Yields on the 10-year Treasury continued lower last week as measured by the S&P/BGCantor Current 10 Year U.S. Treasury Index. Friday’s 2.59% is one basis point off from this year’s low of 2.58% of February 3rd. The index recorded a 2.59% in spite of the fact that the April U.S. Unemployment rate reached a low of 6.3%, a level not seen since 2008. The Ukraine crisis and the Fed’s near zero interest rate policy continued to keep yields low. Wednesday’s conclusion of the FOMC meeting resulted in continued stimulus reduction and stating growth in economic activity has picked up recently after being effected by the harsh winter conditions.

Domestic economic news will be quieter than weeks past as the calendar is light. Today’s Markit U.S. Services PMI was slightly higher at 55 (54.5 expected). Treasuries sold off on the news after having been higher from news of weakness in China’s manufacturing sector. March’s Trade Balance is scheduled for tomorrow while MBA Mortgage Applications (-5.9% prior) is due on Wednesday. Initial Jobless Claims (325k expected) and March’s Wholesale Inventories (0.5% expected) will close out the week.

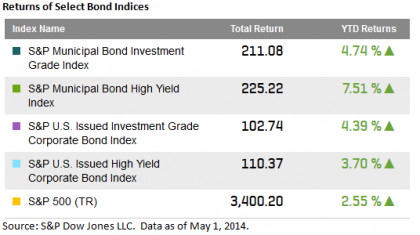

So far 2014 is off to a good start for investment grade corporates. The S&P U.S. Issued Investment Grade Corporate Bond Index has not had a down month yet and has returned 0.45% for May. Year-to-date this index has returned 4.54%, 80 basis points more than high yield. All industry sectors except for catalog retail are contributing positively to the index with the top performing sectors being electric utilities, diversified banks and integrated telecommunications.

The S&P U.S. Issued High Yield Corporate Bond Index has returned 0.08% so far for May after having returned only 0.67% for the month of April. To date, the best performing month has been the 1.92% in February. Year-to-date high yield has returned 3.74%.

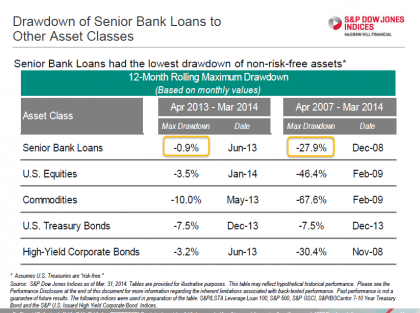

The tone in the market improved over the past week as the S&P/LSTA U.S. Leveraged Loan 100 Index has returned 0.19% month-to-date and 1.33% year-to-date. Last week the long-anticipated bankruptcy filing of Energy Future Holdings (formerly known as TXU) occurred. The S&P/LSTA U.S. Leveraged Loan 100 Index holds two loans which accounted for a 0.03% weight within the index. The loans will remain in the index though not contribute to its yield measures.

The S&P U.S. Preferred Stock Index [TR] so far has returned 0.21% for May and year-to-date has returned 9.15%. Like investment grade corporates, this index has not had a losing month this year. January and February were well above 2% while March and April both returned 1.8%. Longer duration issues in positively performing names such as Royal Bank of Scotland, American Homes and General Electric have increased the returns of this index.

Source: S&P Dow Jones Indices, Data as of 5/2/2014, Leveraged Loan data as of 5/4/2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.