Indonesian bonds, as tracked by the S&P Indonesia Bond Index, gained 5.59% YTD as of April 5, 2017. This is a continuation of the strong growth trend observed in 2016, when the index increased 13.7% owing to the Bank Indonesia’s cut in interest rates on six occasions throughout the year. Indonesia has been one of the top three best-performing countries tracked by the S&P Pan Asia Bond Index over the past three years. Both equities and bonds have been performing well on the basis of solid economic fundamentals.

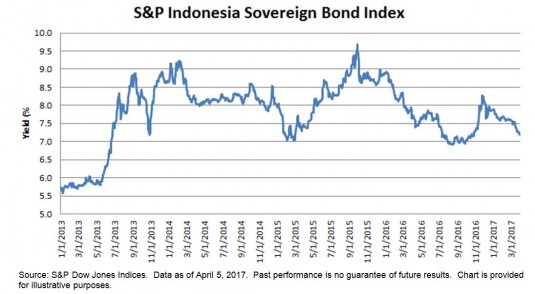

Indonesian government bonds have outperformed corporate bonds over the past year. The S&P Indonesia Sovereign Bond Index was up 6.18% YTD and 11.90% over the one-year period, while its yield also came down 72 bps from 7.88% in December 2016, see exhibit 1.

The S&P Indonesia Corporate Bond Index returned 4.14% YTD and 10.89% over the one-year period. Among the corporate bonds, the utilities sector was the best performer, up 5.38% YTD and 13.86% over the past year; notable contributors were Indosat, TELKOM, and PLN.

The yield-to-maturity of the S&P Indonesia Bond Index tightened 80 bps to 7.07% YTD, and it remains the highest yielding country within Pan Asia YTD, followed by the 7.11% yield of the S&P BSE India Bond Index. As the Indonesian and Indian bonds offer higher yields than their Asian peers which averaged at 4%, they continue to grow in popularity among global investors.

Exhibit 1: The Yield-to-Maturity of the S&P Indonesia Sovereign Bond Index