The 2015 rebalance for commodity indices may be remembered as the one trying to catch a falling knife. Today, two significant events are happening in commodity indices: 1. The world production weighted S&P GSCI is entering its first year with Brent crude oil as the biggest commodity in the index, overtaking WTI. 2. The passive index may be the absolute smartest or dumbest strategy of the year by reallocating to oil now.

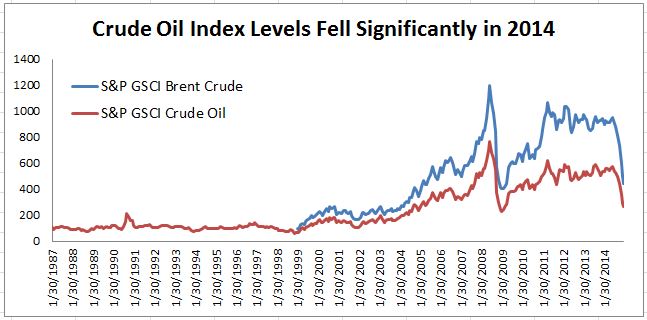

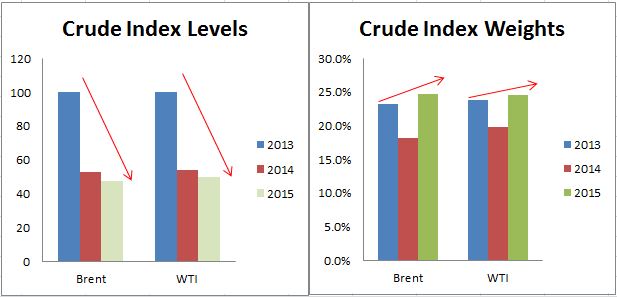

In 2014, the target weights of Brent and WTI in the S&P GSCI were 23.1% and 23.7% but with returns of -47.3% from Brent and -45.9% from WTI, the weights by the year’s end fell to 18.1% in Brent and 19.7% in WTI.  Source: S&P Dow Jones Indices. Data from Jan 30, 1987 to Jan 8, 2015. Past performance is not an indication of future results.

Source: S&P Dow Jones Indices. Data from Jan 30, 1987 to Jan 8, 2015. Past performance is not an indication of future results.

Now amid of one of the worst oil drops in history, the index is adding significant weights to both Brent and WTI bringing them up to their 2015 target weights of 24.7% in Brent and 24.5% in WTI. Not only is the total weight of 11.3% that is being added to crude big, the increase in Brent, the poorer performing oil of the pair, is much bigger with a 6.6% increase versus only a 4.7% for WTI. Please see the charts below:

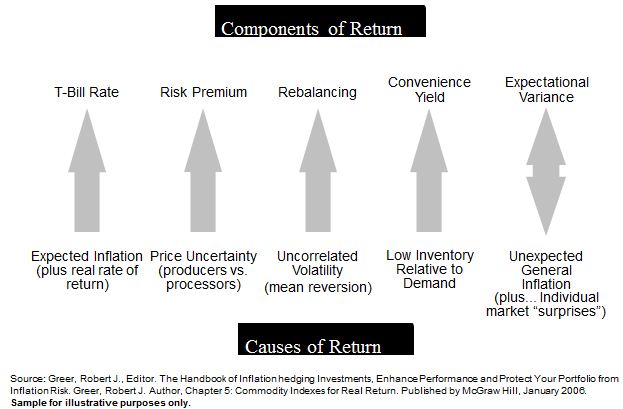

Sound risky? Rebalancing is one of the main sources of return in commodity indexing:

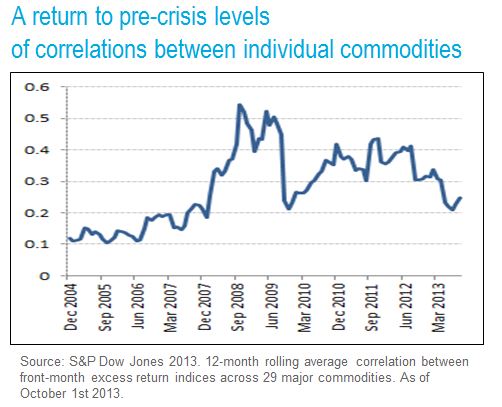

According to PIMCO, the rebalancing return can naturally accrue from periodically resetting a portfolio of assets back to its strategic weights, causing the investor to sell assets that have gone up in value and buy assets that have declined. Lower cross correlation increases the return benefits from rebalancing.

As of yesterday, Brent lost 53.4% and WTI lost 53.6% off theirs highs in June last year (based on monthly data) and in 2008-9 the drawdowns were 66.4% for Brent and 68.0% for WTI. As I’ve mentioned before, it wouldn’t be unprecedented to see oil fall more but based on history it looks as if much of the damage has been done. We’ll see if the 2015 rebalance ends handle-side or blade-side down.

The posts on this blog are opinions, not advice. Please read our Disclaimers.