Data as of May 1, 2014

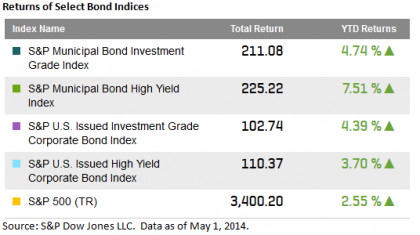

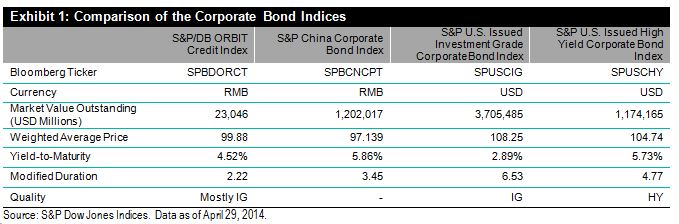

2013 was a not a fun year for municipal bond investors with bond prices and returns being pushed down by events in Detroit and Puerto Rico. 2014 is a different story, demand has shifted back to municipals as the S&P Municipal Bond Index has recorded a 4.91% total return, year to date. Yields of municipal bonds have come down at a faster clip than their counterparts in the U.S. Corporate bond markets. Since year end, investment grade municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index has seen its yield drop to 2.24% (down 87bps) while the S&P U.S. Issued Investment Grade Corporate Bond Index yield ended at 2.82% (down 28bps). High yield municipal bonds, Puerto Rico and Tobacco Settlement bonds while volatile this year have shown strength as investors continue to seek incremental yield over low rate alternatives.

The posts on this blog are opinions, not advice. Please read our Disclaimers.