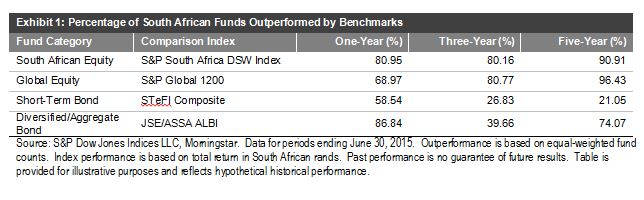

The performance of the South African equities market has been lackluster as a result of poor employment data, weak consumer confidence, and continued power shortages. This has led to an underperformance of approximately 5% in ZAR-denominated domestic equities, as measured by the S&P South Africa Domestic Shareholder Weighted (DSW) Index, compared with global equities.

Equities:

- Over a five-year period, about 91% of domestic funds underperformed the benchmark.

- Over the same period, over 96% of global funds underperformed the S&P Global 1200.

Fixed Income:

- Over a five-year period, over 74% of diversified and aggregate funds underperformed the benchmark.

- Over the same period, the majority of the active short-term bond funds outperformed the benchmark.

For more details on the report, please click here.