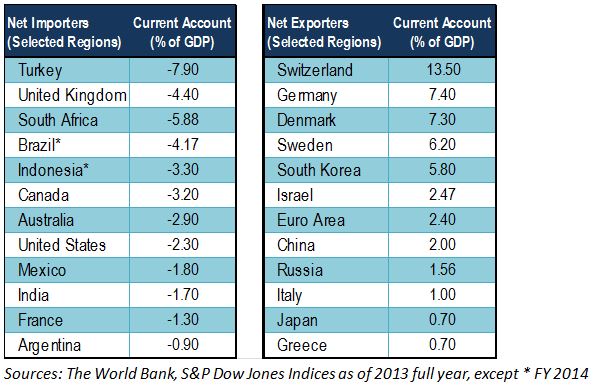

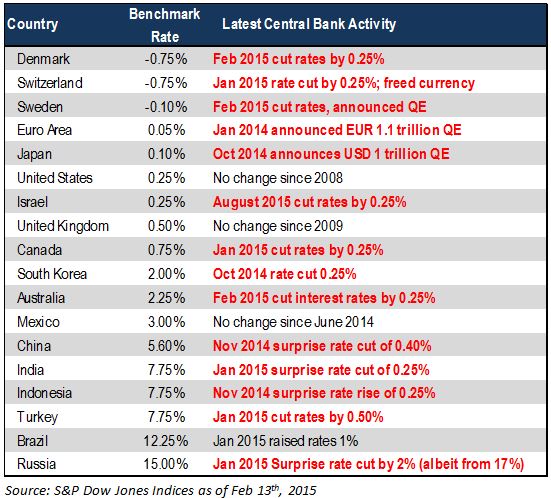

Having touched a low of 1.66% as of mid-February 2015, the yield of the S&P/BGCantor Current 10 Year U.S. Treasury Index bounced up to close at 2.05% on Feb. 13, 2015. The move away from the safety of Treasuries came as an impasse occurred in the negotiations between Greece and their EMU partners. European officials continue to wrestle over terms for a plan to support Greece, which could run out of money as soon as the end of March. If a deal cannot be struck, then the fear of European contagion could cause a move back down in yield for U.S. Treasuries.

For now, the focus of the markets may be circling back to the Fed and the possibility of a rate increase as soon as this June. The improving U.S. economy should naturally lead to higher rates, in order to match the economic growth. Such a policy change would move rates higher to the front-end of the curve, leaving the longer-end to represent investor outlook and reactions. The open-ended question is what other political, market, or global forces could curtail rising rates.

The S&P U.S. Aggregate Bond Index is up 0.78% YTD, though the rise in yields for February has translated to a loss of -1.10% MTD. The investment-grade corporate component of the aggregate index, as measured by the S&P U.S. Investment Grade Corporate Bond Index, is 29% of the parent index, and has contributed 1.09% of total return YTD, while also providing -1.44% return MTD. The only larger component of the aggregate index is the S&P/BGCantor U.S. Treasury Bond Index (38% of the parent index), which has returned 0.62% YTD, while losing 1.43% MTD.

Lower-rated credit indices such as the S&P U.S. High Yield Corporate Bond Index and the S&P/LSTA U.S. Leveraged Loan 100 Index have not greatly outpaced investment grade corporates YTD, given the increase in risks. For the month of February, however, they have performed well, as Treasury rates have been increasing. The high-yield index has returned 1.70% YTD and 1.19% for February. Likewise, the S&P/LSTA U.S. Leveraged Loan 100 Index has returned 1.11% YTD and 0.91% MTD.