The S&P Municipal Bond Puerto Rico Bond Index has barely eked out a positive return so far in 2015. Meanwhile, bond prices in the Index are averaging 50 cents on the dollar. The low point for the average bond price in Puerto Rico was July 8th 2014 at 47.27 cents on the dollar. Just as a comparison, the average price of bonds in the S&P Municipal Bond High Yield Index is over 57 cents and that includes bonds from Puerto Rico. The average price of investment grade bonds in the S&P National AMT-Free Municipal Bond Index is over 107.

So how much more pain is there? That “four letter word”, uncertainty, continues to hang over the market. The possible restructuring of the debt of the larger revenue bond issuers in Puerto Rico makes for a trying time for the Puerto Rico Senate. Needed tax reform is hotly debated and probably harder to implement. Another question weighing on the market is this: How much more underperformance will state funds that own Puerto Rico bonds and the hedge funds that bought Puerto Rico bonds in the downturn tolerate before flooding the market with bonds? While the market may have already adjusted for this, with the S&P Municipal Bond Puerto Rico Index tracking over $73billion of bonds by par value, it is after all a significant portion of the bond market.

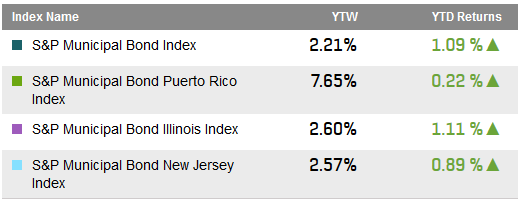

A quick look at performance:

Select Municipal Bond Index Yields and Returns:

Source: S&P Dow Jones Indices LLC. Data as of March 19, 2015.

The posts on this blog are opinions, not advice. Please read our Disclaimers.