The US Municipal bond market has bounced off its recent bottom even as two anchors continue to weigh it down: Puerto Rico and tobacco settlement bonds.

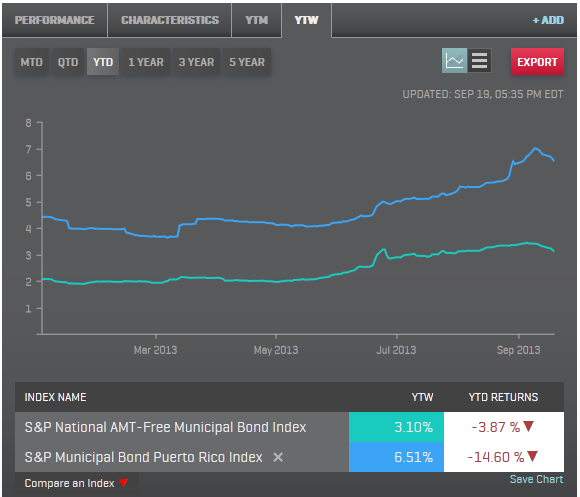

Investment grade tax-exempt bonds tracked in the S&P National AMT-Free Municipal Bond Index have seen a 2.32% positive total return since it’s year to date low on September 5th 2013. In less than two weeks, the weighted average yield to worst of bonds in the index has fallen from 3.43% to 3.10% or a 33bp improvement. The S&P National AMT-Free Municipal Bond Index is still in negative territory for the year, down 3.87% year to date. A drop off in new issue supply and yields reaching more attractive levels have combined to help bring prices back up.

Tracking Puerto Rico municipal bonds since December 1998, the S&P Municipal Bond Puerto Rico Index hit a record high yield on September 9, 2013 with the index reaching a weighted average yield of slightly over 7%. Since that point, yields have improved by 49bps to end last night at a 6.51%. As of last night, the yield for Puerto Rico bonds is more than double those of the average seen in the S&P National AMT-Free Municipal Bond Index. This has been the worst quarter in the index history with a negative 12.68% return and so far the worst performing year with a year to date total return of negative 14.6%.

Tobacco settlement municipal bonds have had a good September so far helping to offset serious losses seen during the quarter. The S&P Municipal Bond Tobacco Index has recorded a positive 5.39% during September so far but for the quarter have returned a negative 4.37%. The index has seen a year to date return of negative 7.66% helping to hold back the returns of the municipal high yield bond market. The S&P Municipal Bond High Yield Index has seen a positive September month to date recording a positive 2.33% however is still in negative territory for the year with a – 4.7% return year to date.

Five year municipal bonds tracked in the S&P AMT-Free Municipal Series 2018 Index have rebounded as yields have come down by 18bps over the course of the month to end at 1.69%.

The ten year maturity range of the municipal bond market has seen a nice rally. Ten year municipal bonds tracked in the S&P AMT-Free Municipal Series 2023 Index have seen yields come down by 39bps this month driving a total return of 3.18% month to date.

A more detailed discussion on the municipal bond market is scheduled for October 17th in NYC. To learn more about attending this complimentary forum please click here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.