Following weak Chinese economic data, several headline stories broke about commodities crashing although the only sectors with consistent losers are energy and grains. One news story stated, “Copper prices resumed their decline on Wednesday, after data showed that inflation in China slowed to the lowest level in five years, underling concerns over a slowdown in the world’s second largest economy.”

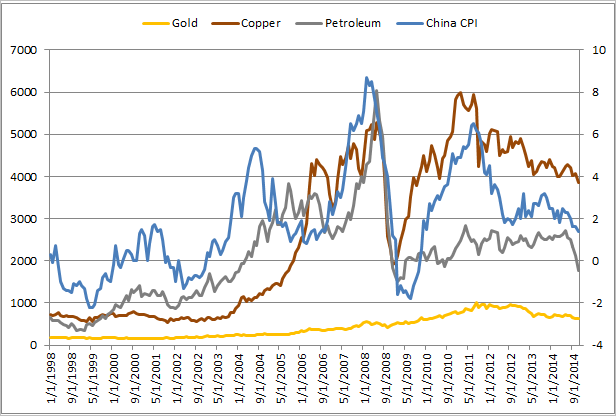

This might seem backwards given the CPI is a reflection of historical prices rather than an expectation of future prices. However, despite Dr. Copper’s lack of smarts and historical evidence showing very little predictive ability of copper prices on GDP growth not only from China but around the world, maybe Chinese CPI holds a secret about the behavior of commodity prices. The chart below shows Chinese CPI yoy% versus the S&P GSCI Gold, Copper and Petroleum. It is no surprise to see a relationship between Chinese CPI and supposedly economically sensitive commodities, copper and oil.

CPI (Consumer Price Index), despite the region, is a measure of prices of a basket of goods. It makes sense to see a relationship between commodity prices and CPI since the same food and energy that is in CPI is in the commodity indices. Given the energy price drop, the lower than expected Chinese CPI shouldn’t be much of a surprise, but if it is a surprise, it might not be a negative surprise for the future of commodity prices.

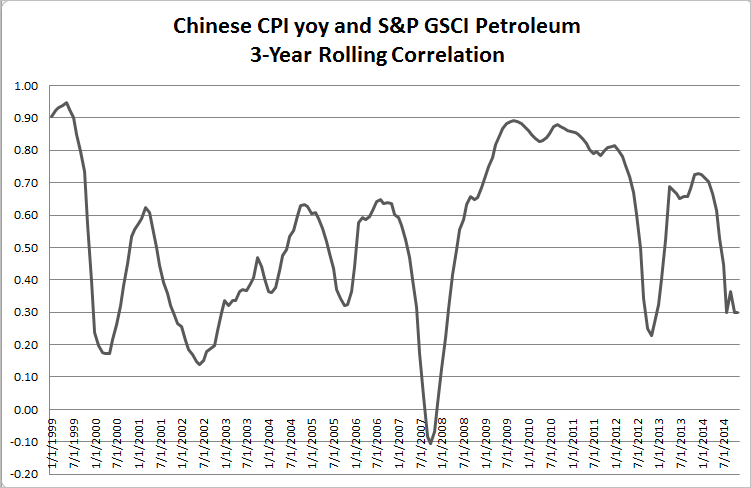

A slowdown in Chinese inflation could be a catalyst for commodities if the chance of rate cuts and monetary easing increases. Historically back to 1999, the S&P GSCI Petroleum has had a generally positive correlation to Chinese CPI.

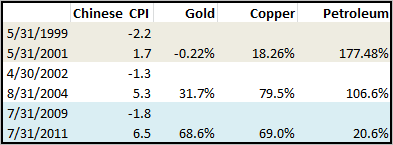

If Saudi continues to pump oil to hold its market share, then maybe oil has further to drop (and Chinese CPI) but since the troughs of Chinese CPI, commodities have performed well. The chart below shows the time periods of trough negative Chinese CPI to peaks in history with generally large returns of commodities following the low inflation. On average in these three periods, the S&P Gold, Copper and Petroleum returned 33.3%, 55.6% and 101.6%, respectively.

Source: S&P Dow Jones Indices LLC. All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. Past performance is not a guarantee of future results. Please see the Performance Disclosure at http://www.spindices.com/regulatory-affairs-disclaimers/ for more information regarding the inherent limitations associated with back-tested performance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.