After China’s stock plunge in Q3 2015, many investors have had two different views toward China. The bearish camp avoids buying Chinese stocks, as they think the Chinese market is volatile, and that the earlier stock market bubble has not fully burst when it comes to the problems of shadow banking, margin lending, and an overheating property market. The bullish camp holds a different view, claiming that Chinese stocks are cheap now and that the panic sell-off had been exaggerated. It claims that the valuation of China is getting lower, which presents a potential buying opportunity, especially for long-term investors.

No matter which view you take, either bearish or bullish on China, one cannot simply ignore China, considering its size and importance in the world economy and long-term economic growth. For this reason, it may not come as a surprise that some indices and investment products were launched for a pure play in China after the recent sell off, such as the S&P China 500, which seeks to track all Chinese share classes, including A-shares and offshore listings.

Alphabet Soup of Chinese Share Classes

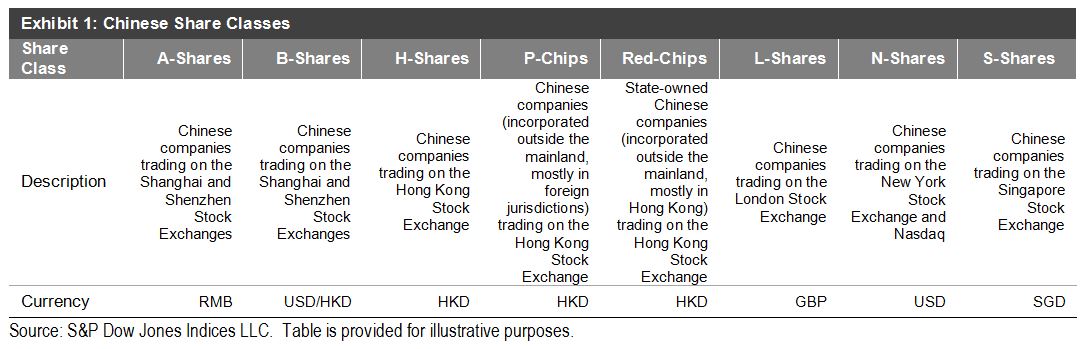

To capture the complete Chinese story, investors may invest in different Chinese share classes. However, Chinese share classes are often seen by foreign investors as being quite complex. A-, B-, H-, L-, N-, and S-shares are just like the different letters mixed in alphabet soup. In reality, only a handful of share classes, namely A-, H-, and N-shares, represent around 99% of the total market capitalization of the Chinese equities market. A-shares are Chinese companies trading on the Shanghai and Shenzhen exchanges in renminbi. International access to these domestic shares has been limited, but they have become more open due to the market liberalization supported by the Chinese government. H-shares are similar to A-shares, but they trade on the Hong Kong Stock Exchange in Hong Kong dollars. They are open to international investors without any restriction. N-shares are Chinese companies trading on the New York Stock Exchange and NASDAQ in U.S. dollars. Some of them are fast-growing internet and technology stocks, such as Alibaba and Baidu. For the list of Chinese share classes, please refer to Exhibit 1.

Liberalization of China’s A-Share Market

It is worth noting that the historically restricted A-share market has now been made more readily available to international investors, and thanks to the launch of the Qualified Foreign Institutional Investor (QFII), Renminbi Qualified Foreign Institutional Investor (RQFII), and Shanghai-Hong Kong Stock Connect (Stock Connect) programs, both QFII and RQFII allow approved applicants to access to the A-share market via a quota system. The total QFII and RQFII quotas have reached USD 78.97 billion and RMB 419.5 billion (USD 66.3 billion), respectively.[1] The Stock Connect is a significant measure that links the Shanghai and Hong Kong stock exchanges, allowing mainland Chinese investors to purchase selected eligible shares listed in Hong Kong, and, at the same time, letting foreign investors (both institutional and retail) buy eligible Chinese A-shares listed in Shanghai. The Stock Connect is expected to expand to the Shenzhen stock exchange soon, since both the Hong Kong and Shenzhen bourses have said the launch preparations had been completed and were waiting regulatory approval.

[1] State Administration of Foreign Exchange, data as of Oct. 29, 2015.

The posts on this blog are opinions, not advice. Please read our Disclaimers.