the oil price drop, putting the price at 2004 levels. The retailers are keeping 5 extra years worth of pricing profits from the customers. Maybe the SPECIAL PROMOTIONS will offer the fair price of gas by passing through the whole oil price drop to the customers,

The posts on this blog are opinions, not advice. Please read our Disclaimers.